Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lee Co owns a building with an original cost of $9,080,000 and accumulated depreciation of $8,640,000. In order to get cash, Lee Co enters

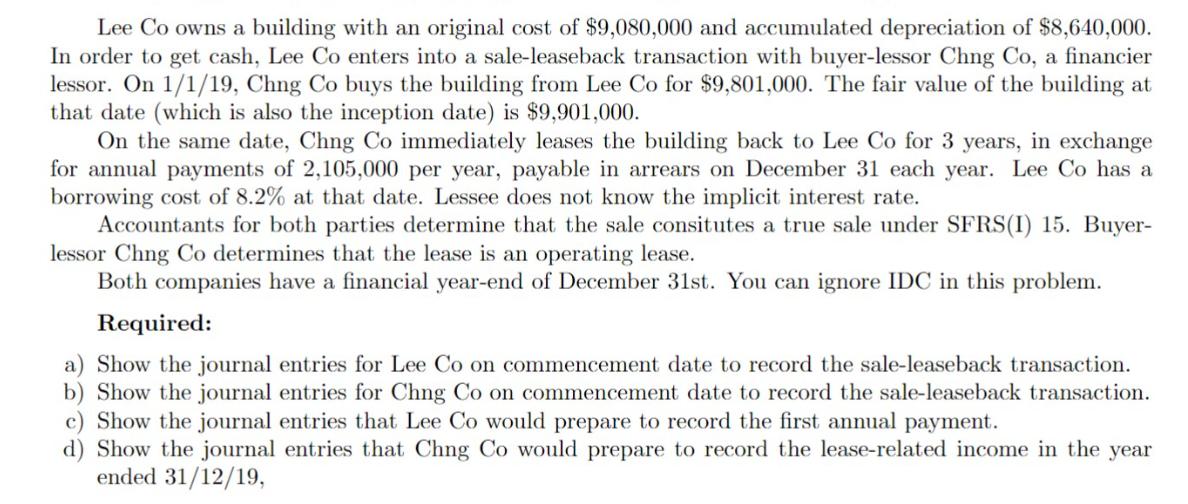

Lee Co owns a building with an original cost of $9,080,000 and accumulated depreciation of $8,640,000. In order to get cash, Lee Co enters into a sale-leaseback transaction with buyer-lessor Chng Co, a financier lessor. On 1/1/19, Chng Co buys the building from Lee Co for $9,801,000. The fair value of the building at that date (which is also the inception date) is $9,901,000. On the same date, Chng Co immediately leases the building back to Lee Co for 3 years, in exchange for annual payments of 2,105,000 per year, payable in arrears on December 31 each year. Lee Co has a borrowing cost of 8.2% at that date. Lessee does not know the implicit interest rate. Accountants for both parties determine that the sale consitutes a true sale under SFRS(I) 15. Buyer- lessor Chng Co determines that the lease is an operating lease. Both companies have a financial year-end of December 31st. You can ignore IDC in this problem. Required: a) Show the journal entries for Lee Co on commencement date to record the sale-leaseback transaction. b) Show the journal entries for Chng Co on commencement date to record the sale-leaseback transaction. c) Show the journal entries that Lee Co would prepare to record the first annual payment. d) Show the journal entries that Chng Co would prepare to record the lease-related income in the year ended 31/12/19,

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Journal entries for Lee Co on commencement date to record the saleleaseback transaction 1119 Debit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started