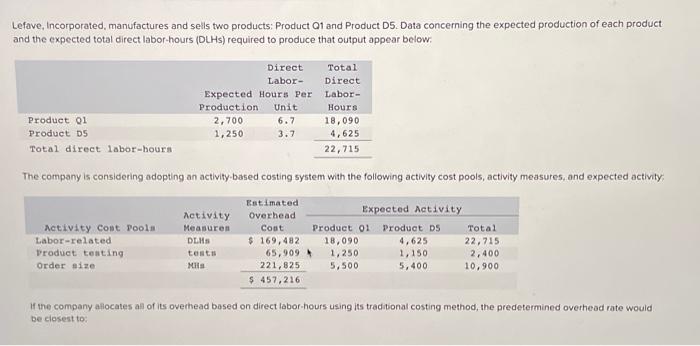

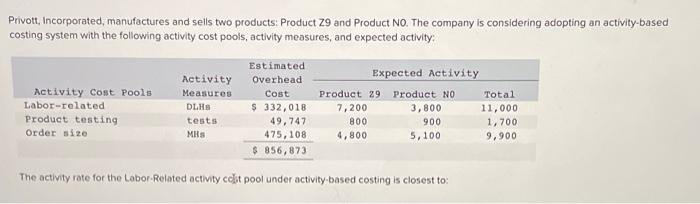

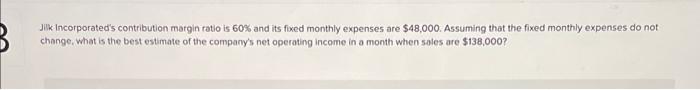

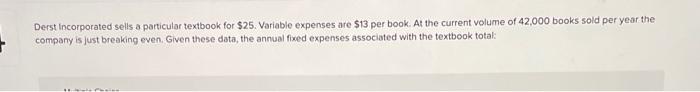

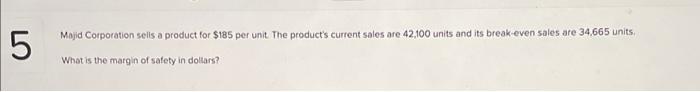

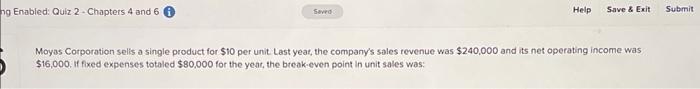

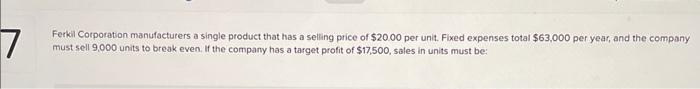

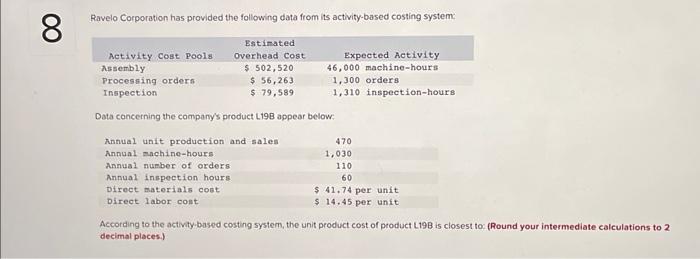

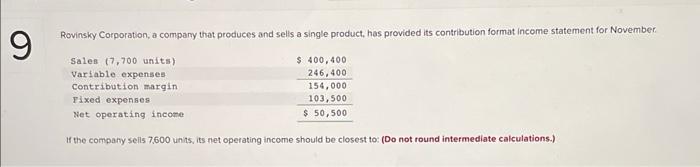

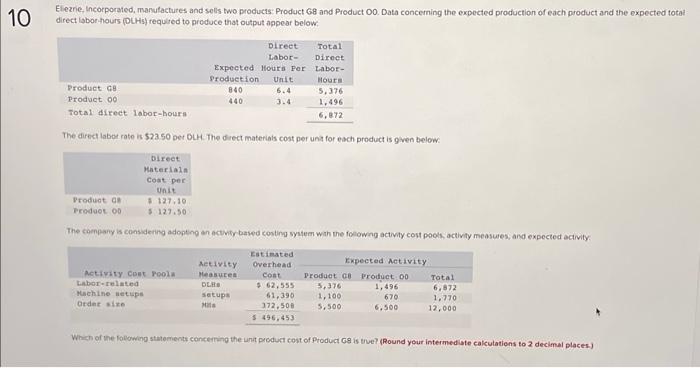

Lefave, Incorporated, manufactures and sells two products: Product Q1 and Product D5. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity; If the company aflocates all of its overhead based on direct labor-hours using its traditional costing method, the predetermined overheod rate would be ciosest to: Privott, Incorporated, manufactures and sells two products: Product Z9 and Product NO. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: The activity rate for the Labor-Related activity colit pool under activity-based costing is closest to: Jilk Incorporated's contribution margin ratio is 60% and its fixed monthly expenses are $48,000. Assuming that the fixed monthly expenses do not chnnge, what is the best estimate of the company's net operating income in a month when sales are $138,000 ? Derst incorporated sells a particular textbook for $25. Variable expenses are $13 per book. At the current volume of 42,000 books sold per year the company is just breaking even. Given these data, the annual fixed expenses associated with the textbook total: Mojid Corporation sells a product for $185 per unit. The product's current sales are 42,100 units and its break-even sales are 34,665 units, What is the margin of satety in doltars? Moyas Corporation selis a single product for $10 per unit Last yeat, the company's sales revenue was $240,000 and its net operating income was $16,000. If fixed expenses totaled $80,000 for the yeat, the break-even point in unit sales was: Ferkil Corporation manufacturers a single product that has a selling price of $20.00 per unit. Fixed expenses totai $63,000 per year, and the company must sell 9,000 units to break even. If the company has a target profit of $17,500, sales in units must be: Ravelo Corporation has provided the following data from its activity-based costing systemc Data concetning the company's product L19B appear below; According to the activitybased costing system, the unit product cost of product L19B is closest toe (Round your intermediate calculations to 2 decimal places.) Rovinsky Corporation, a company that produces and sells a single product, has provided its contribution format income statement for November. If the company sells 7,600 units, its net operating income should be closest to: (Do not round intermediate calculations.) direct labor hours (DUHs) requited to produce that output appear below. The direct labot rate is 523.50 pet BuH. The of rect materiais cost per unit for each product is given belows The company is consdering adopting an activis baswed conting system with the folowing activity cost pools activity measures, and expected activity: Whan of the followind statemente concething the unit prcduct cost of Product cs is thee? (Round your intermed ate calculatiens to 2 decimal places.)