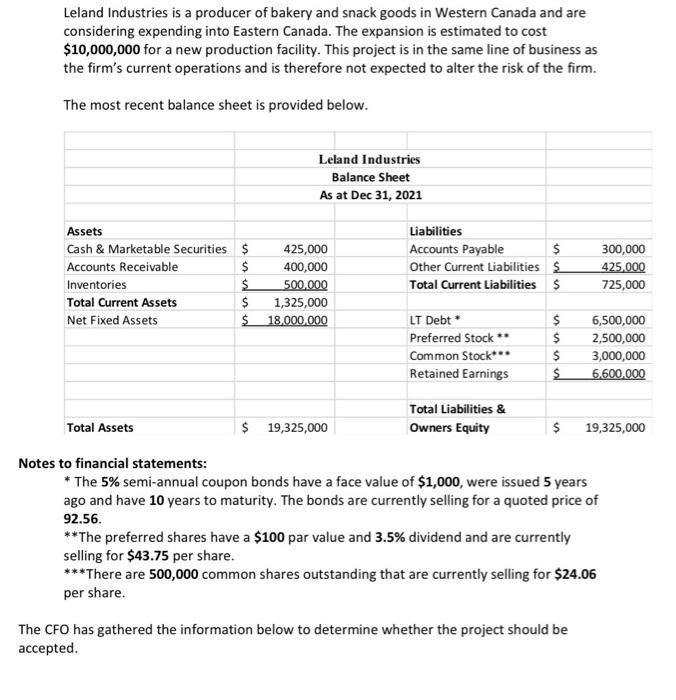

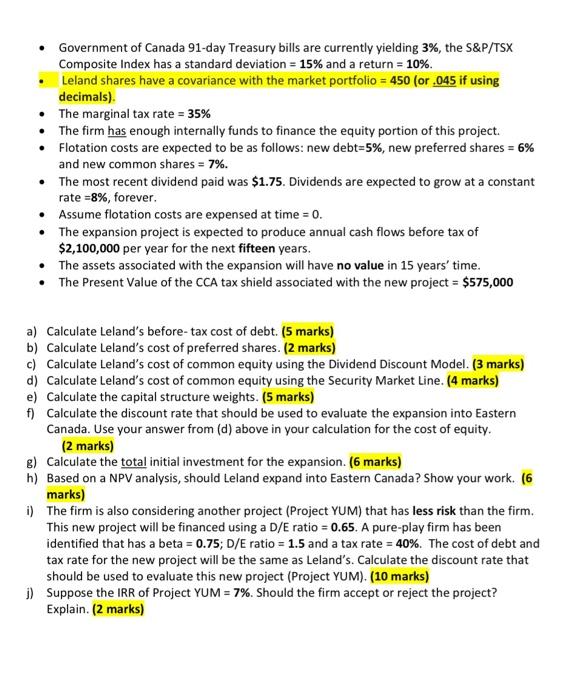

Leland Industries is a producer of bakery and snack goods in Western Canada and are considering expending into Eastern Canada. The expansion is estimated to cost $10,000,000 for a new production facility. This project is in the same line of business as the firm's current operations and is therefore not expected to alter the risk of the firm. The most recent balance sheet is provided below. Leland Industries Balance Sheet As at Dec 31, 2021 Assets Cash & Marketable Securities $ Accounts Receivable $ Inventories $ Total Current Assets $ Net Fixed Assets $ 425,000 400,000 500.000 1,325,000 18.000.000 Liabilities Accounts Payable $ Other Current Liabilities Total Current Liabilities $ 300,000 425.000 725,000 LT Debt Preferred Stock ** Common Stock** Retained Earnings $ $ $ $ 6,500,000 2,500,000 3,000,000 6,600,000 ul Total Liabilities & Owners Equity Total Assets $ 19,325,000 $ 19,325,000 Notes to financial statements: The 5% semi-annual coupon bonds have a face value of $1,000, were issued 5 years ago and have 10 years to maturity. The bonds are currently selling for a quoted price of 92.56. **The preferred shares have a $100 par value and 3.5% dividend and are currently selling for $43.75 per share. ***There are 500,000 common shares outstanding that are currently selling for $24.06 per share. The CFO has gathered the information below to determine whether the project should be accepted. . Government of Canada 91-day Treasury bills are currently yielding 3%, the S&P/TSX Composite Index has a standard deviation = 15% and a return = 10%. Leland shares have a covariance with the market portfolio = 450 (or .045 if using decimals) The marginal tax rate = 35% The firm has enough internally funds to finance the equity portion of this project. Flotation costs are expected to be as follows: new debt=5%, new preferred shares = 6% and new common shares = 7%. The most recent dividend paid was $1.75. Dividends are expected to grow at a constant rate=8%, forever. Assume flotation costs are expensed at time = 0. The expansion project is expected to produce annual cash flows before tax of $2,100,000 per year for the next fifteen years. The assets associated with the expansion will have no value in 15 years' time. The Present Value of the CCA tax shield associated with the new project = $575,000 a) Calculate Leland's before-tax cost of debt. (5 marks) b) Calculate Leland's cost of preferred shares. (2 marks) c) Calculate Leland's cost of common equity using the Dividend Discount Model. (3 marks) d) Calculate Leland's cost of common equity using the Security Market Line. (4 marks) e) Calculate the capital structure weights. (5 marks) f) Calculate the discount rate that should be used to evaluate the expansion into Eastern Canada. Use your answer from (d) above in your calculation for the cost of equity. (2 marks) g) Calculate the total initial investment for the expansion. (6 marks) h) Based on a NPV analysis, should Leland expand into Eastern Canada? Show your work. (6 marks) i) The firm is also considering another project (Project YUM) that has less risk than the firm. This new project will be financed using a D/E ratio = 0.65. A pure-play firm has been identified that has a beta = 0.75; D/E ratio = 1.5 and a tax rate = 40%. The cost of debt and tax rate for the new project will be the same as Leland's. Calculate the discount rate that should be used to evaluate this new project (Project YUM). (10 marks) i) Suppose the IRR of Project YUM = 7%. Should the firm accept or reject the project? Explain. (2 marks) Leland Industries is a producer of bakery and snack goods in Western Canada and are considering expending into Eastern Canada. The expansion is estimated to cost $10,000,000 for a new production facility. This project is in the same line of business as the firm's current operations and is therefore not expected to alter the risk of the firm. The most recent balance sheet is provided below. Leland Industries Balance Sheet As at Dec 31, 2021 Assets Cash & Marketable Securities $ Accounts Receivable $ Inventories $ Total Current Assets $ Net Fixed Assets $ 425,000 400,000 500.000 1,325,000 18.000.000 Liabilities Accounts Payable $ Other Current Liabilities Total Current Liabilities $ 300,000 425.000 725,000 LT Debt Preferred Stock ** Common Stock** Retained Earnings $ $ $ $ 6,500,000 2,500,000 3,000,000 6,600,000 ul Total Liabilities & Owners Equity Total Assets $ 19,325,000 $ 19,325,000 Notes to financial statements: The 5% semi-annual coupon bonds have a face value of $1,000, were issued 5 years ago and have 10 years to maturity. The bonds are currently selling for a quoted price of 92.56. **The preferred shares have a $100 par value and 3.5% dividend and are currently selling for $43.75 per share. ***There are 500,000 common shares outstanding that are currently selling for $24.06 per share. The CFO has gathered the information below to determine whether the project should be accepted. . Government of Canada 91-day Treasury bills are currently yielding 3%, the S&P/TSX Composite Index has a standard deviation = 15% and a return = 10%. Leland shares have a covariance with the market portfolio = 450 (or .045 if using decimals) The marginal tax rate = 35% The firm has enough internally funds to finance the equity portion of this project. Flotation costs are expected to be as follows: new debt=5%, new preferred shares = 6% and new common shares = 7%. The most recent dividend paid was $1.75. Dividends are expected to grow at a constant rate=8%, forever. Assume flotation costs are expensed at time = 0. The expansion project is expected to produce annual cash flows before tax of $2,100,000 per year for the next fifteen years. The assets associated with the expansion will have no value in 15 years' time. The Present Value of the CCA tax shield associated with the new project = $575,000 a) Calculate Leland's before-tax cost of debt. (5 marks) b) Calculate Leland's cost of preferred shares. (2 marks) c) Calculate Leland's cost of common equity using the Dividend Discount Model. (3 marks) d) Calculate Leland's cost of common equity using the Security Market Line. (4 marks) e) Calculate the capital structure weights. (5 marks) f) Calculate the discount rate that should be used to evaluate the expansion into Eastern Canada. Use your answer from (d) above in your calculation for the cost of equity. (2 marks) g) Calculate the total initial investment for the expansion. (6 marks) h) Based on a NPV analysis, should Leland expand into Eastern Canada? Show your work. (6 marks) i) The firm is also considering another project (Project YUM) that has less risk than the firm. This new project will be financed using a D/E ratio = 0.65. A pure-play firm has been identified that has a beta = 0.75; D/E ratio = 1.5 and a tax rate = 40%. The cost of debt and tax rate for the new project will be the same as Leland's. Calculate the discount rate that should be used to evaluate this new project (Project YUM). (10 marks) i) Suppose the IRR of Project YUM = 7%. Should the firm accept or reject the project? Explain. (2 marks)