Question

Leo bought Amazon shares at 140$ in August and after a couple of weeks it dropped to 136.45$ in Mid of September, so based on

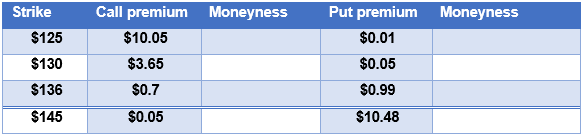

Leo bought Amazon shares at 140$ in August and after a couple of weeks it dropped to 136.45$ in Mid of September, so based on this risky and high volatility situation of stock markets, he is looking to control his risk by the option contract. Leo needs your advice on using options contracts. The following table shows a list of options for you to choose from. Further, suppose that each contract contains 100 shares

a). Please specify the moneyness of the above options. Are they in the money, at the money, or out of the money?

b). Explain the type of risk that Leo is facing and which option is your suggestion to control his risk, provide your reason and explain it.

\begin{tabular}{|c|c|c|c|c|} \hline Strike & Call premium & Moneyness & Put premium & Moneyness \\ \hline$125 & $10.05 & & $0.01 & \\ \hline$130 & $3.65 & & $0.05 & \\ \hline$136 & $0.7 & & $0.99 & \\ \hline \hline$145 & $0.05 & & $10.48 & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started