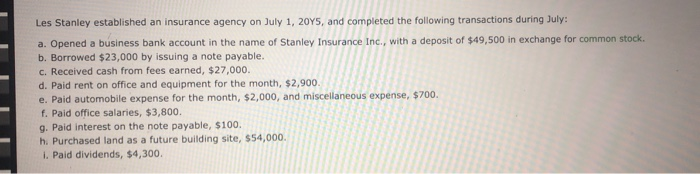

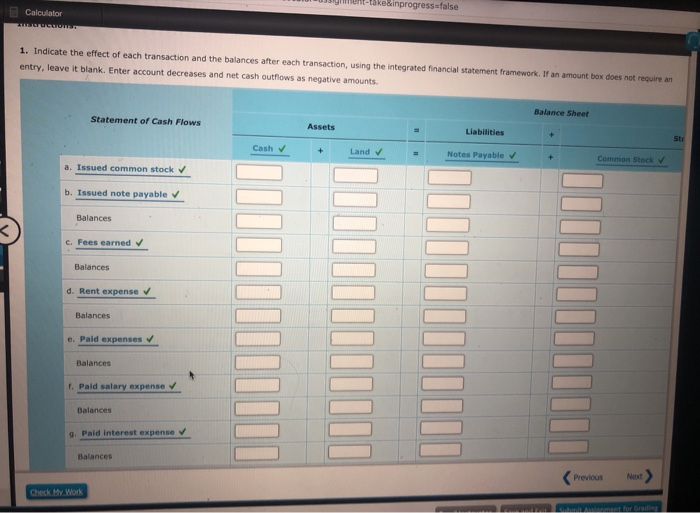

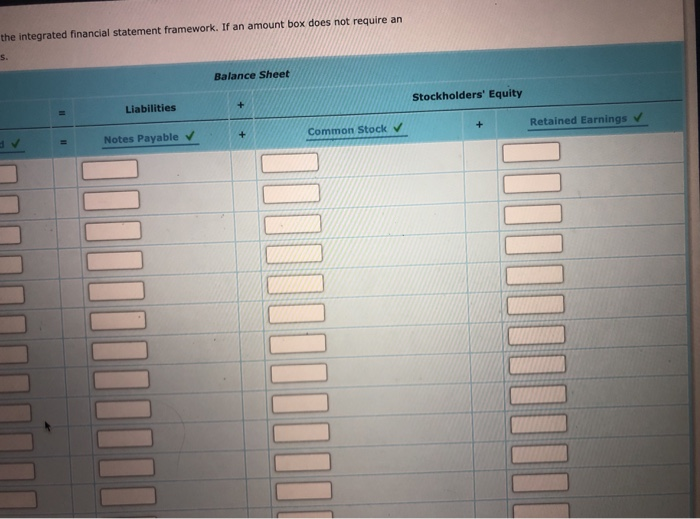

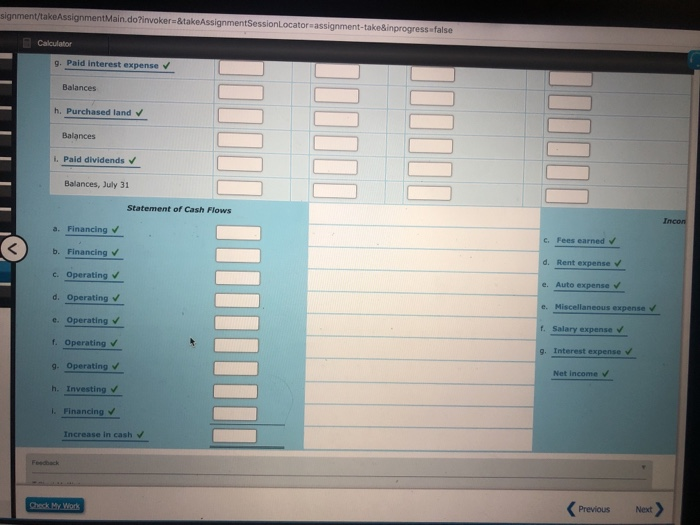

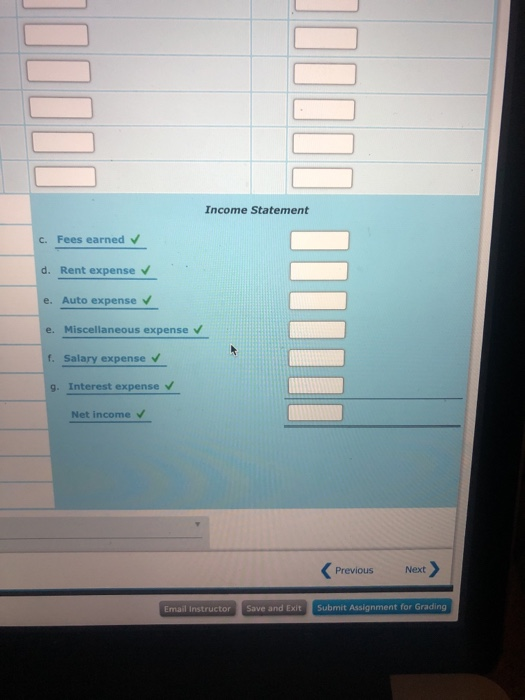

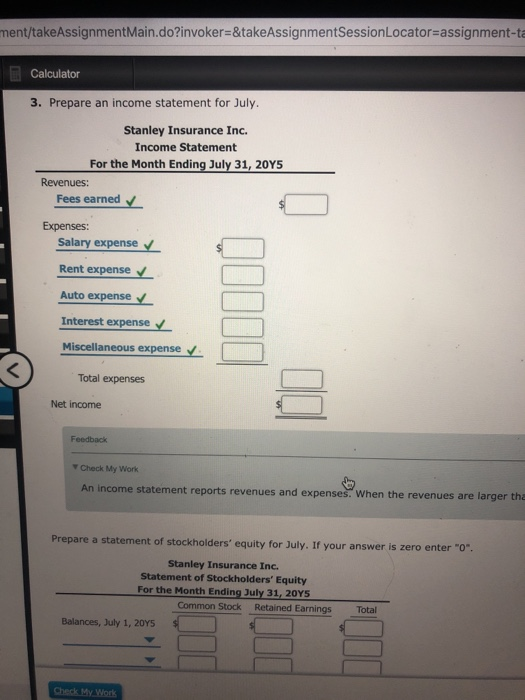

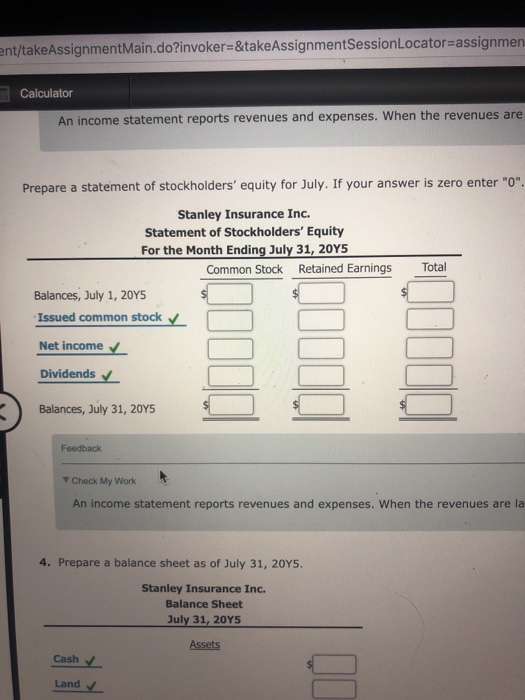

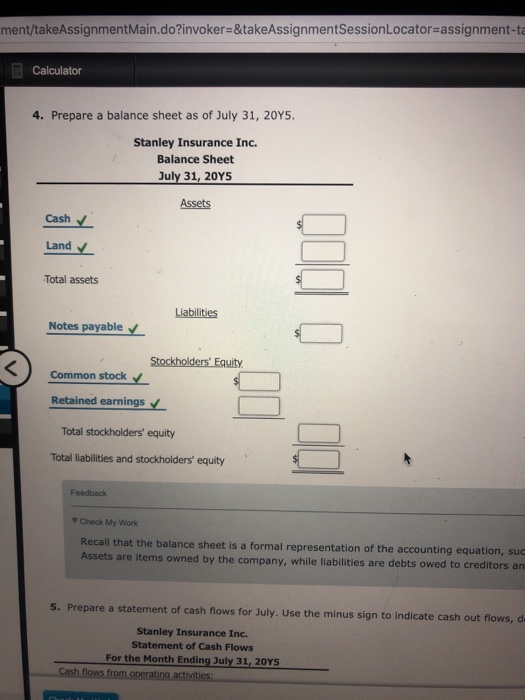

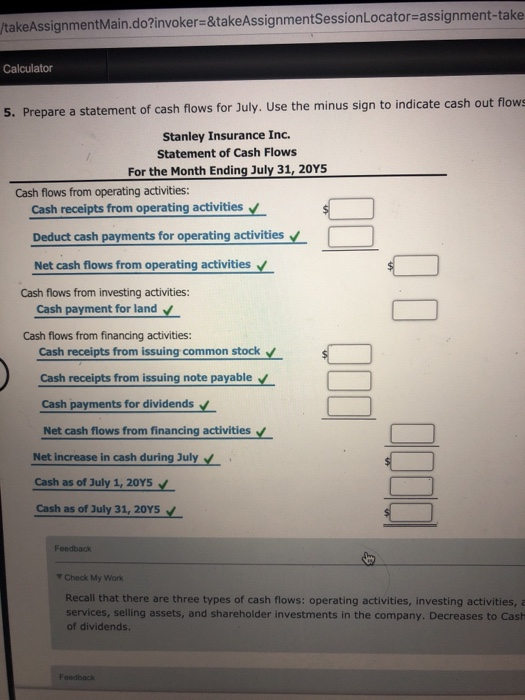

Les Stanley established an insurance agency on July 1, 20Y5, and completed the following transactions during July: a. Opened a business bank account in the name of Stanley Insurance Inc., with a deposit of $49,500 in exchange for common stock. b. Borrowed $23,000 by issuing a note payable. c. Received cash from fees earned, $27,000. d. Paid rent on office and equipment for the month, $2,900 e. Paid automobile expense for the month, $2,000, and miscellaneous expense, $700. f. Paid office salaries, $3,800. g. Paid interest on the note payable, $100. h. Purchased land as a future building site, $54,000. i. Paid dividends, $4,300. take&inprogress-false Calculator 1. Indicate the effect of each transaction and the balances after each transaction, using the integrated financial statement framework. If an amount box does not require arn entry, leave it blank. Enter account decreases and net cash outflows as negative amounts Balance Sheet Statement of Cash Flows Assets Liabilities Cash v Notes Payable v Common Stock V a. Issued common stock b. Issued note payable v Balances c. Fees earned Balances d. Rent expense Balances e. Paid expenses Balances f. Pald salary expense Balances g. Paid interest expense Balances Previous Nexd Check My.Work the integrated financial statement framework. If an amount box does not require an s. Balance Sheet Liabilities Stockholders' Equity Notes PayableV Common Stock V Retained Earnings v signment/takeAssignment Main. do?invoker=&takeAssignmentSessionLocator-assignment-take&inprogress. false Calculator g. Paid interest expense Balances h. Purchased land Balances i. Paid dividends v Balances, July 31 Statement of Cash Flows ncon a. Financing v c. Fees earned v ) b. Financing Rent expense v . Operating V d. Operating v e. Operating v f. Operating g- Operating h. Investing Auto expense v e. Miscellaneous expense V Salary expense Interest expense v Net income V Financing- Increase in cash Check My Work Previous Next Income Statement c. Fees earned d. Rent expense v e. Auto expense e. Miscellaneous expense f. Salary expense v g. Interest expense V Net income v Previous Next tructor Save and Exit Submit Assignment for Grading ment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=assignment-ta Calculator 3. Prepare an income statement for July. Stanley Insurance Inc. Income Statement For the Month Ending July 31, 20Y5 Revenues: Fees earned Expenses: Salary expense Rent expense Auto expense Interest expense Miscellaneous expense Total expenses Net income Feedback Check My Work income statement reports revenues and expenses. When the revenues are larger tha Prepare a statement of stockholders' equity for July. If your answer is zero enter "0. your answer is zero enter "O" Stanley Insurance Inc. Statement of Stockholders' Equity For the Month Ending July 31, 20YS Common Stock Retained Earnings Tota Balances, July 1, 20YS Check My Work nt/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocatora assignmen Calculator An income statement reports revenues and expenses. When the revenues are Prepare a statement of stockholders' equity for July. If your answer is zero enter "o". Stanley Insurance Inc Statement of Stockholders' Equity For the Month Ending July 31, 20YS Common Stock Retained Earnings Total Balances, July 1, 20YS Issued common stock Net income Dividends Balances, July 31, 20Ys Feedback Check My Work An income statement reports revenues and expenses. When the revenues are la 4. Prepare a balance sheet as of July 31, 20Y5. Stanley Insurance Inc. Balance Sheet Assets Cash Land ment/takeAssignmentMain.do?invoker=&takeAssignment Session Locatora assignment-ta Calculator 4. Prepare a balance sheet as of July 31, 20Y5. Stanley Insurance Inc. Balance Sheet July 31, 20YS Assets Cash V Land Total assets Notes payable Stockholders' Equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Feedback Check My Work Recal Assets Il that the balance sheet is a formal representation of the accounting equation, suc are items owned by the company, while liabilities are debts owed to creditors an 5. Prepare a statement of cash flows for July. Use the minus sign to indicate cash out flows, d Stanley Insurance Inc. Statement of Cash Flows For the Month Ending July 31, 20YS Cash flows from operatina activiti takeAssignmentMain.do?invoker-&takeAssignmentSessionLocator-assignment-take Calculator 5. Prepare a statement of cash flows for July. Use the minus sign to indicate cash out flows Stanley Insurance Inc. Statement of Cash Flows For the Month Ending July 31, 20Y5 Cash flows from operating activities: Cash receipts from operating activities Deduct cash payments for operating activities Net cash flows from operating activities Cash flows from investing activities: Cash payment for land Cash flows from financing activities: Cash receipts from issuing common stock Cash receipts from issuing note payable Cash payments for dividends Net cash flows from financing activities Net increase in cash during July Cash as of July 1, 20Y5 Cash as of July 31, 20Y5Y Feedback Check My Work Recall that there are three types of cash flows: operating activities, investing activities, a services, selling assets, and shareholder investments in the company. Decreases to Cash of dividends