Answered step by step

Verified Expert Solution

Question

1 Approved Answer

lesson 8 1. Your best friend, Hunter, is an amateur singer/songwriter. She's decided to up her game and go pro. She purchased sound equipment at

lesson 8

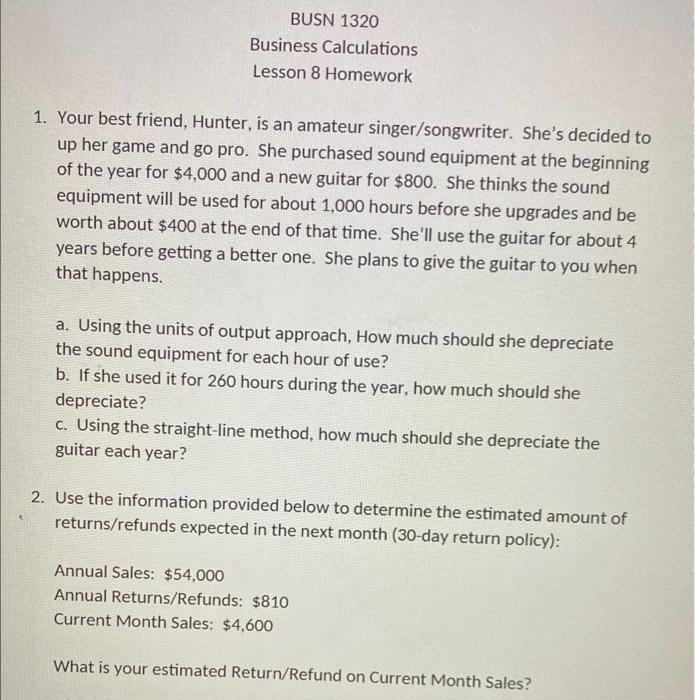

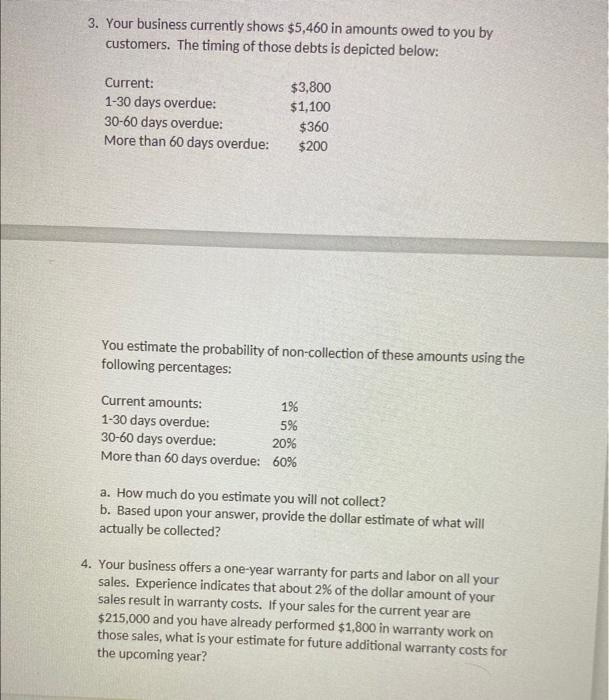

1. Your best friend, Hunter, is an amateur singer/songwriter. She's decided to up her game and go pro. She purchased sound equipment at the beginning of the year for $4,000 and a new guitar for $800. She thinks the sound equipment will be used for about 1,000 hours before she upgrades and be worth about $400 at the end of that time. She'll use the guitar for about 4 years before getting a better one. She plans to give the guitar to you when that happens. a. Using the units of output approach, How much should she depreciate the sound equipment for each hour of use? b. If she used it for 260 hours during the year, how much should she depreciate? c. Using the straight-line method, how much should she depreciate the guitar each year? 2. Use the information provided below to determine the estimated amount of returns/refunds expected in the next month (30-day return policy): Annual Sales: $54,000 Annual Returns/Refunds: $810 Current Month Sales: $4,600 What is your estimated Return/Refund on Current Month Sales? 3. Your business currently shows $5,460 in amounts owed to you by customers. The timing of those debts is depicted below: You estimate the probability of non-collection of these amounts using the following percentages: a. How much do you estimate you will not collect? b. Based upon your answer, provide the dollar estimate of what will actually be collected? 4. Your business offers a one-year warranty for parts and labor on all your sales. Experience indicates that about 2% of the dollar amount of your sales result in warranty costs. If your sales for the current year are $215,000 and you have already performed $1,800 in warranty work on those sales, what is your estimate for future additional warranty costs for the upcoming year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started