Answered step by step

Verified Expert Solution

Question

1 Approved Answer

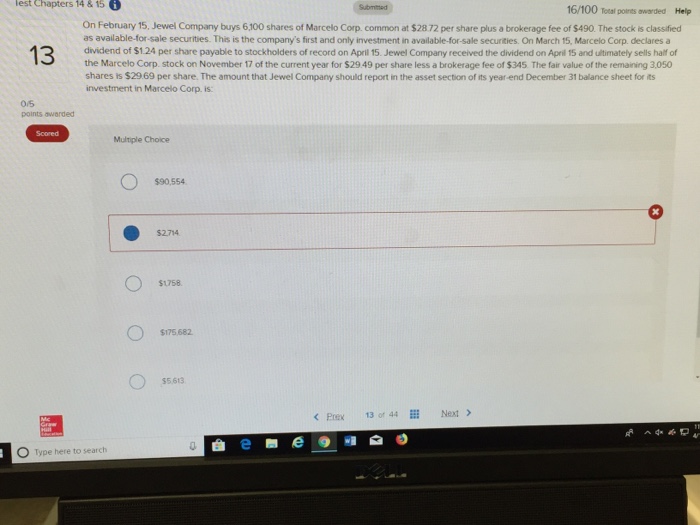

lest Chapters 14 & 15 16/100 Total poines awarded Help On February 15, Jewel Company buys 6.100 shares of Marcelo Corp. common at $2872 per

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started