Answered step by step

Verified Expert Solution

Question

1 Approved Answer

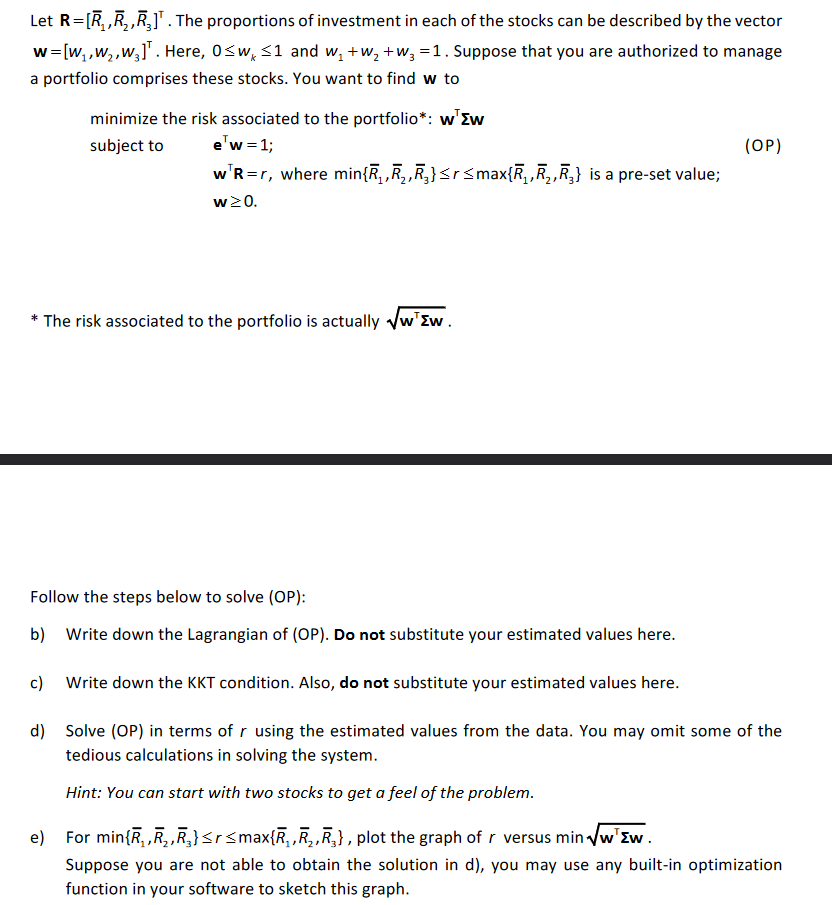

Let R=[R, R2, R3]. The proportions of investment in each of the stocks can be described by the vector w=[W,W, W3]. Here, 0w, 1

Let R=[R, R2, R3]. The proportions of investment in each of the stocks can be described by the vector w=[W,W, W3]. Here, 0w, 1 and w + w+w = 1. Suppose that you are authorized to manage a portfolio comprises these stocks. You want to find w to minimize the risk associated to the portfolio*: ww subject to e'w = 1; w'R=r, where min{R,R}rmax{R,R2, R3} is a pre-set value; (OP) w0. * The risk associated to the portfolio is actually ww. Follow the steps below to solve (OP): b) Write down the Lagrangian of (OP). Do not substitute your estimated values here. c) Write down the KKT condition. Also, do not substitute your estimated values here. d) Solve (OP) in terms of r using the estimated values from the data. You may omit some of the tedious calculations in solving the system. Hint: You can start with two stocks to get a feel of the problem. e) For min{R, R, R}rmax{}, plot the graph of r versus minww. Suppose you are not able to obtain the solution in d), you may use any built-in optimization function in your software to sketch this graph.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started