Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Let us consider two assets, A and B. Asset A has a covariance with the market cov(RA, RM) = 0.04773. Asset B has a

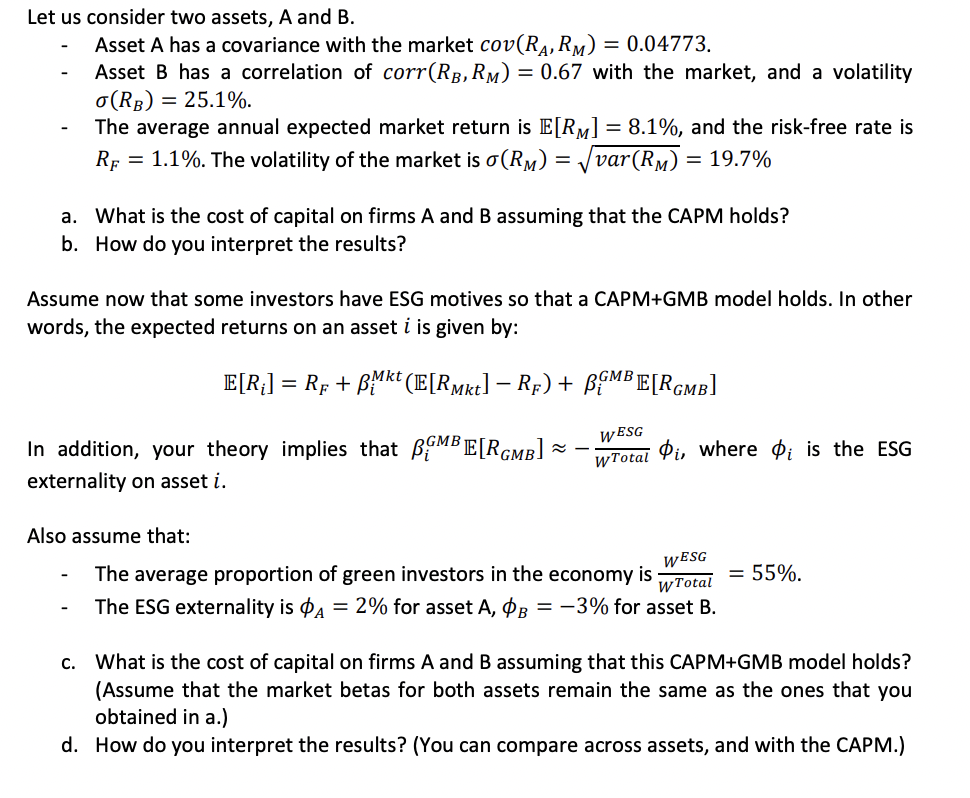

Let us consider two assets, A and B. Asset A has a covariance with the market cov(RA, RM) = 0.04773. Asset B has a correlation of corr(RB, R) = 0.67 with the market, and a volatility (RB) = 25.1%. The average annual expected market return is E[RM] = 8.1%, and the risk-free rate is RF = 1.1%. The volatility of the market is (RM) = var(RM) : = 19.7% a. What is the cost of capital on firms A and B assuming that the CAPM holds? b. How do you interpret the results? Assume now that some investors have ESG motives so that a CAPM+GMB model holds. In other words, the expected returns on an asset i is given by: E[R;] = RF + kt (E[Rmkt] RF) + BGMB E[RGMB] In addition, your theory implies that B&E[RGMB] externality on asset i. WESG WTotal Pi, where ; is the ESG Also assume that: WESG WTotal The average proportion of green investors in the economy is The ESG externality is = 2% for asset A, B = -3% for asset B. = 55%. c. What is the cost of capital on firms A and B assuming that this CAPM+GMB model holds? (Assume that the market betas for both assets remain the same as the ones that you obtained in a.) d. How do you interpret the results? (You can compare across assets, and with the CAPM.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started