Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Let's break down and analyze Citigroup's credit loss experience, based on the provided data. 1 . Examine Citigroup's credit loss experience a . How does

Let's break down and analyze Citigroup's credit loss experience, based on the provided data.

Examine Citigroup's credit loss experience

a How does the dollar amount of loans charged off in compare with that of

Loans charged off represent the portion of loans that are deemed uncollectible and are written off the books. In Citigroup charged off $ billion in loans, whereas in the amount charged off was $ billion.

Comparison: The amount of loans charged off in increased significantly, by $ billion or approximately a increase from

b How much was added to the Provision for loan losses in

The Provision for loan losses is the amount Citigroup sets aside to cover potential future loan losses. In Citigroup added $ billion to the provision.

This was an increase from $ billion in indicating Citigroup was preparing for potentially higher loan losses due to the ongoing economic challenges, particularly the aftermath of the financial crisis.

c What is the trend in the allowance for loan losses as a percentage of total loans over the period

The Allowance for loan losses as a percentage of total loans shows how much Citigroup has reserved for potential loan losses relative to the total loan portfolio. The trend over the period is as follows:

:

:

:

:

:

Trend: There is a clear upward trend in the allowance for loan losses as a percentage of total loans from to especially during which reflects the impact of the financial crisis. This trend suggests that Citigroup anticipated higher levels of uncollectible loans and increased its reserves to cover potential losses.

What is the effect of having to comply with SFAS and SFAS on Citigroup's capital ratios?

SFAS Accounting for Transfers of Financial Assets and SFAS Amendments to FIN R introduced significant changes in how Citigroup had to account for financial assets and certain entities. Specifically, these standards required Citigroup to consolidate certain variable interest entities VIEs and former qualifying specialpurpose entities QSPEs that were previously off the balance sheet.

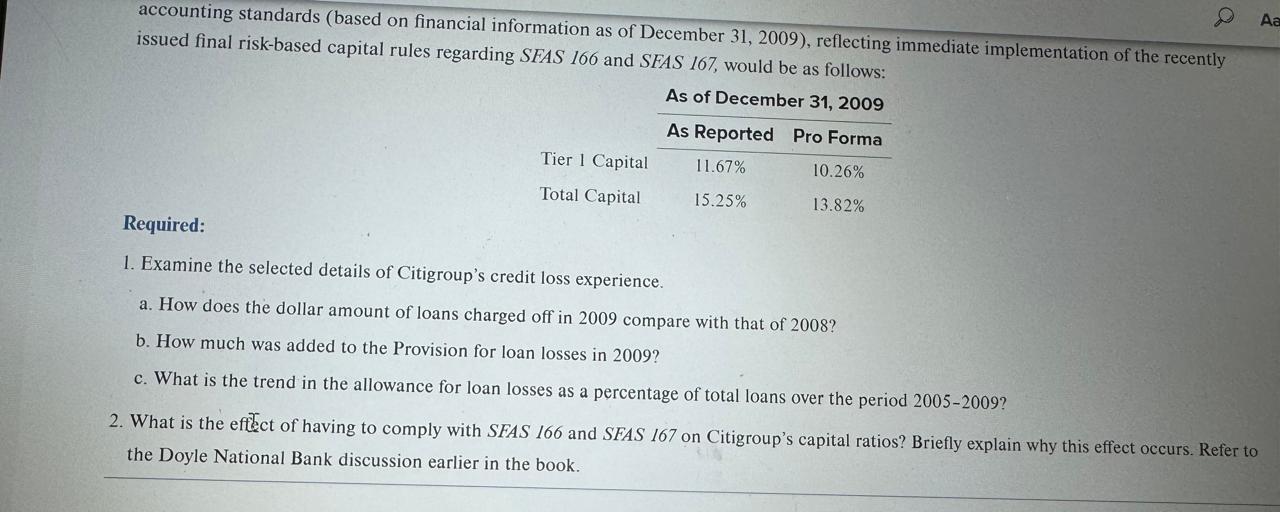

Effect on capital ratios: The adoption of SFAS and SFAS led to a decline in Citigroup's regulatory capital ratios as follows:

Tier Capital Ratio: Declined from to

Total Capital Ratio: Declined from to

Why does this effect occur?

By requiring Citigroup to consolidate certain assets that were previously off its balance sheet, the new accounting standards increased the assets and liabilities reported on the balance sheet. Since capital ratios such as Tier and Total Capital are calculated as a percentage of riskweighted assets, an increase in assets lowers these ratios. The new assets due to consolidation increase Citigroups risk exposure, thereby reducing the capital ratios even if the banks core capital remains unchanged.

Regulatory impact: Higher levels of reported assets required Citigroup to hold more capital to maintain its regulatory capital ratios, contributing to a decline in those ratios after compliance with the new standards.

These changes underscore the broader regulatory response to the financial crisis, aimed at bringing more transparency and accountability to offbalancesheet activities and ensuring banks maintain adequate capital to absorb potential losses.accounting standards based on financial information as of December reflecting immediate implementation of the recently

issued final riskbased capital rules regarding SFAS and SFAS would be as follows:

As of December

Required:

Examine the selected details of Citigroup's credit loss experience.

a How does the dollar amount of loans charged off in compare with that of

b How much was added to the Provision for loan losses in

c What is the trend in the allowance for loan losses as a percentage of total loans over the period

What is the eftect of having to comply with SFAS and SFAS on Citigroup's capital ratios? Briefly explain why this effect occurs. Refer to

the Doyle National Bank discussion earlier in the book.

Case Study: Write a thorough and detailed solution to Case Study C about Citigroup at the end of Chapter Your response should be to pages long, doublespaced. Please use APA format.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started