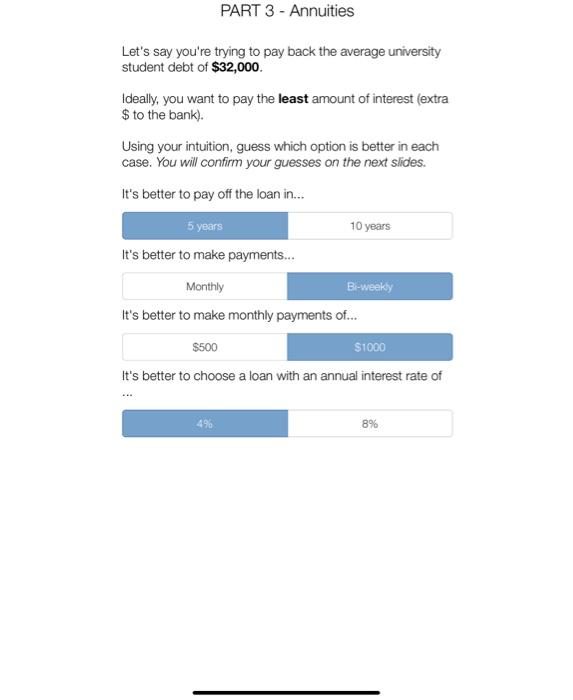

Let's say you're trying to pay back the average university student debt of $32,000.

Ideally, you want to pay the least amount of interest (extra $ to the bank).

Using your intuition, guess which option is better in each case. You will confirm your guesses on the next slides.

can someone please confirm my solution as I post the question twice I saw different answers !! from expert

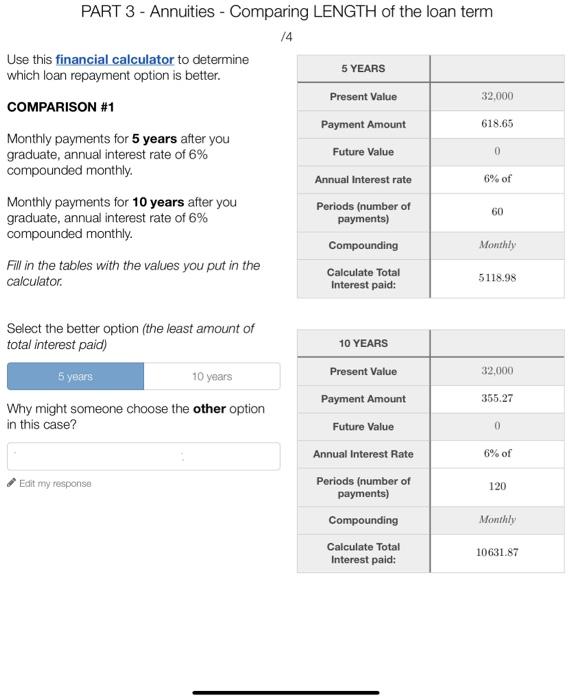

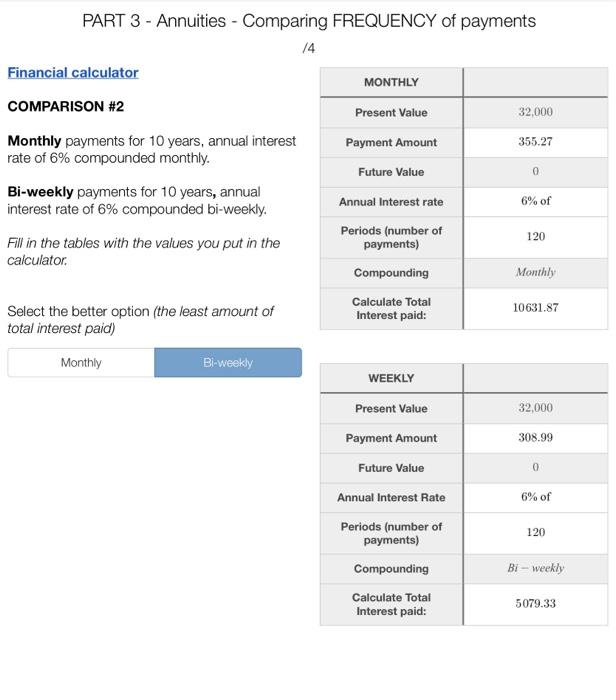

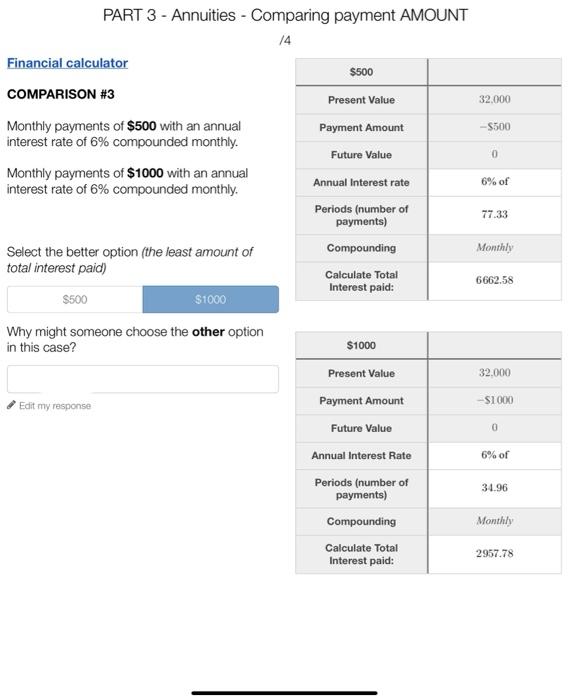

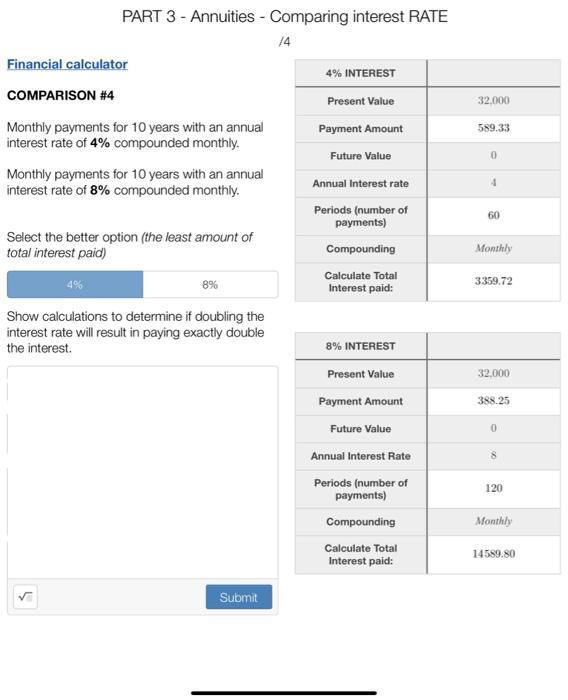

PART 3 - Annuities Let's say you're trying to pay back the average university student debt of $32,000. Ideally, you want to pay the least amount of interest (extra $ to the bank). Using your intuition, guess which option is better in each case. You will confirm your guesses on the next slides. It's better to pay off the loan in... 5 years 10 years It's better to make payments... Monthly Bi-weekly It's better to make monthly payments of... $500 $1000 It's better to choose a loan with an annual interest rate of 4% 8% PART 3 - Annuities - Comparing LENGTH of the loan term 14 5 YEARS Present Value 32,000 Payment Amount 618.65 Future Value 0 Annual Interest rate 6% of Periods (number of payments) 60 Compounding Monthly Calculate Total 5118.98 Interest paid: 10 YEARS Present Value 32,000 Payment Amount 355.27 Future Value 0 Annual Interest Rate 6% of Periods (number of 120 payments) Compounding Monthly Calculate Total 10631.87 Interest paid: Use this financial calculator to determine which loan repayment option is better. COMPARISON #1 Monthly payments for 5 years after you graduate, annual interest rate of 6% compounded monthly. Monthly payments for 10 years after you graduate, annual interest rate of 6% compounded monthly. Fill in the tables with the values you put in the calculator. Select the better option (the least amount of total interest paid) 5 years 10 years Why might someone choose the other option in this case? Edit my response PART 3 - Annuities - Comparing FREQUENCY of payments 14 Financial calculator MONTHLY COMPARISON #2 Present Value 32,000 Payment Amount 355.27 Monthly payments for 10 years, annual interest rate of 6% compounded monthly. Future Value 0 Bi-weekly payments for 10 years, annual interest rate of 6% compounded bi-weekly. Annual Interest rate 6% of Periods (number of payments) 120 Fill in the tables with the values you put in the calculator. Compounding Monthly Calculate Total 10631.87 Interest paid: Select the better option (the least amount of total interest paid) Monthly Bi-weekly WEEKLY Present Value 32,000 Payment Amount 308.99 Future Value 0 Annual Interest Rate 6% of Periods (number of 120 payments) Compounding Bi-weekly Calculate Total 5079.33 Interest paid: PART 3 - Annuities - Comparing payment AMOUNT 14 $500 Present Value Payment Amount Future Value Annual Interest rate Periods (number of payments) Compounding Calculate Total Interest paid: $1000 Present Value Payment Amount Future Value Annual Interest Rate Periods (number of payments) Compounding Calculate Total Interest paid: Financial calculator COMPARISON #3 Monthly payments of $500 with an annual interest rate of 6% compounded monthly. Monthly payments of $1000 with an annual interest rate of 6% compounded monthly. Select the better option (the least amount of total interest paid) $500 $1000 Why might someone choose the other option in this case? Edit my response 32,000 -$500 0 6% of 77.33 Monthly 6662.58 32,000 -$1000 0 6% of 34.96 Monthly 2957.78 PART 3 - Annuities - Comparing interest RATE 14 4% INTEREST Present Value Payment Amount Future Value Annual Interest rate Periods (number of payments) Compounding Calculate Total Interest paid: 8% INTEREST Present Value Payment Amount Future Value Annual Interest Rate Periods (number of payments) Compounding Calculate Total Interest paid: Financial calculator COMPARISON #4 Monthly payments for 10 years with an annual interest rate of 4% compounded monthly. Monthly payments for 10 years with an annual interest rate of 8% compounded monthly. Select the better option (the least amount of total interest paid) 8% Show calculations to determine if doubling the interest rate will result in paying exactly double the interest. 5 Submit 32,000 589.33 0 4 60 Monthly 3359.72 32,000 388.25 0 8 120 Monthly 14589.80