Answered step by step

Verified Expert Solution

Question

1 Approved Answer

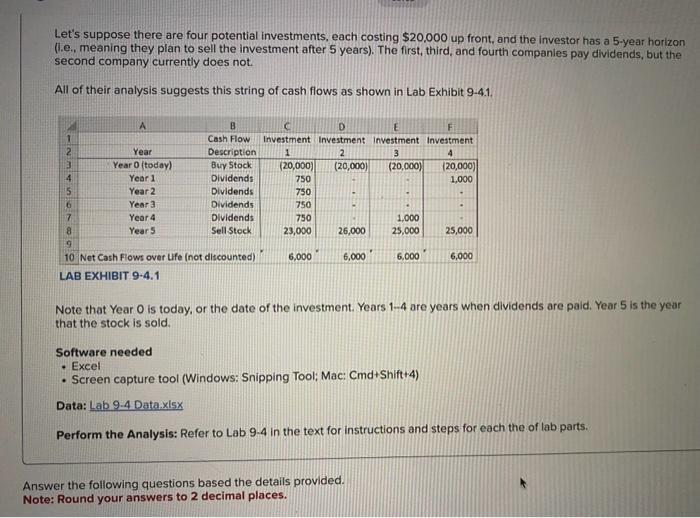

Let's suppose there are four potential investments, each costing $20,000 up front, and the investor has a 5-year horizon (i.e., meaning they plan to sell

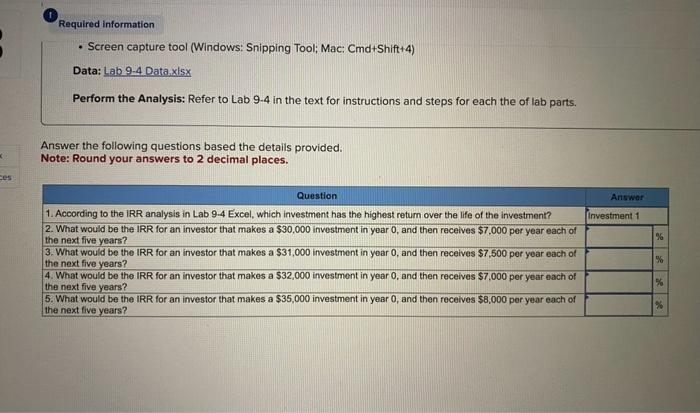

Let's suppose there are four potential investments, each costing $20,000 up front, and the investor has a 5-year horizon (i.e., meaning they plan to sell the investment after 5 years). The first, third, and fourth companies pay dividends, but the second company currently does not. All of their analysis suggests this string of cash flows as shown in Lab Exhibit 9-4.1. 1 2 3 4 5 6 A Year Year 0 (today) Year 1 Year 2 Year 3 Year 4 Year 5 B C D E 1 2 Cash Flow Investment Investment Investment Description Buy Stock Dividends Dividends 3 (20,000) (20,000) (20,000) 750 750 Dividends 750 Dividends 750 Sell Stock 23,000 8 19 10 Net Cash Flows over Life (not discounted) LAB EXHIBIT 9-4.1 6,000 26,000 6,000 1,000 25,000 6,000 Software needed Excel Screen capture tool (Windows: Snipping Tool; Mac: Cmd+Shift+4) Data: Lab 9-4 Data.xlsx Answer the following questions based the details provided. Note: Round your answers to 2 decimal places. F Investment 4 (20,000) 1,000 25,000 Note that Year O is today, or the date of the investment. Years 1-4 are years when dividends are paid. Year 5 is the year that the stock is sold. 6,000 Perform the Analysis: Refer to Lab 9-4 in the text for instructions and steps for each the of lab parts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started