Answered step by step

Verified Expert Solution

Question

1 Approved Answer

South African law Denzo (Pty) Ltd (Denzo) manufactures and supplies spark plugs to the local automotive industry. Denzo has a February year-end and is not

South African law

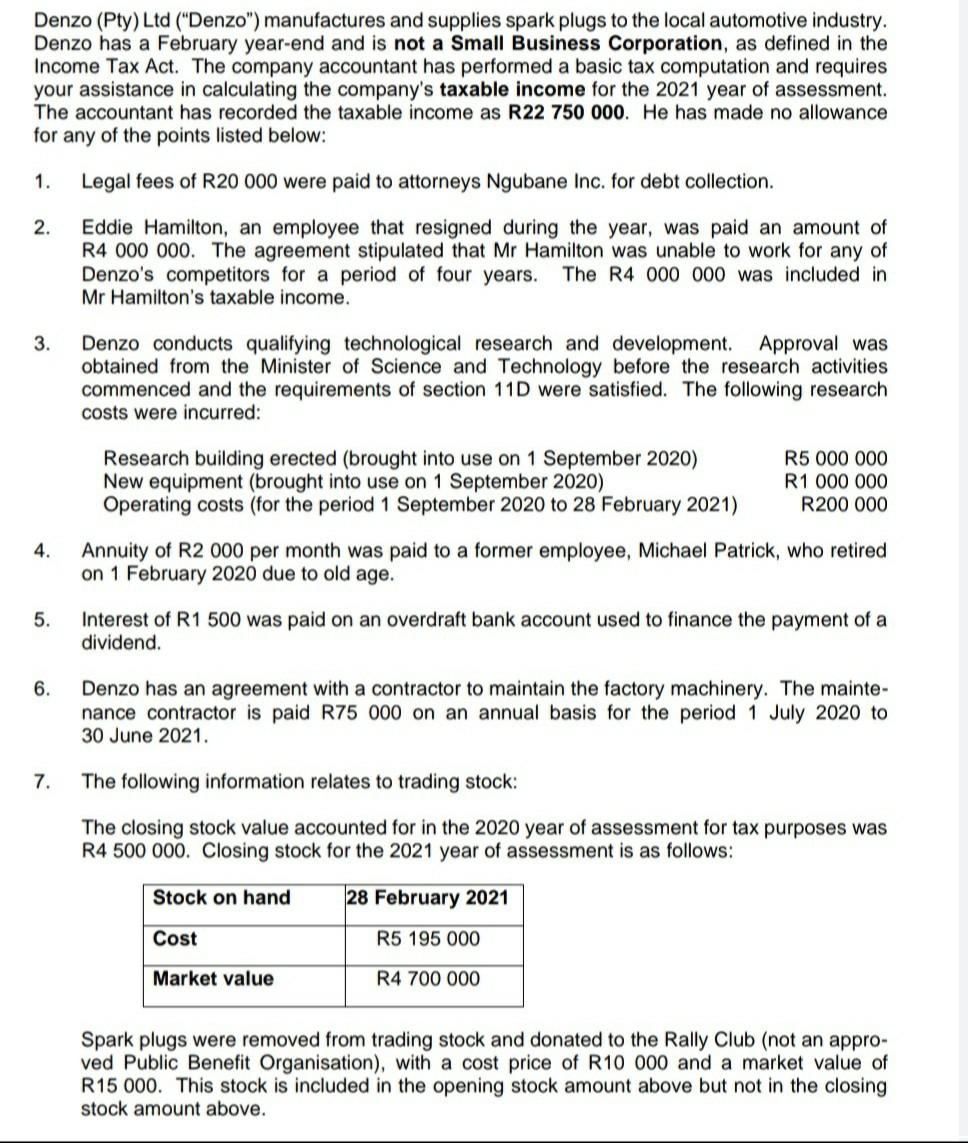

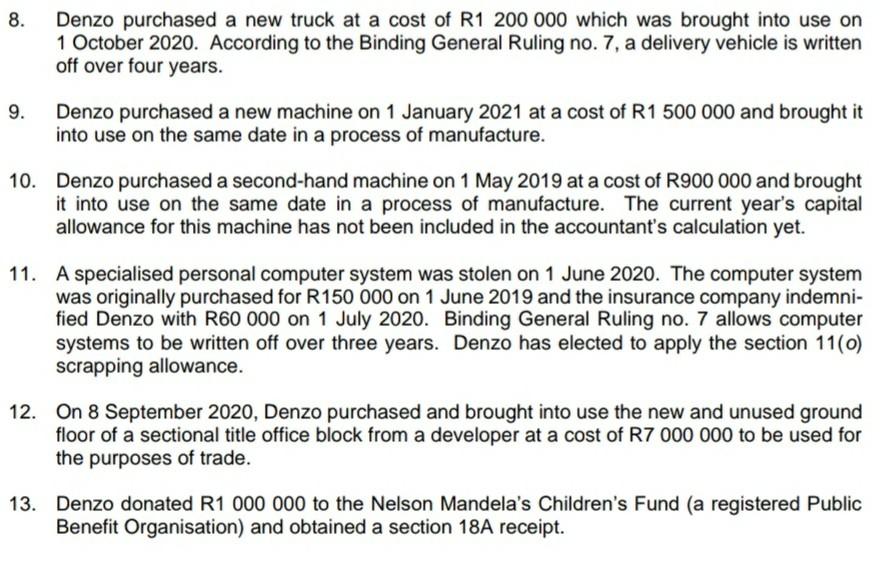

Denzo (Pty) Ltd ("Denzo") manufactures and supplies spark plugs to the local automotive industry. Denzo has a February year-end and is not a Small Business Corporation, as defined in the Income Tax Act. The company accountant has performed a basic tax computation and requires your assistance in calculating the company's taxable income for the 2021 year of assessment. The accountant has recorded the taxable income as R22 750 000. He has made no allowance for any of the points listed below: 1. Legal fees of R20 000 were paid to attorneys Ngubane Inc. for debt collection. 2. Eddie Hamilton, an employee that resigned during the year, was paid an amount of R4 000 000. The agreement stipulated that Mr Hamilton was unable to work for any of Denzo's competitors for a period of four years. The R4 000 000 was included in Mr Hamilton's taxable income. 3. Denzo conducts qualifying technological research and development. Approval was obtained from the Minister of Science and Technology before the research activities commenced and the requirements of section 11D were satisfied. The following research costs were incurred: Research building erected (brought into use on 1 September 2020) New equipment (brought into use on 1 September 2020) Operating costs (for the period 1 September 2020 to 28 February 2021) R5 000 000 R1 000 000 R200 000 4. Annuity of R2 000 per month was paid to a former employee, Michael Patrick, who retired on 1 February 2020 due to old age. 5. Interest of R1 500 was paid on an overdraft bank account used to finance the payment of a dividend. 6. Denzo has an agreement with a contractor to maintain the factory machinery. The mainte- nance contractor is paid R75 000 on an annual basis for the period 1 July 2020 to 30 June 2021. 7. The following information relates to trading stock: The closing stock value accounted for in the 2020 year of assessment for tax purposes was R4 500 000. Closing stock for the 2021 year of assessment is as follows: Stock on hand 28 February 2021 Cost R5 195 000 Market value R4 700 000 Spark plugs were removed from trading stock and donated to the Rally Club (not an appro- ved Public Benefit Organisation), with a cost price of R10 000 and a market value of R15 000. This stock is included in the opening stock amount above but not in the closing stock amount above. 8. Denzo purchased a new truck at a cost of R1 200 000 which was brought into use on 1 October 2020. According to the Binding General Ruling no. 7, a delivery vehicle is written off over four years. 9. Denzo purchased a new machine on 1 January 2021 at a cost of R1 500 000 and brought it into use on the same date in a process of manufacture. 10. Denzo purchased a second-hand machine on 1 May 2019 at a cost of R900 000 and brought it into use on the same date in a process of manufacture. The current year's capital allowance for this machine has not been included in the accountant's calculation yet. 11. A specialised personal computer system was stolen on 1 June 2020. The computer system was originally purchased for R150 000 on 1 June 2019 and the insurance company indemni- fied Denzo with R60 000 on 1 July 2020. Binding General Ruling no. 7 allows computer systems to be written off over three years. Denzo has elected to apply the section 11(0) scrapping allowance. 12. On 8 September 2020, Denzo purchased and brought into use the new and unused ground floor of a sectional title office block from a developer at a cost of R7 000 000 to be used for the purposes of trade. 13. Denzo donated R1 000 000 to the Nelson Mandela's Children's Fund (a registered Public Benefit Organisation) and obtained a section 18A receipt. REQUIRED: Calculate the income tax liability of Denzo (Pty) Ltd for the 2021 year of assessmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started