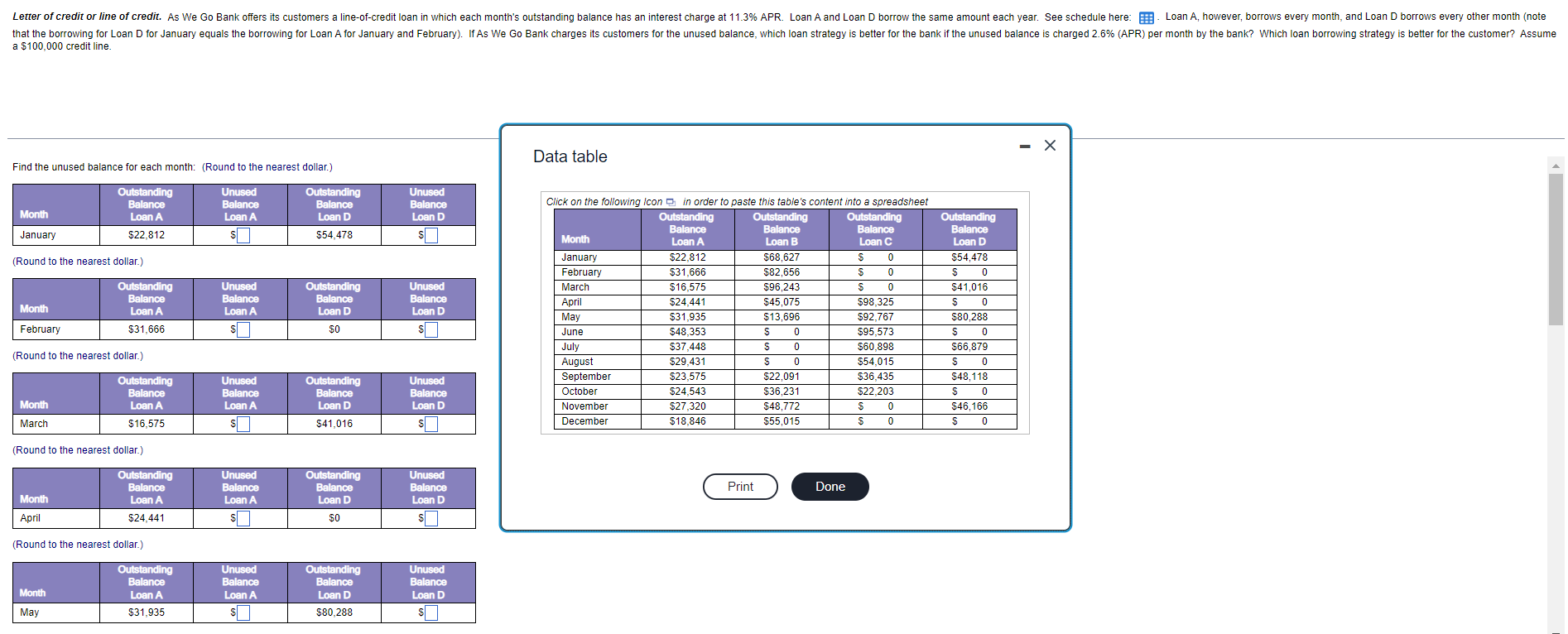

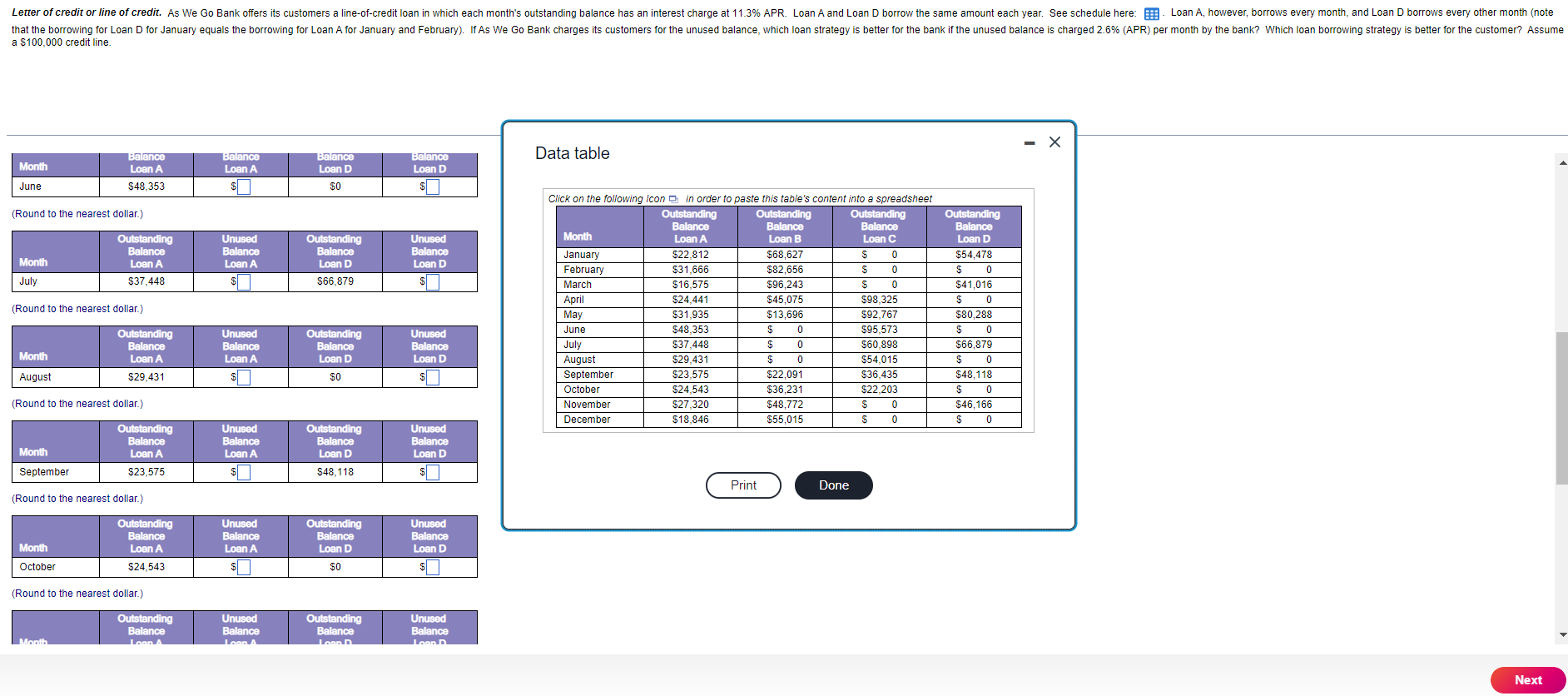

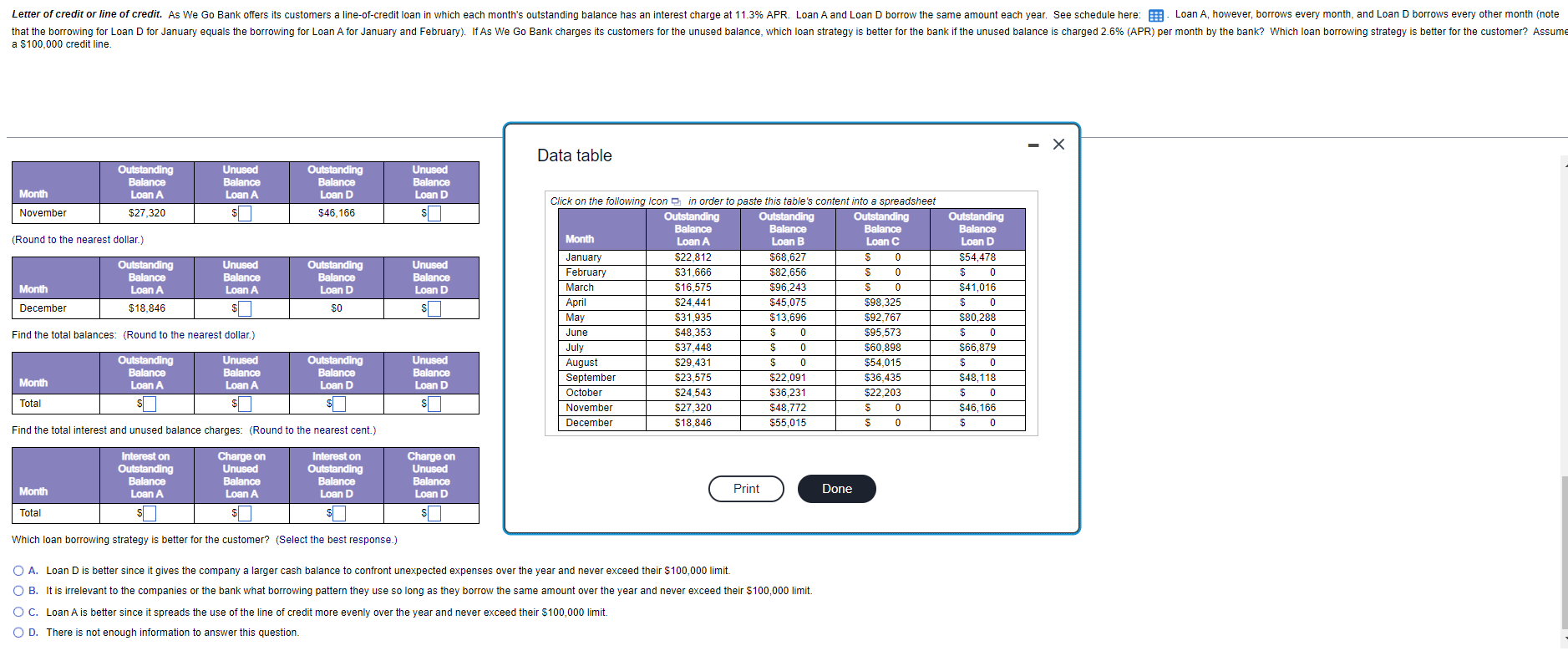

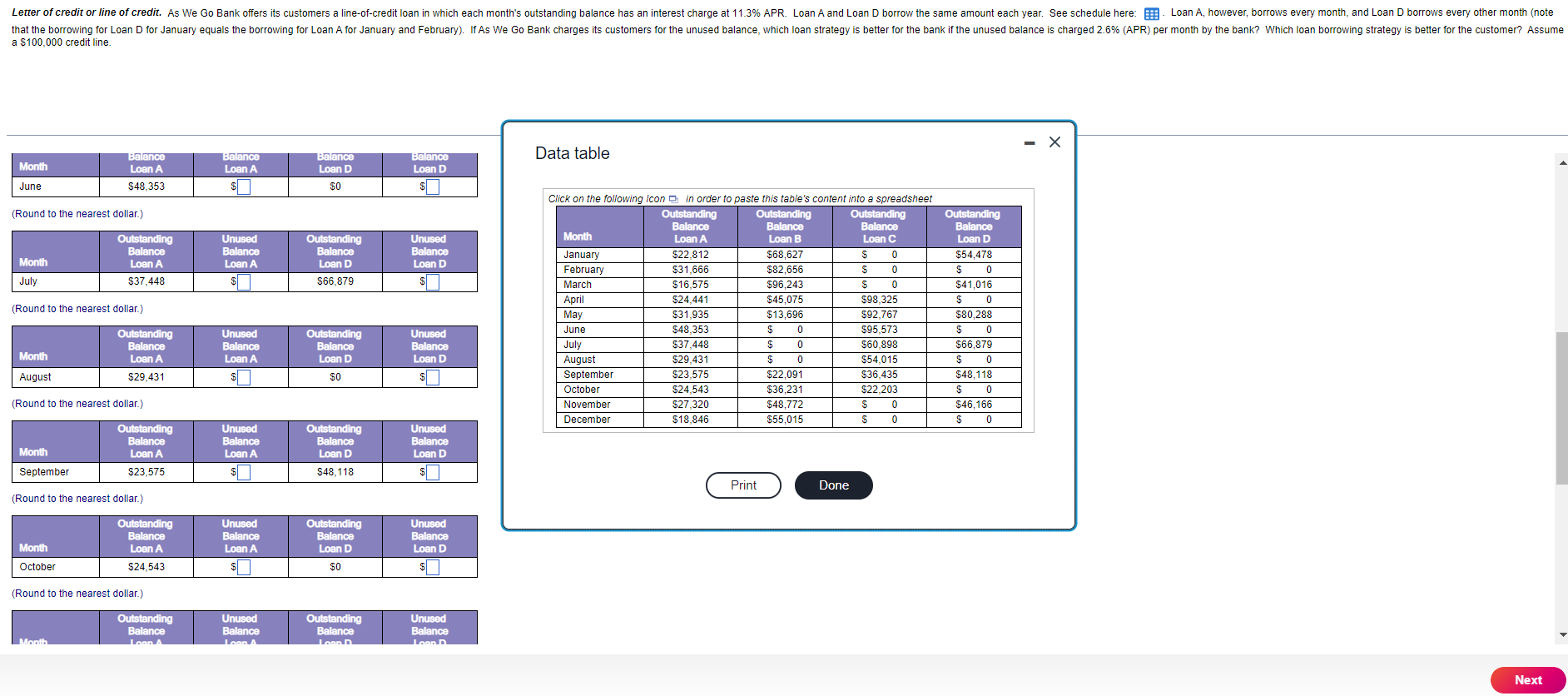

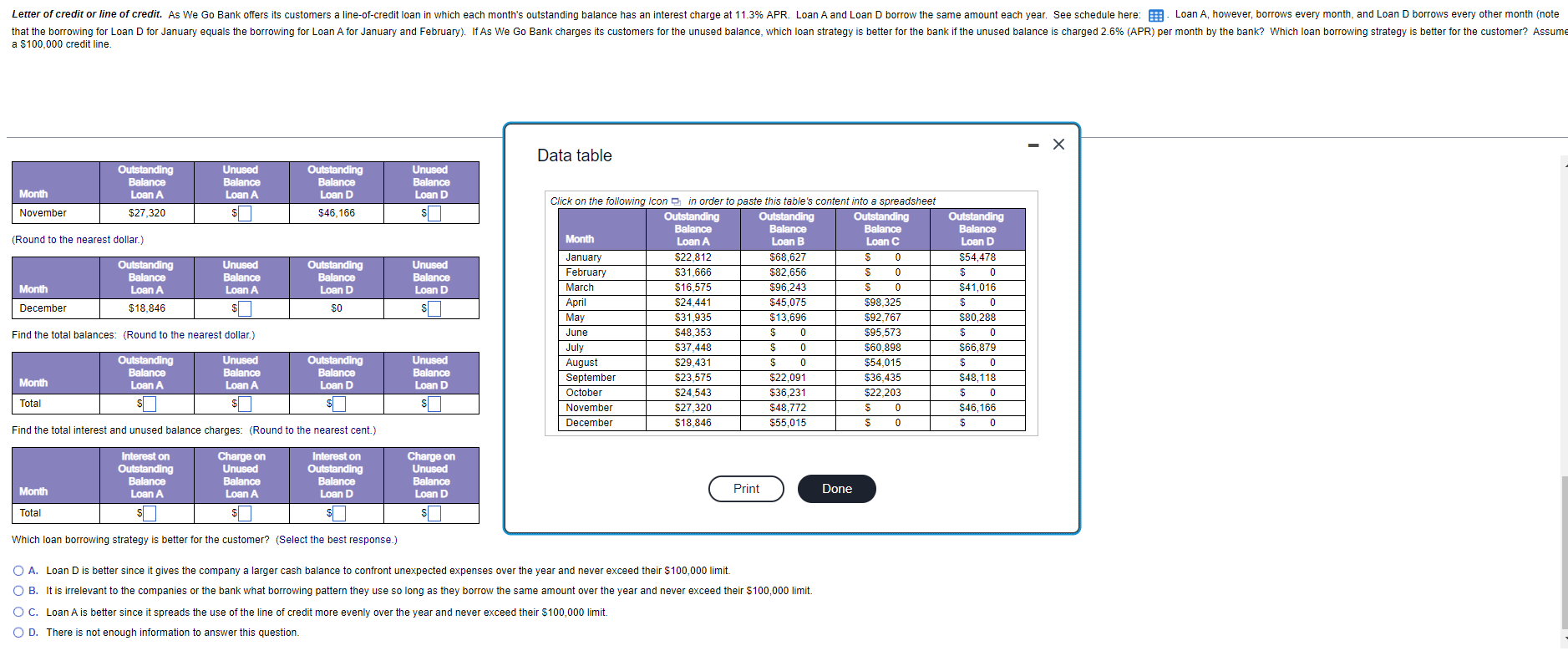

Letter of credit or line of credit. As We Go Bank offers its customers a line-of-credit loan in which each month's outstanding balance has an interest charge at 11.3% APR. Loan A and Loan D borrow the same amount each year. See schedule here: B Loan A, however, borrows every month, and Loan D borrows every other month (note that the borrowing for Loan D for January equals the borrowing for Loan A for January and February). If As We Go Bank charges its customers for the unused balance, which loan strategy is better for the bank if the unused balance is charged 2.6% (APR) per month by the bank? Which loan borrowing strategy is better for the customer? Assume a $100,000 credit line. Data table Find the unused balance for each month: (Round to the nearest dollar.) Month Outstanding Balance Loan A $22,812 Unused Balance Loan A $ Outstanding Balance Loan D $54,478 Unused Balance Loan D $ January (Round to the nearest dollar.) Outstanding Balance Loan A $31,666 Month Unused Balance Loan A $ Outstanding Balance Loan D Unused Balance Loan D $ Click on the following icon in order to paste this table's content into a spreadsheet Outstanding Outstanding Outstanding Balance Balance Balance Month Loan A Loan B Loan C January $22,812 $68,627 S 0 February $31,666 $82,656 S 0 March $16.575 $96,243 S 0 April $24.441 $45,075 $98,325 May $31.935 $13,696 $92,767 June $48,353 $ 0 $95,573 July $37,448 $ 0 $60,898 August $29,431 $ 0 $54,015 September $23,575 $22,091 $36.435 October $24,543 $36,231 $22.203 November $27.320 $48,772 S 0 December $18,846 $55,015 S 0 Outstanding Balance Loan D $54,478 $ 0 $41,016 $ 0 $80,288 $ 0 $66,879 $ 0 $48,118 $ 0 $46,166 $ 0 February $0 (Round to the nearest dollar) Outstanding Balance Loan A $16.575 Month March Unused Balance Loan A s Outstanding Balance Loan D Unused Balance Loan D $ $41,016 (Round to the nearest dollar.) Print Done Month Outstanding Balance Loan A $24.441 Unused Balance Loan A $ Outstanding Balance Loan D $0 Unused Balance Loan D $ April (Round to the nearest dollar) Month Outstanding Balance Loan A $31,935 Unused Balance Loan A $0 Outstanding Balance Loan D $80,288 Unused Balance Loan D $L May Letter of credit or line of credit. As We Go Bank offers its customers a line-of-credit loan in which each month's outstanding balance has an interest charge at 11.3% APR. Loan A and Loan D borrow the same amount each year. See schedule here: B Loan A, however, borrows every month, and Loan D borrows every other month (note that the borrowing for Loan D for January equals the borrowing for Loan A for January and February). If As We Go Bank charges its customers for the unused balance, which loan strategy is better for the bank if the unused balance is charged 2.6% (APR) per month by the bank? Which loan borrowing strategy is better for the customer? Assume a $100,000 credit line. Data table Balance Loan A $48,353 Month June Balance Loan A $ Balance Loan D $0 Balance Loan D (Round to the nearest dollar.) Unused Balance Loan A Outstanding Balance Outstanding Balance Loan A $37.448 Month July Loan D Unused Balance Loan D $ $ $66,879 April $98,325 (Round to the nearest dollar.) Click on the following icon in order to paste this table's content into a spreadsheet Outstanding Outstanding Outstanding Balance Balance Balance Month Loan A Loan B Loan C January $22,812 $68,627 S 0 February $31,666 $82,656 S 0 March $16,575 $96,243 S 0 $24,441 $45,075 May $31,935 $13,696 $92,767 June $48,353 $ 0 $95.573 July $37,448 0 $60,898 August $29,431 $ 0 $54,015 September $23,575 $22,091 $36,435 October $24,543 $36,231 $22.203 November $27,320 $48,772 S 0 December $18,846 $55,015 S 0 Outstanding Balance Loan D $54,478 $ 0 $41,016 $ 0 $80,288 $ 0 $66,879 0 $48,118 $ 0 $46,166 $ 0 Outstanding Balance Unused Balance Loan A Month Loan A Outstanding Balance Loan D $0 Unused Balance Loan D $ August $29,431 (Round to the nearest dollar.) Outstanding Balance Loan A $23,575 Month Unused Balance Loan A $ Outstanding Balance Loan D $48,118 Unused Balance Loan D September Print Done (Round to the nearest dollar.) Outstanding Balance Loan A $24,543 Unused Balance Loan A $ Outstanding Balance Loan D Month Unused Balance Loan D October SO (Round to the nearest dollar.) Outstanding Balance Unused Balance Loan A Outstanding Balance Unused Balance Loan Month Ioan A Loan Next Letter of credit or line of credit. As We Go Bank offers its customers a line-of-credit loan in which each month's outstanding balance has an interest charge at 11.3% APR. Loan A and Loan D borrow the same amount each year. See schedule here: B Loan A, however, borrows every month, and Loan D borrows every other month (note that the borrowing for Loan D for January equals the borrowing for Loan A for January and February). If As We Go Bank charges its customers for the unused balance, which loan strategy is beiter for the bank if the unused balance is charged 2.6% (APR) per month by the bank? Which loan borrowing strategy is better for the customer? Assume a $100,000 credit line. Data table Outstanding Balance Loan A $27,320 Month November Unused Balance Loan A $ Outstanding Balance Loan D $46.166 Unused Balance Loan D (Round to the nearest dollar.) Outstanding Balance Loan A $18,846 Unused Balance Loan A Outstanding Balance Loan D Unused Balance Loan D Month December $ $0 Click on the following Icon in order to paste this table's content into a spreadsheet Outstanding Outstanding Outstanding Balance Balance Balance Month Loan A Loan B Loan C January $22,812 $68,627 S 0 February $31,666 $82,656 S 0 March $16,575 $96,243 S 0 April $24,441 $45,075 $98,325 May $31.935 $13,696 $92,767 June $48,353 $ 0 $95,573 July $37,448 $ 0 $60,898 August $29,431 $ 0 $54,015 September $23,575 $22,091 $36,435 October $24.543 $36,231 $22.203 November $27,320 $48,772 S 0 December $18,846 $55,015 S 0 Outstanding Balance Loan D $54,478 $ 0 $41,016 $ 0 $80,288 $ 0 $66,879 $ 0 $48,118 $ 0 $46,166 $ 0 Find the total balances: (Round to the nearest dollar.) Outstanding Balance Loan A Month Unused Balance Loan A $ Outstanding Balance Loan D $ Unused Balance Loan D $ Total Find the total interest and unused balance charges: (Round to the nearest cent.) Interest on Outstanding Balance Loan A Charge on Unused Balance Loan A $ Interest on Outstanding Balance Loan D Charge on Unused Balance Loan D Month Print Done Total SI Which loan borrowing strategy is better for the customer? (Select the best response.) O A. Loan D is better since it gives the company a larger cash balance to confront unexpected expenses over the year and never exceed their $100,000 limit. B. It is irrelevant to the companies or the bank what borrowing pattern they use so long as they borrow the same amount over the year and never exceed their $100,000 limit. O C. Loan A is better since it spreads the use of the line of credit more evenly over the year and never exceed their $100,000 limit. OD. There is not enough information to answer this question. Letter of credit or line of credit. As We Go Bank offers its customers a line-of-credit loan in which each month's outstanding balance has an interest charge at 11.3% APR. Loan A and Loan D borrow the same amount each year. See schedule here: B Loan A, however, borrows every month, and Loan D borrows every other month (note that the borrowing for Loan D for January equals the borrowing for Loan A for January and February). If As We Go Bank charges its customers for the unused balance, which loan strategy is better for the bank if the unused balance is charged 2.6% (APR) per month by the bank? Which loan borrowing strategy is better for the customer? Assume a $100,000 credit line. Data table Find the unused balance for each month: (Round to the nearest dollar.) Month Outstanding Balance Loan A $22,812 Unused Balance Loan A $ Outstanding Balance Loan D $54,478 Unused Balance Loan D $ January (Round to the nearest dollar.) Outstanding Balance Loan A $31,666 Month Unused Balance Loan A $ Outstanding Balance Loan D Unused Balance Loan D $ Click on the following icon in order to paste this table's content into a spreadsheet Outstanding Outstanding Outstanding Balance Balance Balance Month Loan A Loan B Loan C January $22,812 $68,627 S 0 February $31,666 $82,656 S 0 March $16.575 $96,243 S 0 April $24.441 $45,075 $98,325 May $31.935 $13,696 $92,767 June $48,353 $ 0 $95,573 July $37,448 $ 0 $60,898 August $29,431 $ 0 $54,015 September $23,575 $22,091 $36.435 October $24,543 $36,231 $22.203 November $27.320 $48,772 S 0 December $18,846 $55,015 S 0 Outstanding Balance Loan D $54,478 $ 0 $41,016 $ 0 $80,288 $ 0 $66,879 $ 0 $48,118 $ 0 $46,166 $ 0 February $0 (Round to the nearest dollar) Outstanding Balance Loan A $16.575 Month March Unused Balance Loan A s Outstanding Balance Loan D Unused Balance Loan D $ $41,016 (Round to the nearest dollar.) Print Done Month Outstanding Balance Loan A $24.441 Unused Balance Loan A $ Outstanding Balance Loan D $0 Unused Balance Loan D $ April (Round to the nearest dollar) Month Outstanding Balance Loan A $31,935 Unused Balance Loan A $0 Outstanding Balance Loan D $80,288 Unused Balance Loan D $L May Letter of credit or line of credit. As We Go Bank offers its customers a line-of-credit loan in which each month's outstanding balance has an interest charge at 11.3% APR. Loan A and Loan D borrow the same amount each year. See schedule here: B Loan A, however, borrows every month, and Loan D borrows every other month (note that the borrowing for Loan D for January equals the borrowing for Loan A for January and February). If As We Go Bank charges its customers for the unused balance, which loan strategy is better for the bank if the unused balance is charged 2.6% (APR) per month by the bank? Which loan borrowing strategy is better for the customer? Assume a $100,000 credit line. Data table Balance Loan A $48,353 Month June Balance Loan A $ Balance Loan D $0 Balance Loan D (Round to the nearest dollar.) Unused Balance Loan A Outstanding Balance Outstanding Balance Loan A $37.448 Month July Loan D Unused Balance Loan D $ $ $66,879 April $98,325 (Round to the nearest dollar.) Click on the following icon in order to paste this table's content into a spreadsheet Outstanding Outstanding Outstanding Balance Balance Balance Month Loan A Loan B Loan C January $22,812 $68,627 S 0 February $31,666 $82,656 S 0 March $16,575 $96,243 S 0 $24,441 $45,075 May $31,935 $13,696 $92,767 June $48,353 $ 0 $95.573 July $37,448 0 $60,898 August $29,431 $ 0 $54,015 September $23,575 $22,091 $36,435 October $24,543 $36,231 $22.203 November $27,320 $48,772 S 0 December $18,846 $55,015 S 0 Outstanding Balance Loan D $54,478 $ 0 $41,016 $ 0 $80,288 $ 0 $66,879 0 $48,118 $ 0 $46,166 $ 0 Outstanding Balance Unused Balance Loan A Month Loan A Outstanding Balance Loan D $0 Unused Balance Loan D $ August $29,431 (Round to the nearest dollar.) Outstanding Balance Loan A $23,575 Month Unused Balance Loan A $ Outstanding Balance Loan D $48,118 Unused Balance Loan D September Print Done (Round to the nearest dollar.) Outstanding Balance Loan A $24,543 Unused Balance Loan A $ Outstanding Balance Loan D Month Unused Balance Loan D October SO (Round to the nearest dollar.) Outstanding Balance Unused Balance Loan A Outstanding Balance Unused Balance Loan Month Ioan A Loan Next Letter of credit or line of credit. As We Go Bank offers its customers a line-of-credit loan in which each month's outstanding balance has an interest charge at 11.3% APR. Loan A and Loan D borrow the same amount each year. See schedule here: B Loan A, however, borrows every month, and Loan D borrows every other month (note that the borrowing for Loan D for January equals the borrowing for Loan A for January and February). If As We Go Bank charges its customers for the unused balance, which loan strategy is beiter for the bank if the unused balance is charged 2.6% (APR) per month by the bank? Which loan borrowing strategy is better for the customer? Assume a $100,000 credit line. Data table Outstanding Balance Loan A $27,320 Month November Unused Balance Loan A $ Outstanding Balance Loan D $46.166 Unused Balance Loan D (Round to the nearest dollar.) Outstanding Balance Loan A $18,846 Unused Balance Loan A Outstanding Balance Loan D Unused Balance Loan D Month December $ $0 Click on the following Icon in order to paste this table's content into a spreadsheet Outstanding Outstanding Outstanding Balance Balance Balance Month Loan A Loan B Loan C January $22,812 $68,627 S 0 February $31,666 $82,656 S 0 March $16,575 $96,243 S 0 April $24,441 $45,075 $98,325 May $31.935 $13,696 $92,767 June $48,353 $ 0 $95,573 July $37,448 $ 0 $60,898 August $29,431 $ 0 $54,015 September $23,575 $22,091 $36,435 October $24.543 $36,231 $22.203 November $27,320 $48,772 S 0 December $18,846 $55,015 S 0 Outstanding Balance Loan D $54,478 $ 0 $41,016 $ 0 $80,288 $ 0 $66,879 $ 0 $48,118 $ 0 $46,166 $ 0 Find the total balances: (Round to the nearest dollar.) Outstanding Balance Loan A Month Unused Balance Loan A $ Outstanding Balance Loan D $ Unused Balance Loan D $ Total Find the total interest and unused balance charges: (Round to the nearest cent.) Interest on Outstanding Balance Loan A Charge on Unused Balance Loan A $ Interest on Outstanding Balance Loan D Charge on Unused Balance Loan D Month Print Done Total SI Which loan borrowing strategy is better for the customer? (Select the best response.) O A. Loan D is better since it gives the company a larger cash balance to confront unexpected expenses over the year and never exceed their $100,000 limit. B. It is irrelevant to the companies or the bank what borrowing pattern they use so long as they borrow the same amount over the year and never exceed their $100,000 limit. O C. Loan A is better since it spreads the use of the line of credit more evenly over the year and never exceed their $100,000 limit. OD. There is not enough information to answer this