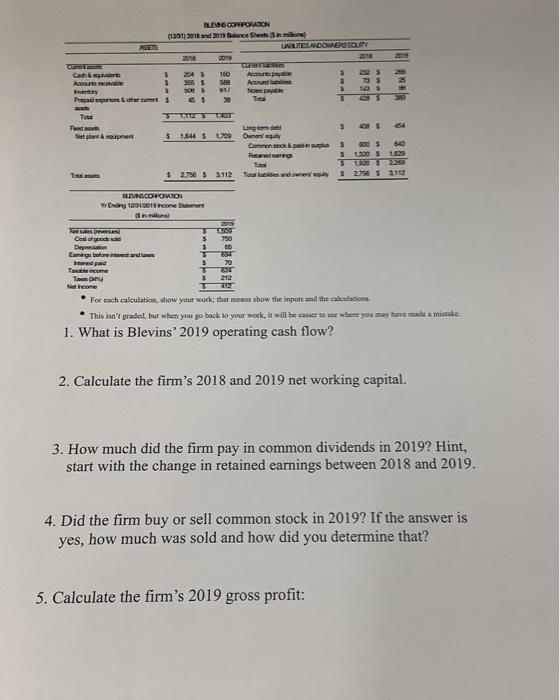

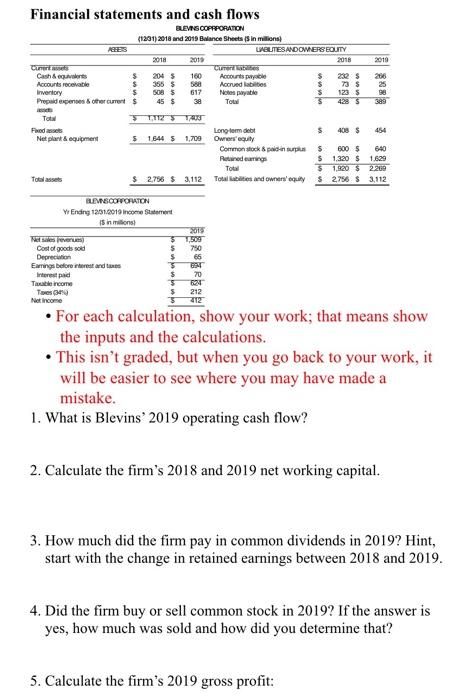

LEVINSONPORATION 1201) 2016 2015 Bilance Sheen BE UNELTES NODWER OY 205 CIL 5 2045 160 Arte 5 225 Ambe $ 3555 568 A $ Invertory 3 3 Prasad partes cerca 15$ 5 OBS Met planten S 1.645 700 Longame Ownegal Commons Remed 5 OG $ S 00SLS To 52.756 S3112 Tellides and we S 27 5 2112 ILIMOS DEPORTES Ending 101219 ore See din mors 2019 5 TO Cated 5 750 De 3 05 Cari banda pad 5 70 Tencome 5 212 5 Z For each calculation, show your work that means show the inputs and the calculation This isn't praded, but when you go back to your work, it will be easier to see where you may have made a mistake 1. What is Blevins' 2019 operating cash flow? 2. Calculate the firm's 2018 and 2019 net working capital. 3. How much did the firm pay in common dividends in 2019? Hint, start with the change in retained earnings between 2018 and 2019. 4. Did the firm buy or sell common stock in 2019? If the answer is yes, how much was sold and how did you determine that? 5. Calculate the firm's 2019 gross profit: 2010 Financial statements and cash flows BLEVNS COPRPORATION (1201) 2018 and 2019 Balance Sheets (5 in millions RES LABUTESANDOMERS EOLITY 2015 2018 Cinere Cutenes Cash & $2043 160 Accounts payable $ 232 s 2016 Accounts receivable $ 355 $ 588 Accrved Babies $ 73 S 25 Inventory $ 5085 617 Nefes payable $ 1235 98 Prepaiden other current $ 38 Total S 428 $ Tot 1112 TAU Fred Longform dobi $ 408 S 454 Net plant & equipment $1644 $ 1,700 Ownegut Common stock pain surplus S 600 5 Retured mes $ 1.320 $ 1.629 $ 1,920 $ 2.200 Total assets $ 2756 $ 3112 Tolabilities and owners' equly 2756 S 3,112 BLES CONVOITON Yr Ending 1201.0019 Income Statement 15 in Millions! 2013 Nese vorm $1,500 Cost of goods sold 5 750 Depreciation $ 66 Earnings before treat and 3 891 Interestad $ 70 Tercome 5 524 Tesne $ 212 Net income 212 To . For each calculation, show your work; that means show the inputs and the calculations. This isn't graded, but when you go back to your work, it will be easier to see where you may have made a mistake. 1. What is Blevins' 2019 operating cash flow? 2. Calculate the firm's 2018 and 2019 net working capital. 3. How much did the firm pay in common dividends in 2019? Hint, start with the change in retained earnings between 2018 and 2019. 4. Did the firm buy or sell common stock in 2019? If the answer is yes, how much was sold and how did you determine that? 5. Calculate the firm's 2019 gross profit