Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Samuel just moved to Radford and plans to live here for 5 years. He just found a perfect house to live in with his family.

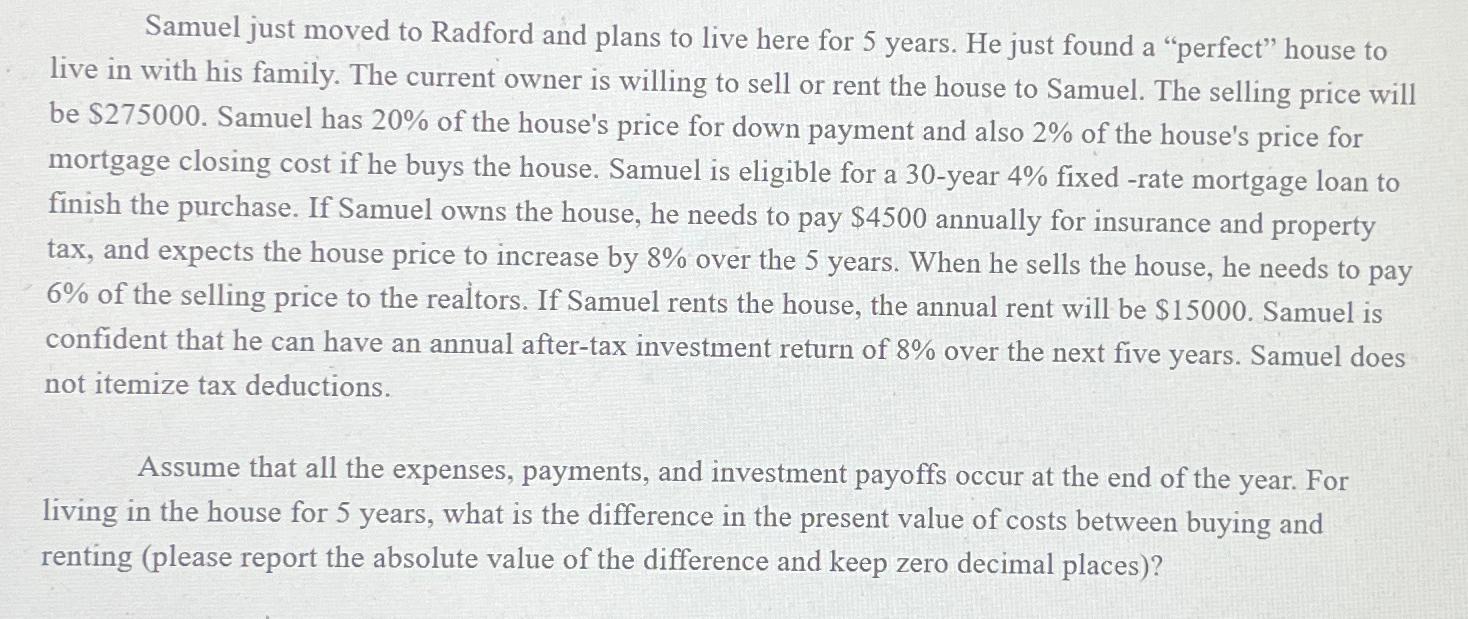

Samuel just moved to Radford and plans to live here for years. He just found a "perfect" house to live in with his family. The current owner is willing to sell or rent the house to Samuel. The selling price will be $ Samuel has of the house's price for down payment and also of the house's price for mortgage closing cost if he buys the house. Samuel is eligible for a year fixed rate mortgage loan to finish the purchase. If Samuel owns the house, he needs to pay $ annually for insurance and property tax, and expects the house price to increase by over the years. When he sells the house, he needs to pay of the selling price to the realtors. If Samuel rents the house, the annual rent will be $ Samuel is confident that he can have an annual aftertax investment return of over the next five years. Samuel does not itemize tax deductions. Assume that all the expenses, payments, and investment payoffs occur at the end of the year. For living in the house for years, what is the difference in the present value of costs between buying and renting please report the absolute value of the difference and keep zero decimal places

Samuel just moved to Radford and plans to live here for years. He just found a "perfect" house to live in with his family. The current owner is willing to sell or rent the house to Samuel. The selling price will be $ Samuel has of the house's price for down payment and also of the house's price for mortgage closing cost if he buys the house. Samuel is eligible for a year fixed rate mortgage loan to finish the purchase. If Samuel owns the house, he needs to pay $ annually for insurance and property tax, and expects the house price to increase by over the years. When he sells the house, he needs to pay of the selling price to the realtors. If Samuel rents the house, the annual rent will be $ Samuel is confident that he can have an annual aftertax investment return of over the next five years. Samuel does not itemize tax deductions.

Assume that all the expenses, payments, and investment payoffs occur at the end of the year. For living in the house for years, what is the difference in the present value of costs between buying and renting please report the absolute value of the difference and keep zero decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started