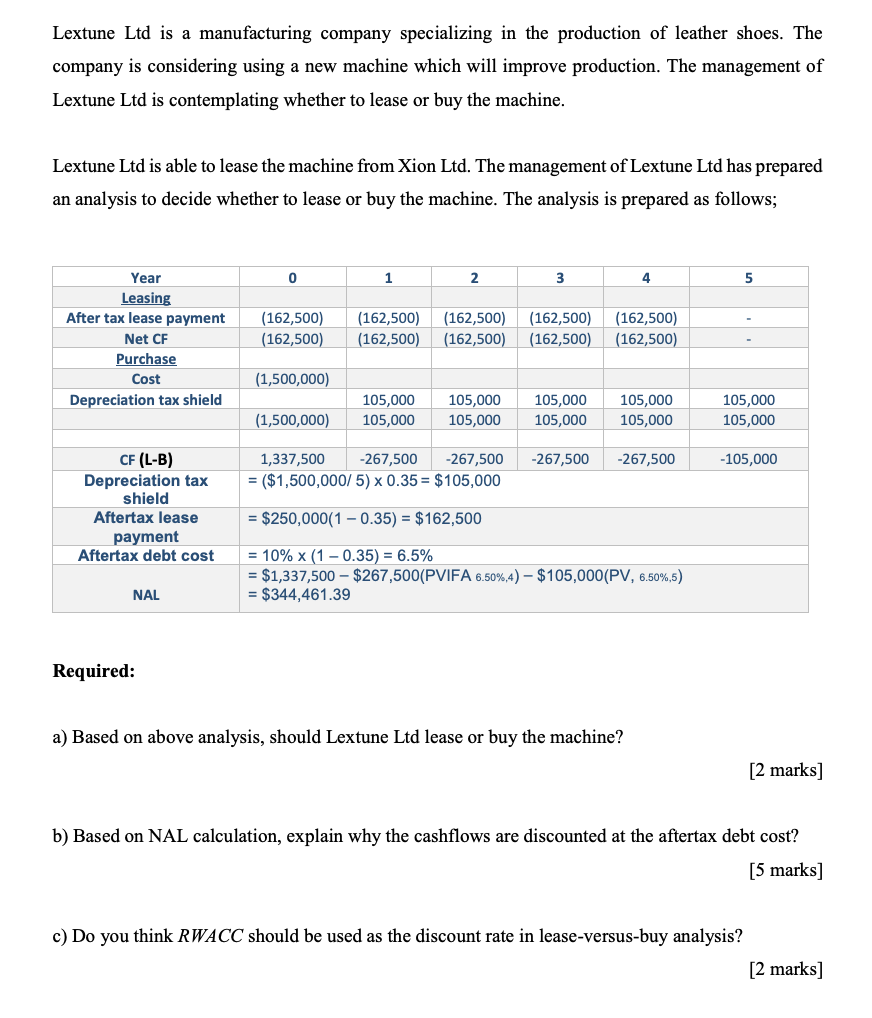

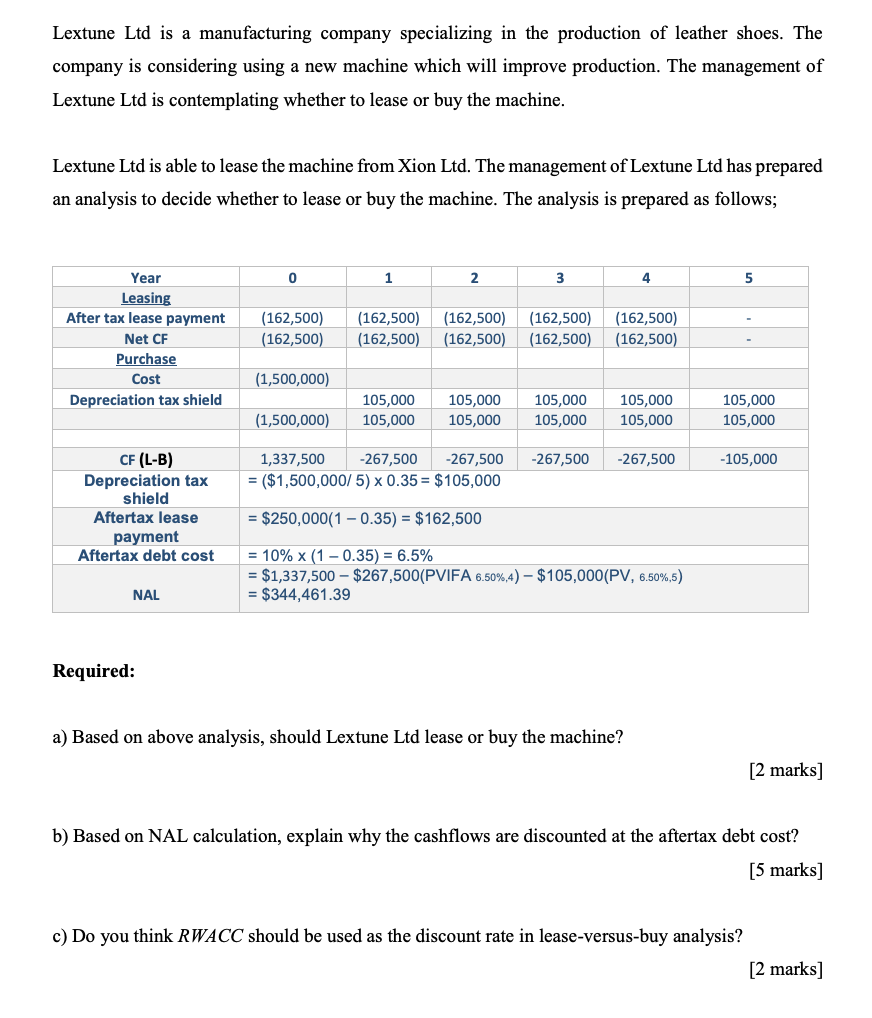

Lextune Ltd is a manufacturing company specializing in the production of leather shoes. The company is considering using a new machine which will improve production. The management of Lextune Ltd is contemplating whether to lease or buy the machine. Lextune Ltd is able to lease the machine from Xion Ltd. The management of Lextune Ltd has prepared an analysis to decide whether to lease or buy the machine. The analysis is prepared as follows; 0 1 2 3 4 5 Year Leasing After tax lease payment Net CF Purchase Cost Depreciation tax shield (162,500) (162,500) (162,500) (162,500) (162,500) (162,500) (162,500) (162,500) (162,500) (162,500) (1,500,000) 105,000 105,000 105,000 105,000 105,000 105,000 105,000 105,000 105,000 105,000 (1,500,000) -267,500 -267,500 -105,000 1,337,500 -267,500 -267,500 = ($1,500,000/5) x 0.35 = $105,000 CF (L-B) Depreciation tax shield Aftertax lease payment Aftertax debt cost = $250,000(1 -0.35) = $162,500 = 10% x (1 -0.35) = 6.5% = $1,337,500 - $267,500(PVIFA 6.50%,4) $105,000(PV, 6.50%,5) = $344,461.39 NAL Required: a) Based on above analysis, should Lextune Ltd lease or buy the machine? [2 marks] b) Based on NAL calculation, explain why the cashflows are discounted at the aftertax debt cost? [5 marks] c) Do you think RWACC should be used as the discount rate in lease-versus-buy analysis? [2 marks] d) Discuss how debt displacement become a hidden cost of leasing? [2 marks] e) Discuss how leasing might be a bad decision for the company. [4 marks] Lextune Ltd is a manufacturing company specializing in the production of leather shoes. The company is considering using a new machine which will improve production. The management of Lextune Ltd is contemplating whether to lease or buy the machine. Lextune Ltd is able to lease the machine from Xion Ltd. The management of Lextune Ltd has prepared an analysis to decide whether to lease or buy the machine. The analysis is prepared as follows; 0 1 2 3 4 5 Year Leasing After tax lease payment Net CF Purchase Cost Depreciation tax shield (162,500) (162,500) (162,500) (162,500) (162,500) (162,500) (162,500) (162,500) (162,500) (162,500) (1,500,000) 105,000 105,000 105,000 105,000 105,000 105,000 105,000 105,000 105,000 105,000 (1,500,000) -267,500 -267,500 -105,000 1,337,500 -267,500 -267,500 = ($1,500,000/5) x 0.35 = $105,000 CF (L-B) Depreciation tax shield Aftertax lease payment Aftertax debt cost = $250,000(1 -0.35) = $162,500 = 10% x (1 -0.35) = 6.5% = $1,337,500 - $267,500(PVIFA 6.50%,4) $105,000(PV, 6.50%,5) = $344,461.39 NAL Required: a) Based on above analysis, should Lextune Ltd lease or buy the machine? [2 marks] b) Based on NAL calculation, explain why the cashflows are discounted at the aftertax debt cost? [5 marks] c) Do you think RWACC should be used as the discount rate in lease-versus-buy analysis? [2 marks] d) Discuss how debt displacement become a hidden cost of leasing? [2 marks] e) Discuss how leasing might be a bad decision for the company. [4 marks]