Answered step by step

Verified Expert Solution

Question

1 Approved Answer

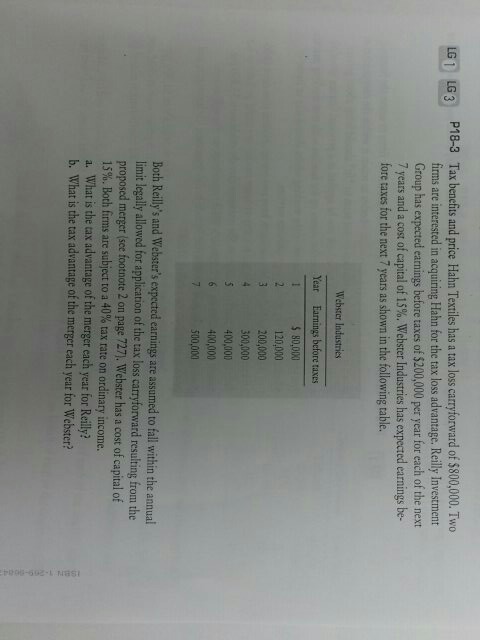

LG LG3 P18-3 Tax benefits and price Hahn Textiles has a tax loss carryforward of $800,000. Two firms are interested in acquiring Hahn for the

LG LG3 P18-3 Tax benefits and price Hahn Textiles has a tax loss carryforward of $800,000. Two firms are interested in acquiring Hahn for the tax loss advantage. Reilly Investment Group has expected earnings before taxes of $200,000 per year for each of the next 7 years and a cost of capital of 15%. Webster Industries has expected earnings be- fore taxes for the next 7 years as shown in the following table. Year Earnings before taxes 120,000 200,000 00,000 400,000 400,000 500,000 Both Reilly's and Webster's expected earnings are assamed to fall within the annual imit legally allowed for application of the tax loss carryforward resulting from the proposed merger (see footnote 2 on page 727). Webster has a cost of capital of 15%. Both firms are subject to a 40% tax rate on ordinary income. a. What is the tax advantage of the merger each year for Reilly? b. What is the tax advantage of the merger each year for Webster

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started