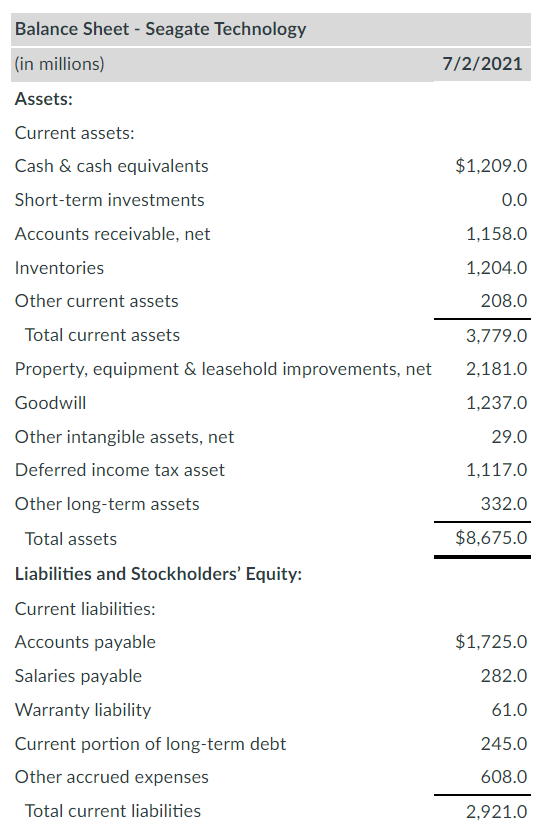

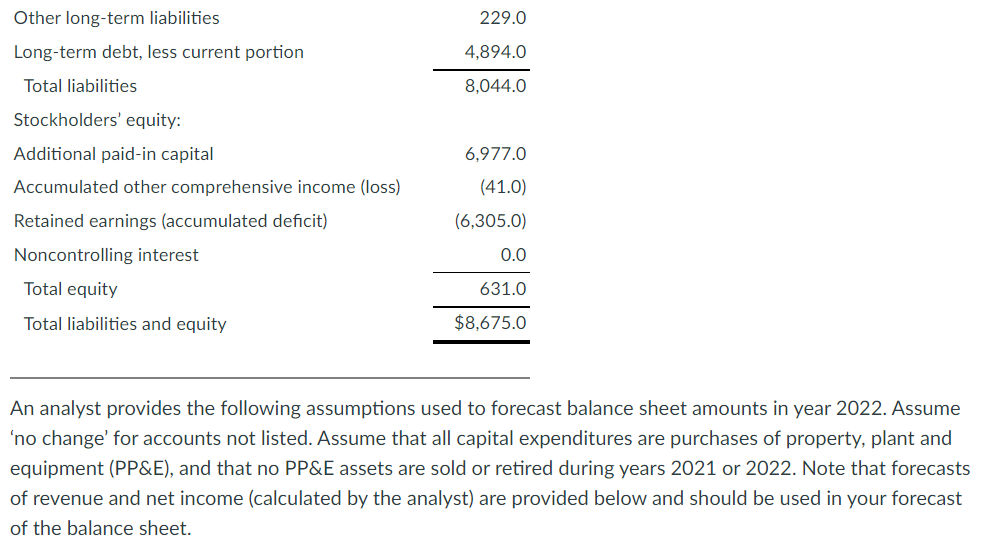

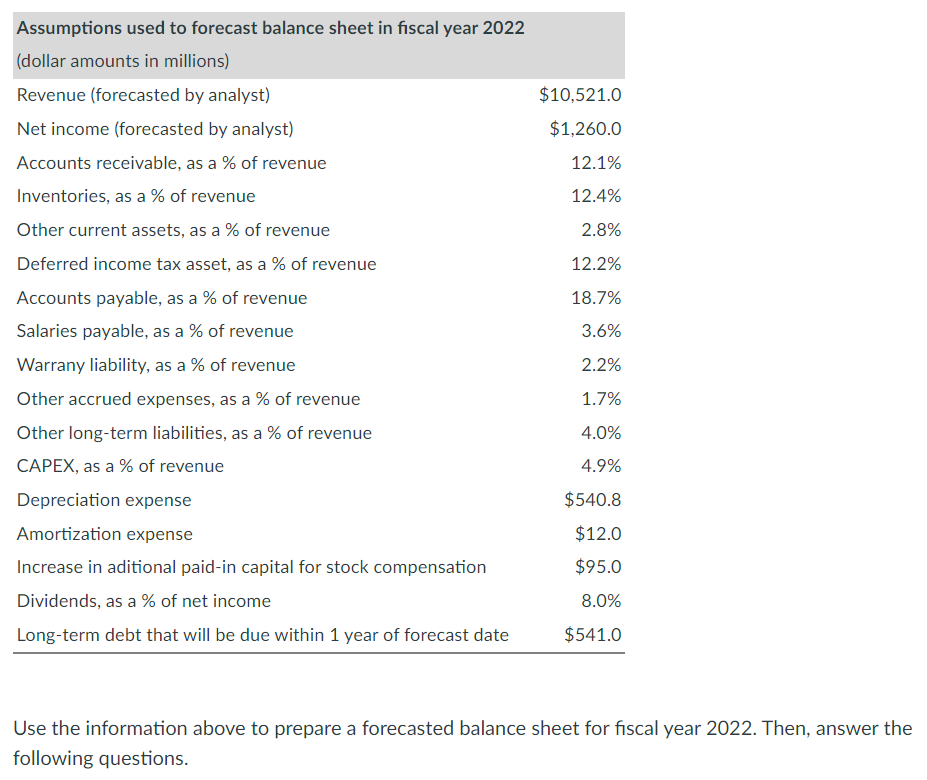

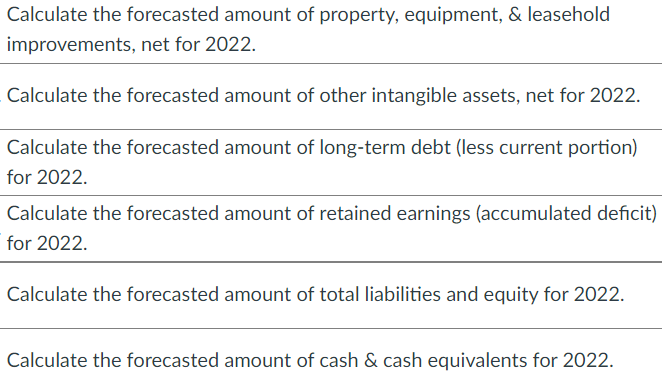

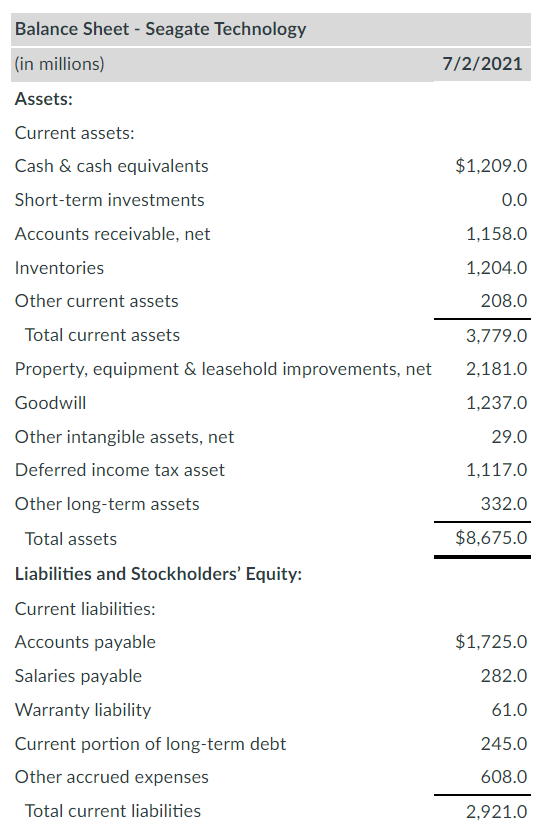

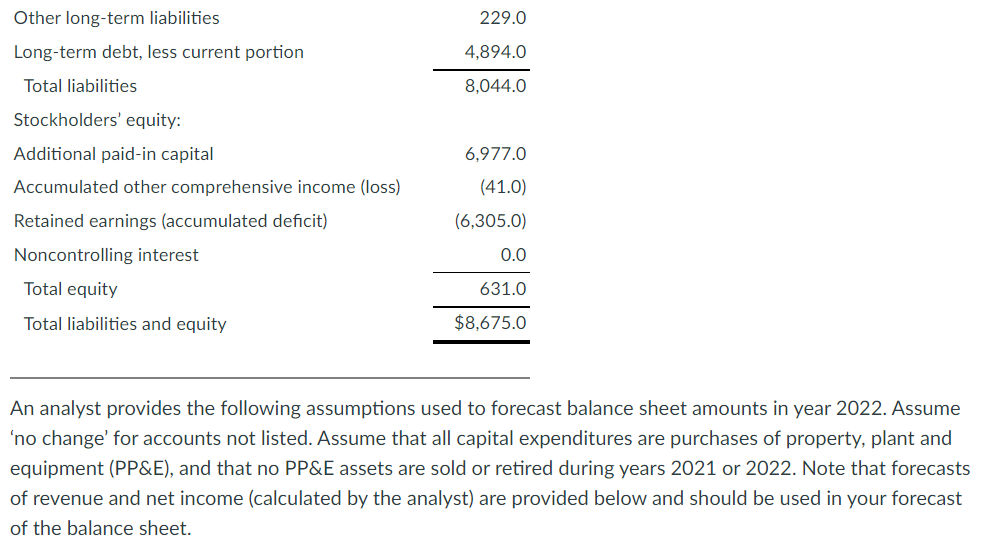

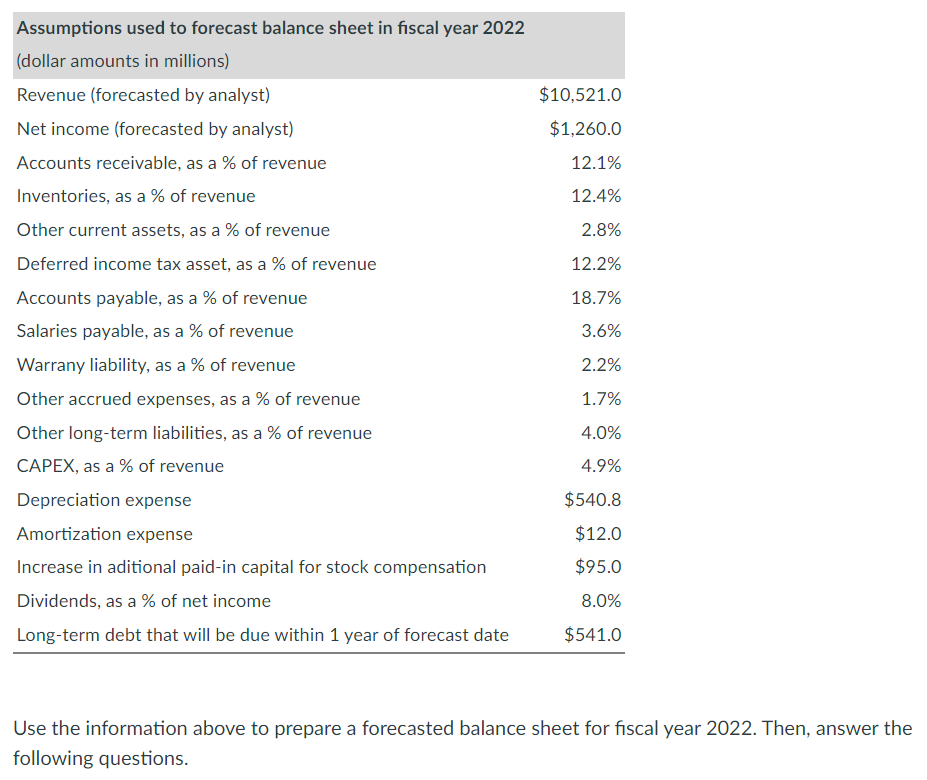

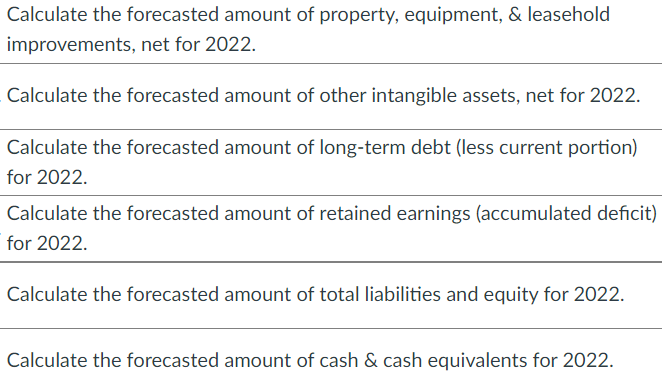

Liabilities and Stockholders' Equity: Current liabilities: \begin{tabular}{lr} Accounts payable & $1,725.0 \\ Salaries payable & 282.0 \\ Warranty liability & 61.0 \\ Current portion of long-term debt & 245.0 \\ Other accrued expenses & 608.0 \\ \cline { 2 } Total current liabilities & 2,921.0 \end{tabular} An analyst provides the following assumptions used to forecast balance sheet amounts in year 2022. Assume 'no change' for accounts not listed. Assume that all capital expenditures are purchases of property, plant and equipment (PP\&E), and that no PP\&E assets are sold or retired during years 2021 or 2022 . Note that forecasts of revenue and net income (calculated by the analyst) are provided below and should be used in your forecast of the balance sheet. Use the information above to prepare a forecasted balance sheet for fiscal year 2022. Then, answer the following questions. Calculate the forecasted amount of property, equipment, \& leasehold improvements, net for 2022. Calculate the forecasted amount of other intangible assets, net for 2022. Calculate the forecasted amount of long-term debt (less current portion) for 2022. Calculate the forecasted amount of retained earnings (accumulated deficit) for 2022. Calculate the forecasted amount of total liabilities and equity for 2022. Calculate the forecasted amount of cash \& cash equivalents for 2022. Liabilities and Stockholders' Equity: Current liabilities: \begin{tabular}{lr} Accounts payable & $1,725.0 \\ Salaries payable & 282.0 \\ Warranty liability & 61.0 \\ Current portion of long-term debt & 245.0 \\ Other accrued expenses & 608.0 \\ \cline { 2 } Total current liabilities & 2,921.0 \end{tabular} An analyst provides the following assumptions used to forecast balance sheet amounts in year 2022. Assume 'no change' for accounts not listed. Assume that all capital expenditures are purchases of property, plant and equipment (PP\&E), and that no PP\&E assets are sold or retired during years 2021 or 2022 . Note that forecasts of revenue and net income (calculated by the analyst) are provided below and should be used in your forecast of the balance sheet. Use the information above to prepare a forecasted balance sheet for fiscal year 2022. Then, answer the following questions. Calculate the forecasted amount of property, equipment, \& leasehold improvements, net for 2022. Calculate the forecasted amount of other intangible assets, net for 2022. Calculate the forecasted amount of long-term debt (less current portion) for 2022. Calculate the forecasted amount of retained earnings (accumulated deficit) for 2022. Calculate the forecasted amount of total liabilities and equity for 2022. Calculate the forecasted amount of cash \& cash equivalents for 2022