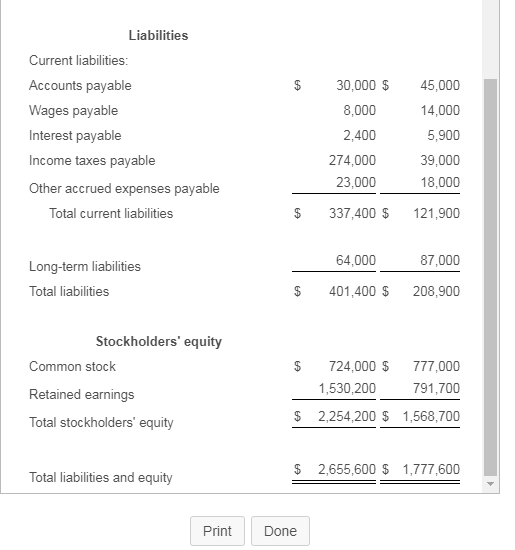

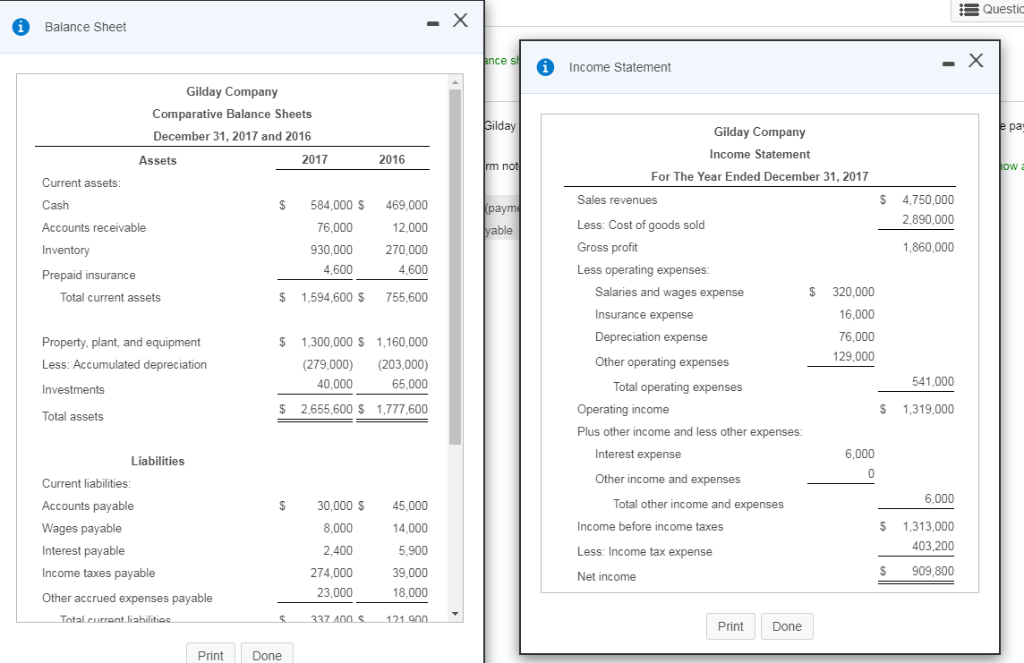

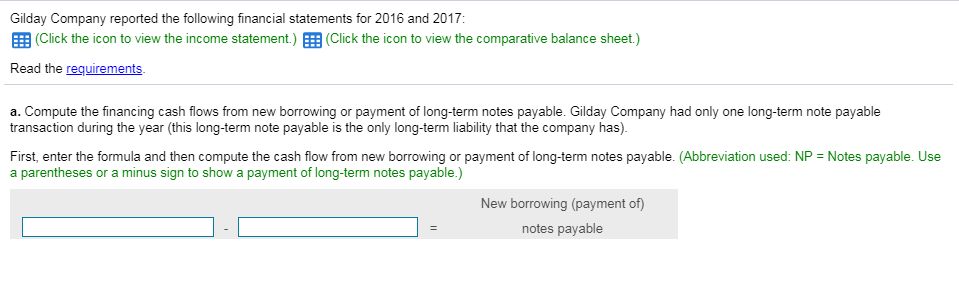

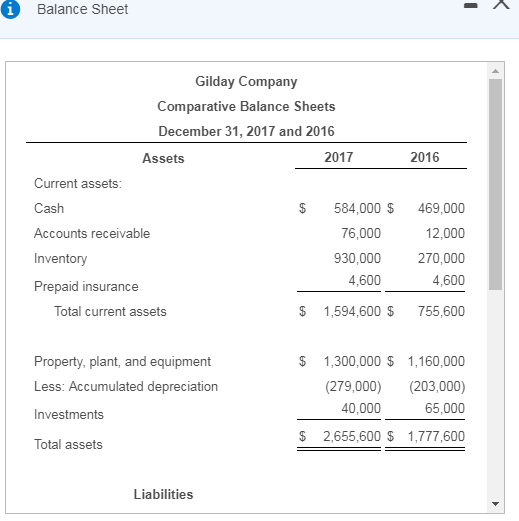

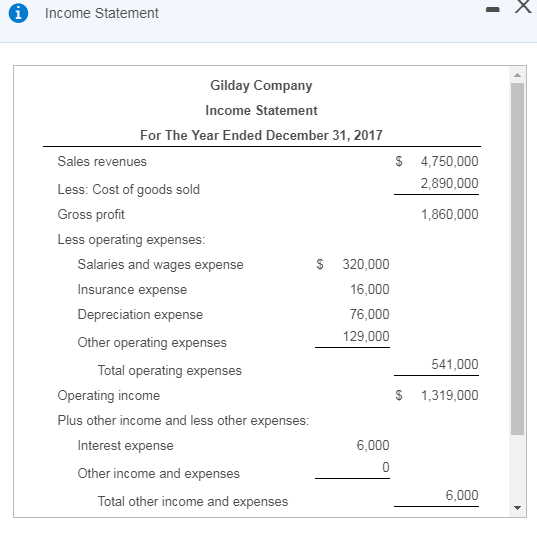

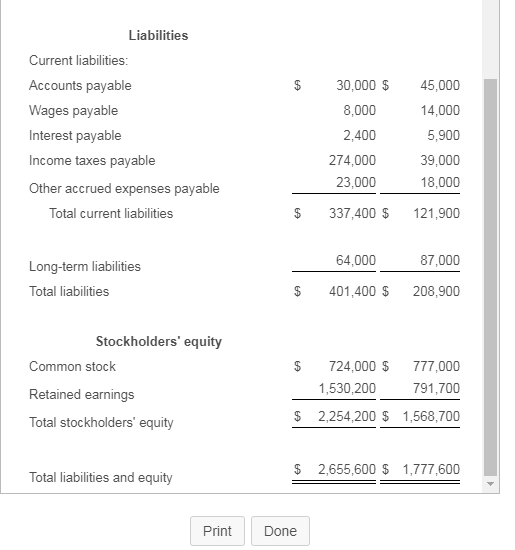

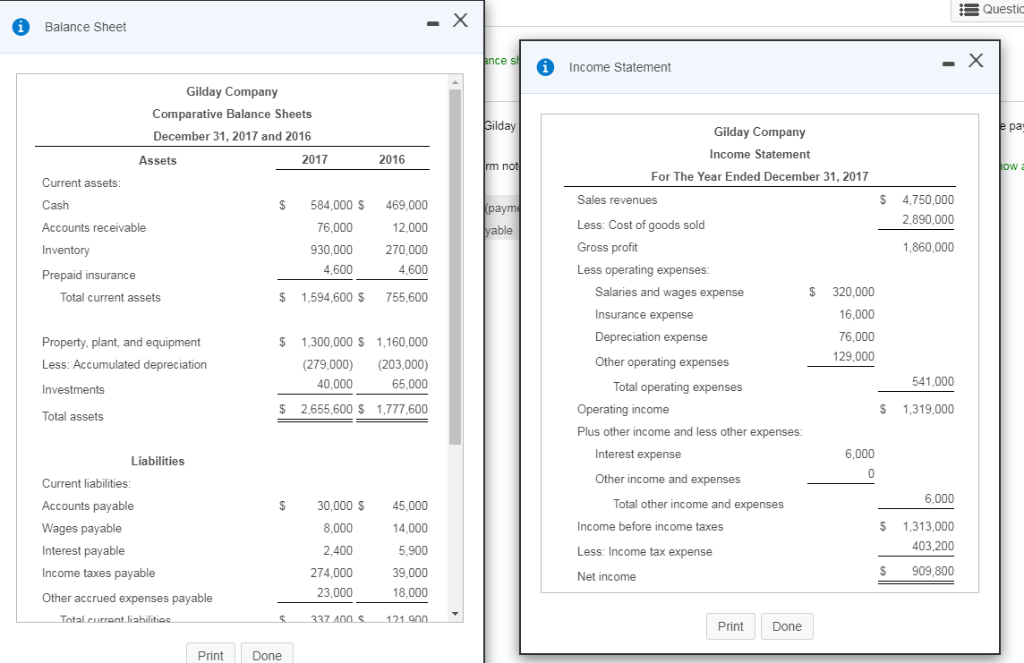

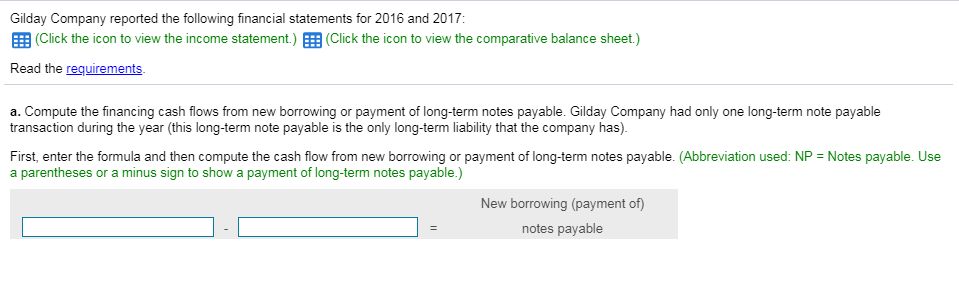

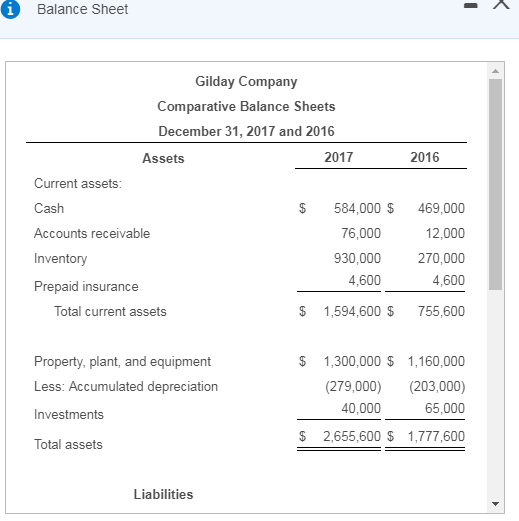

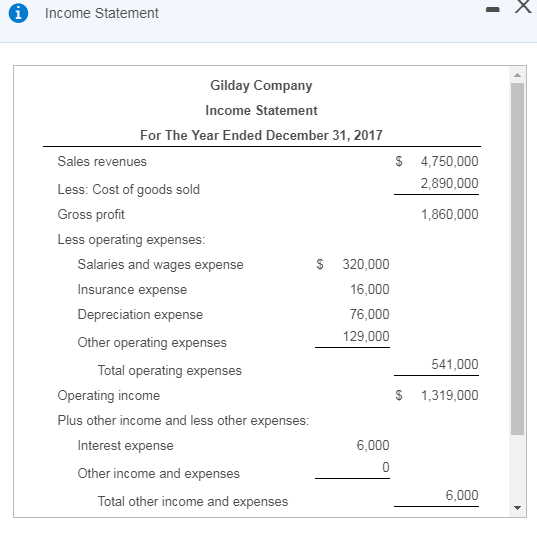

Liabilities Current liabilities Accounts payable Wages payable Interest payable ncome taxes payable Other accrued expenses payable $ 30,000 $ 45,000 14,000 5,900 39,000 18,000 $ 337,400 $121,900 8,000 2,400 274,000 23,000 Total current liabilities 87,000 64,000 Long-term liabilities Total liabilities $ 401,400 $ 208,900 Stockholders' equity Common stock Retained earnings Total stockholders' equity $ 724,000 $777,000 530,200 791,700 $ 2,254,200 $ 1,568,700 $ 2,655,600 $ 1,777,600 Total liabilities and equity PrintDone Questic Balance Sheet Income Statement Gilday Company Comparative Balance Sheets December 31, 2017 and 2016 iday pa Gilday Company Income Statement For The Year Ended December 31, 2017 2016 2017 Assets Current assets: Cash Accounts receivable Inventory Prepaid insurance S 4,750,000 2,890,000 1,860,000 Sales revenues Less: Cost of goods sold Gross proft Less operating expenses: $ 584,000 469,000 12,000 930,000 270,000 4600 $ 1,594,600 755,600 76,000 able 4,600 Salaries and wages expense Insurance expense Depreciation expense Other operating expenses $ 320,000 16,000 76,000 129,000 Total current assets Property, plant, and equipment Less: Accumulated depreciation Investments Total assets $ 1,300,000 $ 1,160,000 (279,000) (203,000) 65,000 $ 2,655,600 $ 1,777,600 541,000 40,000 Total operating expenses Operating income Plus other income and less other expenses S 1,319,000 Interest expense 6,000 Liabilities Other income and expenses Current liabilities Accounts payable Wages payable Interest payable Income taxes payable Other accrued expenses payable 6,000 S 1,313,000 403,200 S 909,800 30,000 45,000 14,000 5,900 39,000 18,000 Total other income and expenses Income before income Less: Income tax expense Net income 8,000 2,400 274,000 23,000 taxes Print Done Print Done Gilday Company reported the following financial statements for 2016 and 2017 EE (Click the icon to view the income statement.) EEB (Click the icon to view the comparative balance sheet.) Read the requirements a. Compute the financing cash flows from new borrowing or payment of long-term notes payable. Gilday Company had only one long-term note payable transaction during the year (this long-term note payable is the only long-tem liability that the company has) First, enter the formula and then compute the cash flow from new borrowing or payment of long-term notes payable. (Abbreviation used: NP Notes payable. Use a parentheses or a minus sign to show a payment of long-term notes payable.) New borrowing (payment of) notes payable Income Statement Gilday Company Income Statement For The Year Ended December 31. 2017 S 4,750,000 2,890,000 Sales revenues Less: Cost of goods sold Gross profit Less operating expenses 1,860,000 Salaries and wages expense Insurance expense Depreciation expense Other operating expenses S 320,000 16,000 76,000 129,000 541,000 Total operating expenses 1,319,000 Operating income Plus other income and less other expenses Interest expense 6,000 Other income and expenses 6,000 Total other income and expenses