Answered step by step

Verified Expert Solution

Question

1 Approved Answer

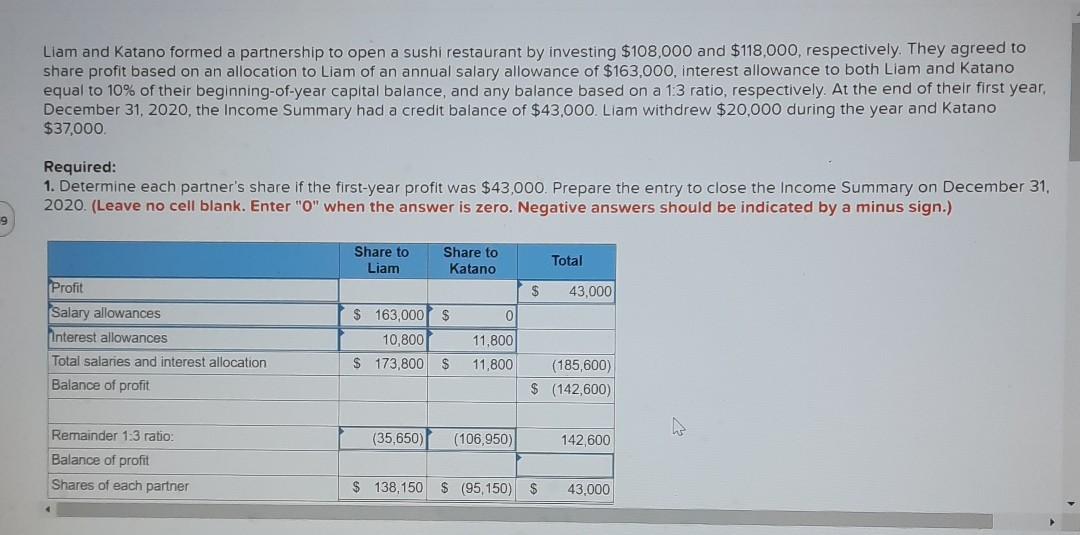

Liam and Katano formed a partnership to open a sushi restaurant by investing $108,000 and $118,000, respectively. They agreed to share profit based on an

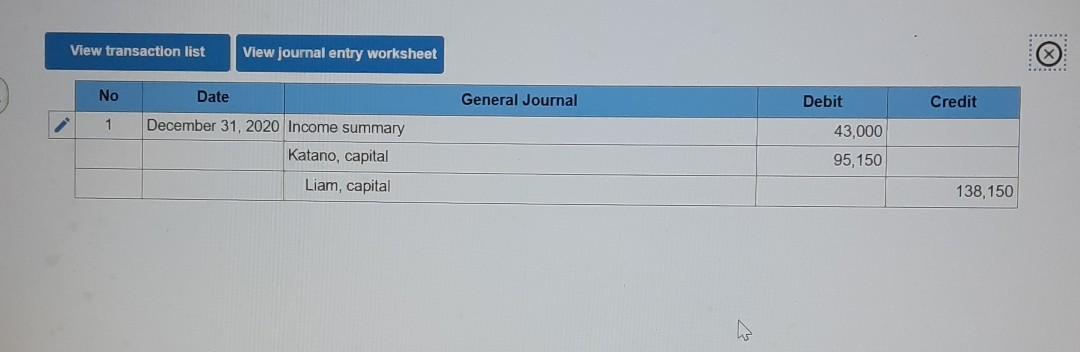

Liam and Katano formed a partnership to open a sushi restaurant by investing $108,000 and $118,000, respectively. They agreed to share profit based on an allocation to Liam of an annual salary allowance of $163,000, interest allowance to both Liam and Katano equal to 10% of their beginning-of-year capital balance, and any balance based on a 1:3 ratio, respectively. At the end of their first year, December 31, 2020, the Income Summary had a credit balance of $43,000. Llam withdrew $20,000 during the year and Katano $37,000 Required: 1. Determine each partner's share if the first-year profit was $43,000. Prepare the entry to close the Income Summary on December 31 2020. (Leave no cell blank. Enter "0" when the answer is zero. Negative answers should be indicated by a minus sign.) 9 Share to Liam Share to Katano Total $ 43,000 0 Profit Salary allowances Interest allowances Total salaries and interest allocation Balance of profit $ 163,000 $ 10,800 $ 173,800 $ 11,800 11,800 (185,600) $ (142,600) (35,650) (106,950) 142.600 Remainder 1:3 ratio: Balance of profit Shares of each partner $ 138,150 $ (95,150) $ 43,000 ***** View transaction list View journal entry worksheet No General Journal Debit Credit 1 Date December 31, 2020 Income summary Katano, capital 43,000 95,150 Liam, capital 138,150 2. Calculate the balance in each partner's capital account at the end of their first year (Negative answers (i.e. debit account balances) should be indicated by a minus sign.) Liam Katano Capital account balances This

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started