Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Libro1 - Microsoft Excel (Error de activacin de productos) Inicio Insertar Diseo de pgina Frmulas Datos Revisar Vista Calibri - 11 A - Ajustar texto

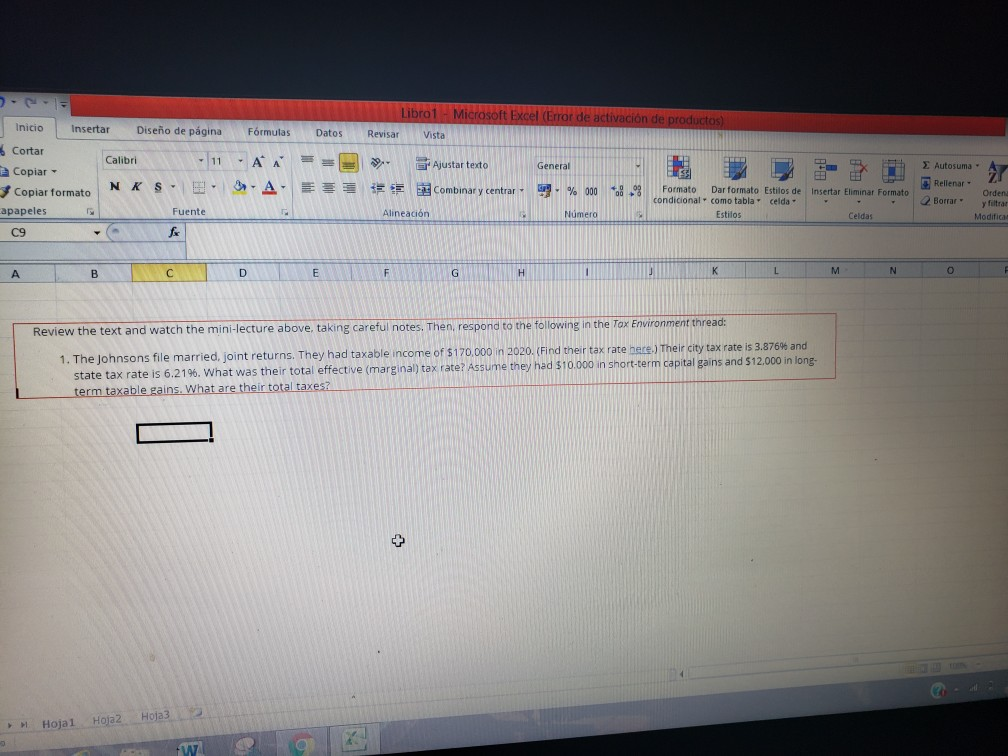

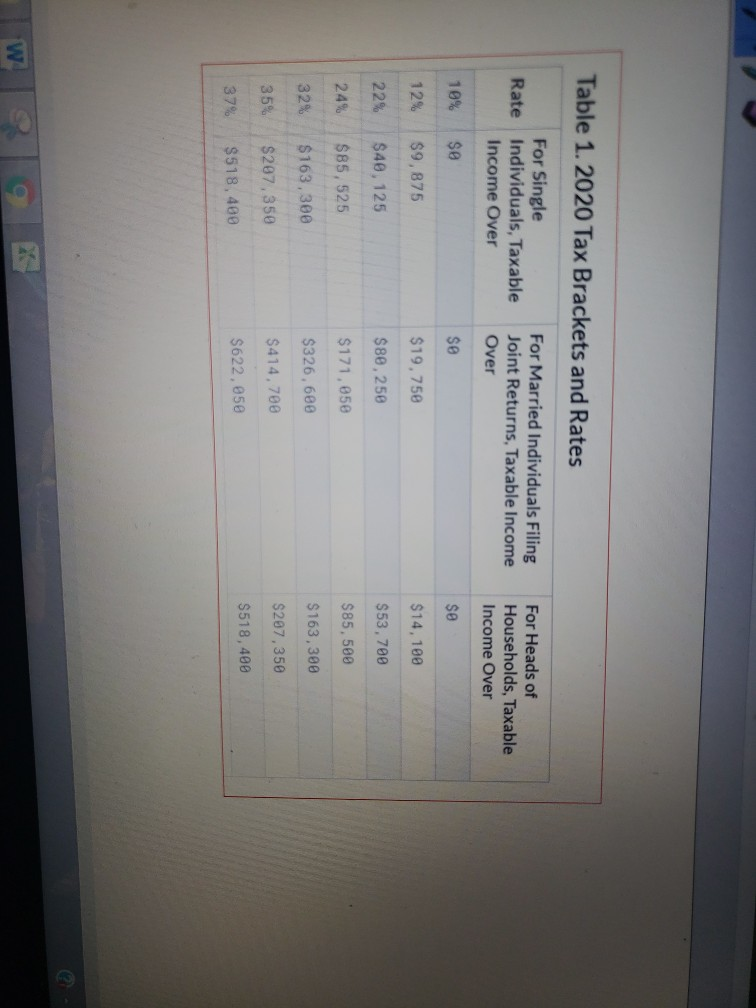

Libro1 - Microsoft Excel (Error de activacin de productos) Inicio Insertar Diseo de pgina Frmulas Datos Revisar Vista Calibri - 11 A - Ajustar texto General Autosuma - Ar 6 Cortar Copiar Copiar formato apapeles C9 NKS. I - A- EEE Combinar y centrar F. % 000.08 Formato Dar formato Estilos de condicional como tabla celda Estilos bar Insertar Eliminar Formato Rellenar - Ordene Borrar y filtras Modifica Fuente Alineacin Numero Celdas fx A B c D E F G H 1 K L N O F Review the text and watch the mini-lecture above, taking careful notes. Then, respond to the following in the Tox Environment thread: 1. The Johnsons file married, joint returns. They had taxable income of $170,000 in 2020. (Find their tax rate here.) Their city tax rate is 3.876% and state tax rate is 6.2196. What was their total effective (marginal) tax rate? Assume they had $10.000 in short-term capital gains and $12,000 in long- term taxable gains. What are their total taxes? O Hojal Hoja2 Hoja3 w Table 1.2020 Tax Brackets and Rates For Single Rate Individuals, Taxable Income Over For Married Individuals Filing Joint Returns, Taxable income Over For Heads of Households, Taxable Income Over 10% so so $0 12% $9,875 $19.750 $14, 100 22% $40, 125 $80, 250 $53, 700 24% $85, 525 $171,050 $85,500 $163, 300 32% $ 163,300 $326,600 $207,350 35% $414,700 $207,350 $518,400 37% $622,050 $518,400 w

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started