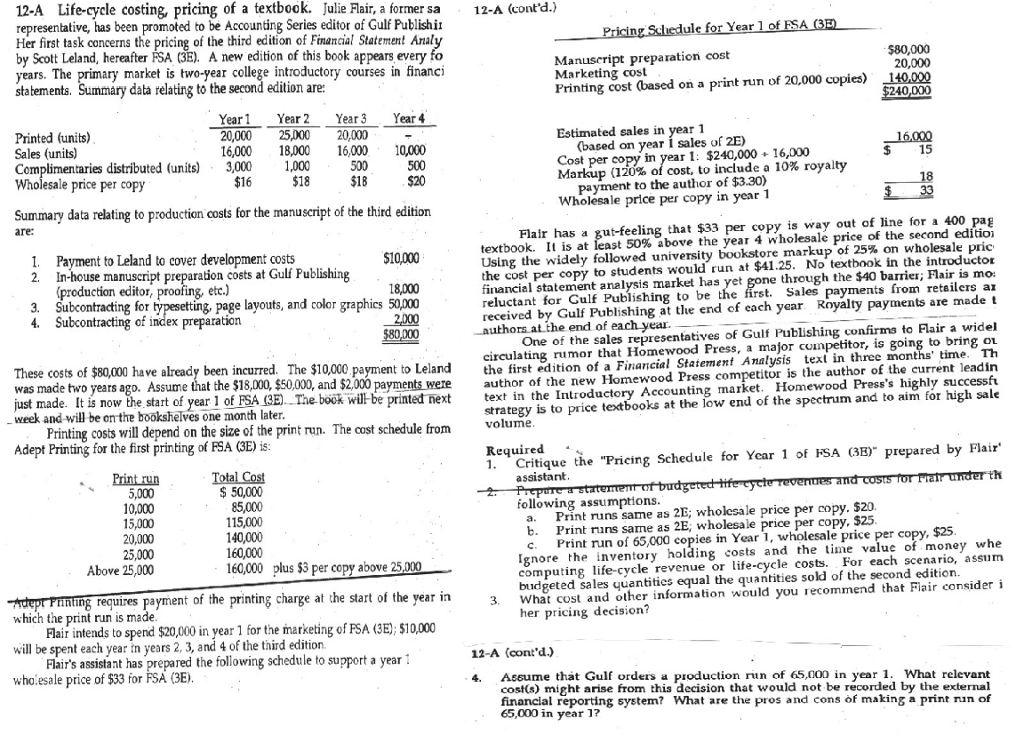

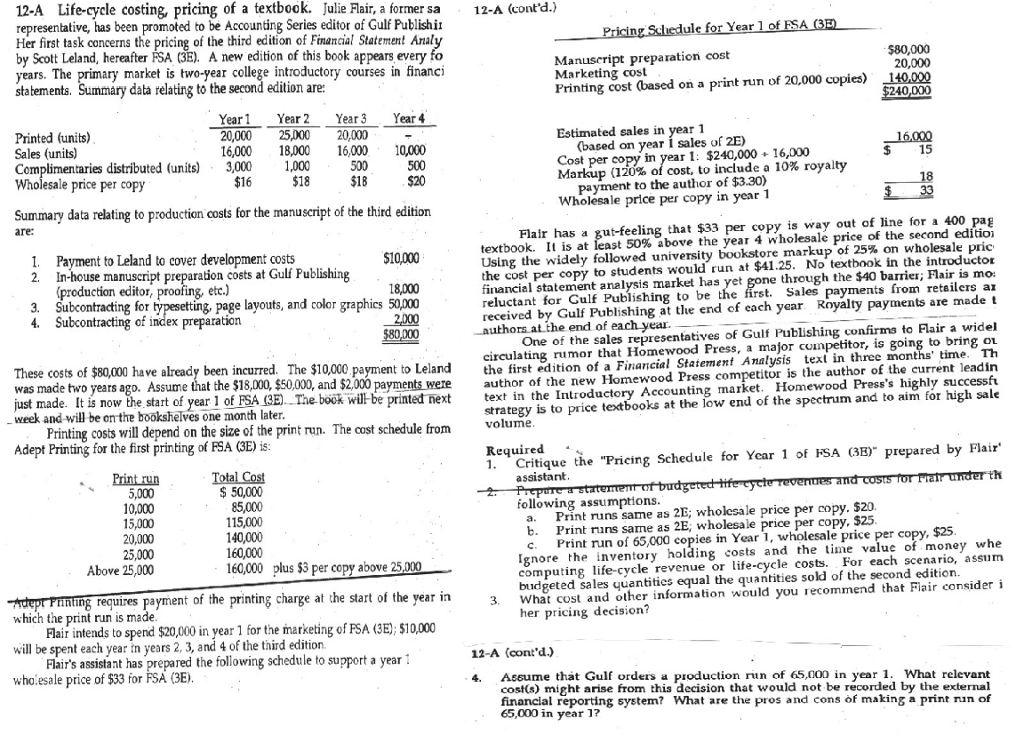

Life-cycle costing, pricing of a textbook. Julie Flair, a former sa representative, has been promoted to be Accounting Series editor of Gulf Publishir Her first task concerns the pricing of the third edition of Financial Statement Analy by Scott Leland, hereafter FSA (3E). A new edition of this book appears every to years. The primary market is two-year college introductory courses in financi statements. Summary data relating to the second edition are: Summary data relating to production costs for the manuscript of the third edition are: These costs of $80,000 have already been incurred. The $10,000 payment to Leland was made two years ago. Assume that the $18,000, $50,000, and $2,000 payments were just made. It is now the start of year 1 of FSA (3E). The book will be printed next week and will be on the bookshelves one month later. Printing costs will depend on the size of the print run. The cost schedule from Adept Printing for the first printing of FSA (3E) is: Adept Printing requires payment of the printing charge at the start of the year in which the print run is made. Flair intends to spends $20,000 in year 1 for the marketing of FSA (3E); $10,000 will be spend each year in years 2, 3, and 4 of the third edition. Flair's assistant has prepared the following schedule to support a year 1 wholesale price of $33 for FSA (3E). Flair has a gut-feeling that $33 per copy is way out of line for a 400 pag textbook. It is at least 50% above the year 4 wholesale price of the second edition. Using the widely followed university bookstore markup of 25% on Wholesale pric the cost per copy to students would run at $41.25. No textbook in the introductory financial statement analysis market has yet gone through the $40 barrier; Flair is mo reluctant for Gulf Publishing to be the first. Sales payments from retailers a received by Gulf Publishing at the end of each year. Royalty payments are made authors at the end of each year. One of the sales representatives Gulf Publishing confirms to Flair a widel circulating rumor that Homewood Press, a major competitor, is going to bring on the first edition of a Financial Statement Analysis text in three months time. Th author of the new Homewood Press competitor is the author of the current leadin text in the Introductory Accounting market. Homewood Press's highly successful strategy is to price textbooks at the low end of the spectrum and to aim for high sale volume. 1. Critique the "Pricing Schedule for Year 1 of FSA (3E)" prepared by Flair assistant. 2. Prepare a statement of budgeted life cycle revenues and costs for Flair under the following components. a. Print runs same as 2E; Wholesale price per copy, $20. b. Print runs same as 2E; Wholesale price per copy, $25. Ignore the inventory holding costs and the time value of money when computing life-cycle revenue or life-cycle costs. For each scenario, assum budgeted sales quantities equal the quantities sold of the second edition. 3. What cost and other information would you recommend that Flair consider i her pricing decision? Assume that Gulf orders a production run of 65,000 in year 1. What relevant cost(s) might arise from this decision that would not be recorded by the external financial reporting system? What are the pros and cons of making a print run of 65,000 in year 1