Answered step by step

Verified Expert Solution

Question

1 Approved Answer

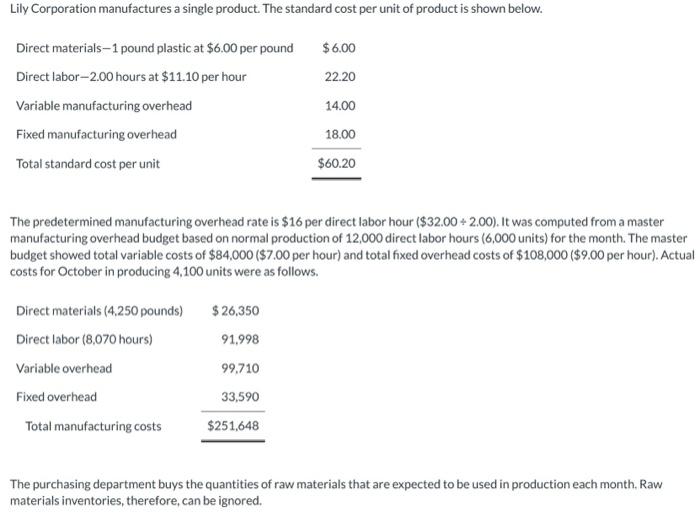

Lily Corporation manufactures a single product. The standard cost per unit of product is shown below. Direct materials- 1 pound plastic at $6.00 per pound

Lily Corporation manufactures a single product. The standard cost per unit of product is shown below.

Direct materials- 1 pound plastic at $6.00 per pound Direct labor- 2.00 hours at $11.10 per hour

Variable manufacturing overhead

Fixed manufacturing overhead

Total standard cost per unit

$ 6.00

22.20

14.00

18.00$60.20

The predetermined manufacturing overhead rate is $ 16 per direct labor hour ($32.00 i 2.00). It was computed from a master

manufacturing overhead budget based on normal production of 12,000 direct labor hours (6,000 units) for the month. The master budget showed total variable costs of $84,000 ($7.00 per hour) and total fhixed overhead costs of $ 108,000 ($9.00 per hour). Actual costs for October in producing 4,100 units were as follows.

Direct materials (4,250 pounds) Direct labor (8,070 hours)

Variable overhead

Fixed overhead

Total manufacturing costs

$ 26,35091,99899,71033,590$251,648

The purchasing department buys the quantities of raw materials that are expected to be used in production each month. Raw materials inventories, therefore, can be ignored.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started