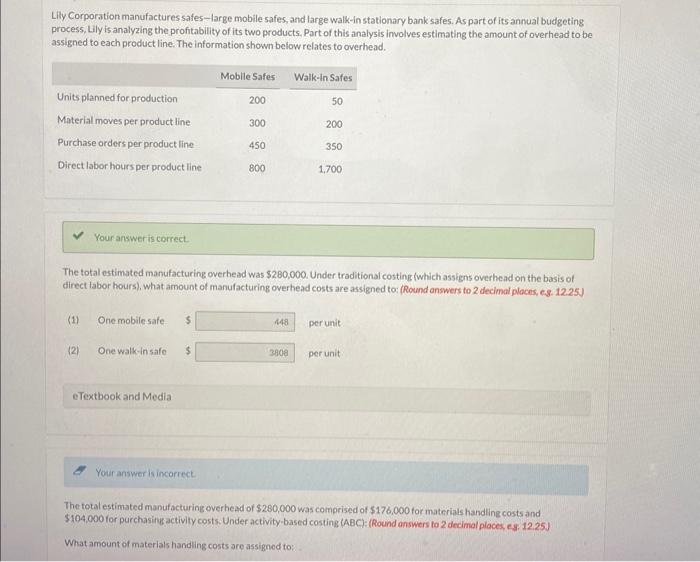

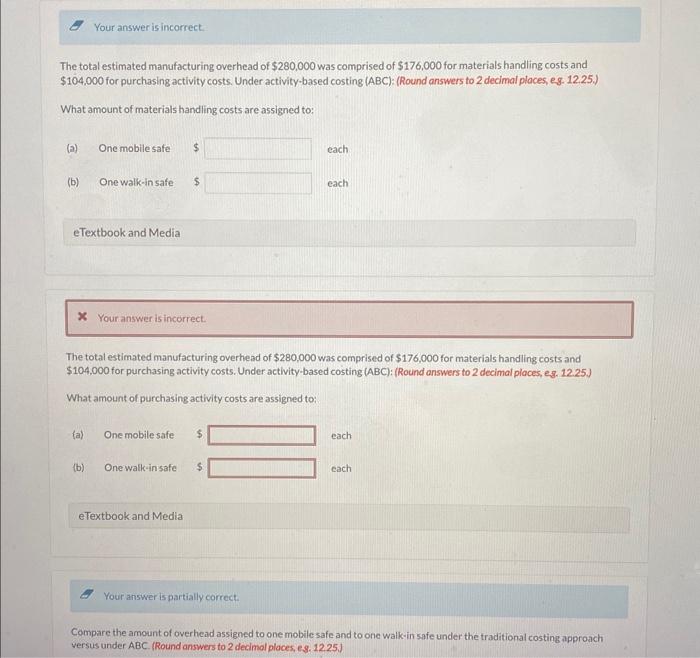

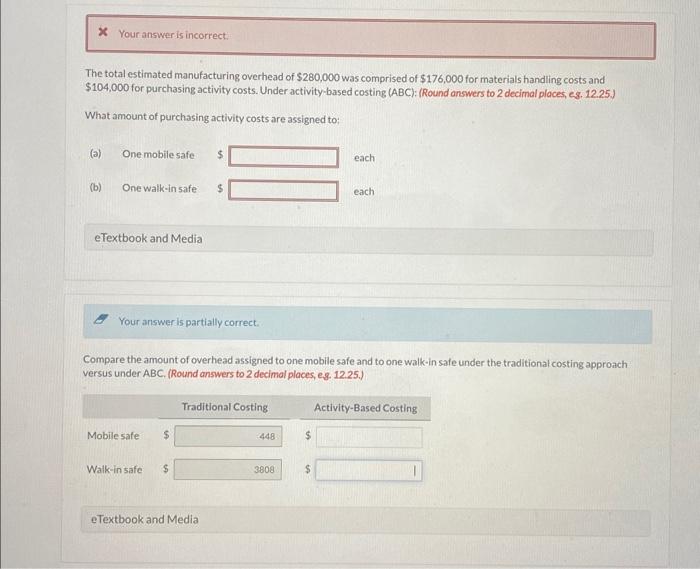

Lily Corporation manufactures safes-large mobile safes, and large walk-in stationary bank safes. As part of its annual budgeting process, Lily is analyzing the profitability of its two products. Part of this analysis involves estimating the amount of overhead to be assigned to each product line. The information shown below relates to overhead. Your answer is correct. The total estimated manufacturing overhead was $280,000. Under traditional costing f which assigns overhead on the basis of direct labor hours), what amount of manufacturing overhead costs are assigned to: (Round answers to 2 decimal places, es. 12.25.) (1) One mobile safeperunit. (2) One walkinsafe perunit. eTextbook and Media 2 Your answer is incorrect. The total estimated manufacturing overhead of $280,000 was comprised of $176,000 for materials handling costs and $104,000 for purchasinus activity costs. Under activity-based costing (ABC): (Round answers to 2 decimal places, e9. 12.25) What amount of materials handling costs are assigned to: The total estimated manufacturing overhead of $280,000 was comprised of $176,000 for materials handling costs and $104,000 for purchasing activity costs. Under activity-based costing (ABC): (Round answers to 2 decimal ploces, eg. 12. 25.) What amount of materials handling costs are assigned to: (a) One mobilesafe (b) One walk-in safe. each eTextbook and Media X Your answer is incorrect. The total estimated manufacturing overhead of $280,000 was comprised of $176,000 for materials handling costs and $104,000 for purchasing activity costs. Under activity-based costing (ABC): (Round onswers to 2 decimal places, eg. 12.25.) What amount of purchasing activity costs are assigned to: (a) One mobile safe each (b) Onewalkcinsafe each * Your answer is partially correct. Compare the amount of overhead assigned to one mobile safe and to one walk-in safe under the traditional costing approach versus under ABC. (Round answers to 2 dedimal places, es. 12.25.) The total estimated manufacturing overhead of $280,000 was comprised of $176,000 for materials handling costs and $104,000 for purchasing activity costs. Under activity-based costing (ABC): (Round answers to 2 decimal places, es, 12.25) What amount of purchasing activity costs are assigned to: (a) One mobile safe each (b) One walk-in safe each eTextbook and Media Your answer is partially correct. Compare the amount of overhead assigned to one mobile safe and to one walk-in safe under the traditional costing approach versus under ABC. (Round answers to 2 decimal places, eg. 12.25.)