Question

Limerick Construction Company elected to change its method of accounting from the completed-contract method to the percentage-of-completion method. Prior years' income (cumulative) would have been

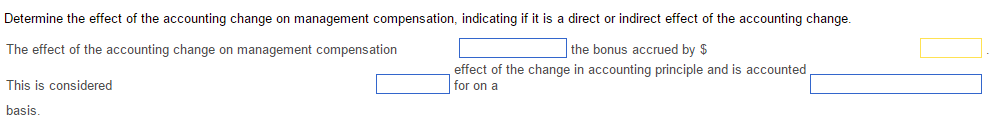

Limerick Construction Company elected to change its method of accounting from the completed-contract method to the percentage-of-completion method. Prior years' income (cumulative) would have been $530,000 higher if Limerickhad always used the percentage-of-completion method. The company is subject to a 40% tax rate. Assume now that Limerick Construction Company compensates its management team by offering a base salary and a 6% bonus based on reported earnings before tax. The bonus plan requires adjustment for changes in accounting methods that includes prior bonus awards. Compute the effect of the accounting change on management compensation, indicating if it is a direct or indirect effect of the accounting change and how Limerick should report it in the financial statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started