Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lina Ltd purchased equipment on 1 April 2017 for $56 000. The purchased equipment has an estimated useful life of 8 years, and the entity

Lina Ltd purchased equipment on 1 April 2017 for $56 000. The purchased equipment has an estimated useful life of 8 years, and the entity uses the straight-line method for depreciation.

On 31 March 2019, Lina Ltd switched to the revaluation model for its equipment. At this date, the fair value of the equipment above was assessed to be $45 000.

On 31 March 2020, at this date, the fair value (FV) of the equipment above was assessed to be $33 500.

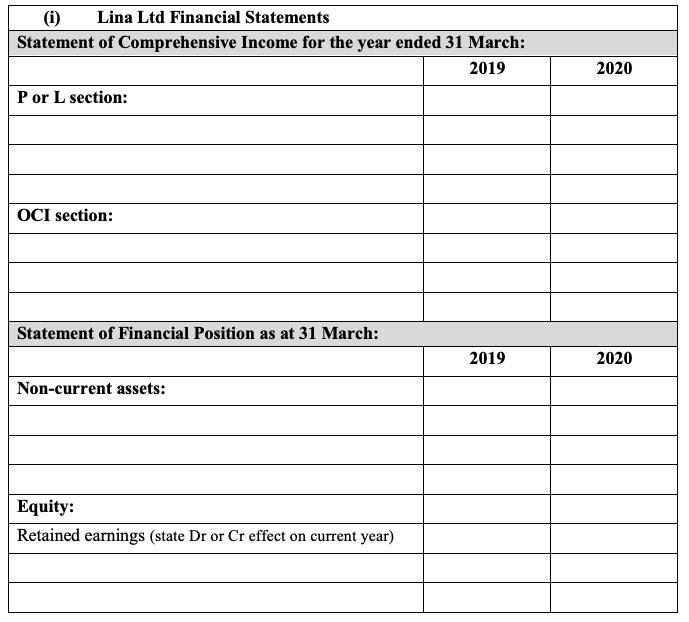

(i) Prepare financial statements, related to the purchased equipment above, for Lina Ltd for the years ended 31 March 2019, and 31 March 2020. Show your workings.

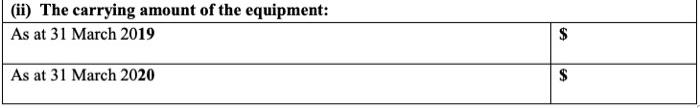

(ii) Determine the carrying amount of the equipment, as at 31 March 2019 and 31 March 2020, if Lina Ltd had not changed to the revaluation model.

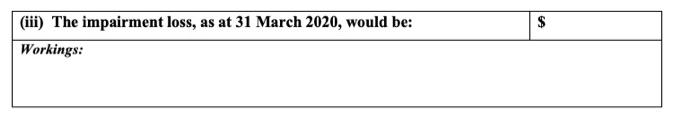

(iii) Assume, as at 31 March 2020, that the FV of $ 33 500 equals the recoverable amount under the cost model. Determine the amount of the impairment loss as at 31 March 2020. Show your workings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started