Answered step by step

Verified Expert Solution

Question

1 Approved Answer

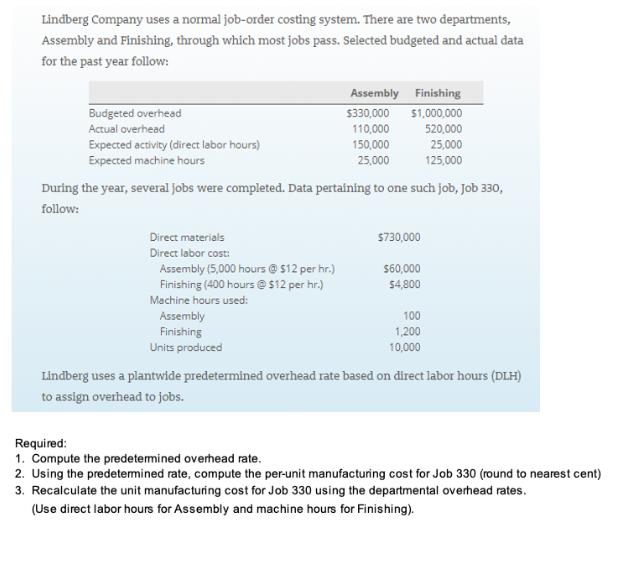

Lindberg Company uses a normal job-order costing system. There are two departments, Assembly and Finishing, through which most jobs pass. Selected budgeted and actual

Lindberg Company uses a normal job-order costing system. There are two departments, Assembly and Finishing, through which most jobs pass. Selected budgeted and actual data for the past year follow: Budgeted overhead Actual overhead Expected activity (direct labor hours) Assembly Finishing $330,000 $1,000,000 110,000 520,000 150,000 25,000 25,000 125,000 Expected machine hours During the year, several jobs were completed. Data pertaining to one such job, Job 330, follow: Direct materials $730,000 Direct labor cost: Assembly (5,000 hours @ $12 per hr.) $60,000 Finishing (400 hours @ $12 per hr.) $4,800 100 1,200 10,000 Machine hours used: Assembly Finishing Units produced Lindberg uses a plantwide predetermined overhead rate based on direct labor hours (DLH) to assign overhead to jobs. Required: 1. Compute the predetermined overhead rate. 2. Using the predetermined rate, compute the per-unit manufacturing cost for Job 330 (round to nearest cent) 3. Recalculate the unit manufacturing cost for Job 330 using the departmental overhead rates. (Use direct labor hours for Assembly and machine hours for Finishing). Overhead rate = Total Overhead $1,330,000 Predetermined 2 Job 330: Apply OH = 3 Total Direct Labor Hours 175,000 Rate 7.60 OH Rate Activity 7.60 5,400 Applied OH 41,040.00 Unit Manufacturing Cost = Direct Materials + Direct Labor + Applied OH Total Cost 730,000 64,800 41,040.00 835,840 Per Unit Cost = Total Cost / Units 835,840 10,000 =Per Unit Cost 83.58 Predetermined OH Rate Overhead / Activity: Direct Labor Hours Activity: Machine Hours OH Rate: Applied OH: OH Rate* Activity Applied OH Assembly Finishing $ 330,000 150,000 $ 1,000,000 25,000 100 1,200 2.20 40.00 2.20 40.00 Unit Manufactured Cost: Direct Materials + Direct Labor + Applied OH Total Cost Per Unit Cost Unit Cost / Units = Per Unit Cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started