Question

Lindsay is looking to put $25,000 at the end of each year into her Registered Retirement Savings Plan (RRSP) for the next 20 years. She

Lindsay is looking to put $25,000 at the end of each year into her Registered Retirement Savings Plan (RRSP) for the next 20 years. She believes that she can earn 4% interest, compounded monthly.

Lindsay is looking to put $25,000 at the end of each year into her Registered Retirement Savings Plan (RRSP) for the next 20 years. She believes that she can earn 4% interest, compounded monthly.

a) How much will Lindsay have saved after 20 years? (with calculation please)

b) If Lindsay decides to withdraw the entire amount in one lump sum in 20 years, what would be the amount that she would receive after taxes, assuming her effective tax rate is 32% at that time?

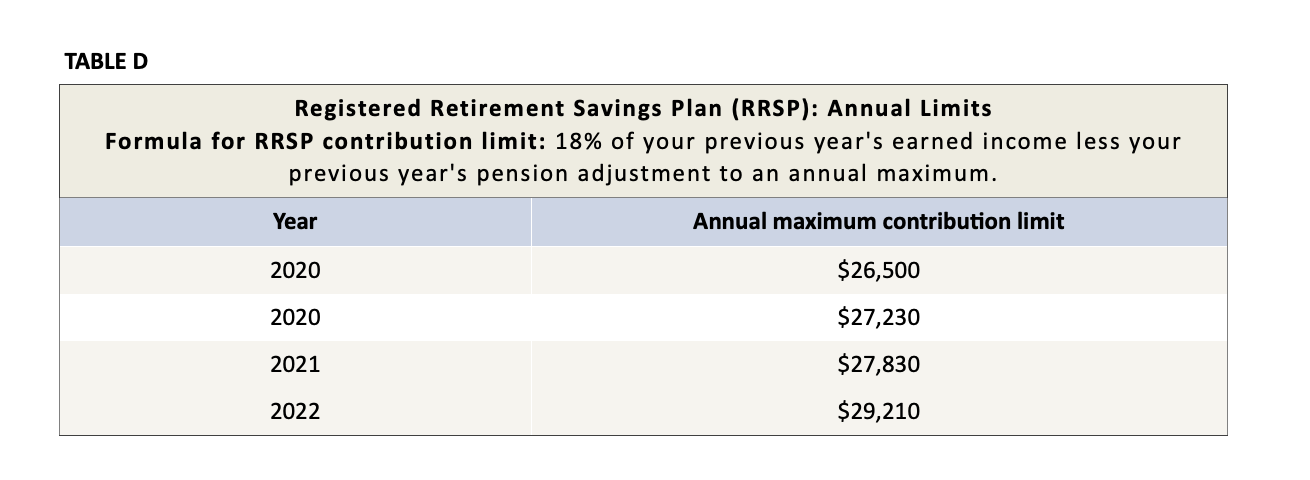

c) What is the minimum annual salary that Lindsay needs to earn each year to make a $25,000 annual RRSP contribution?

Registered Retirement Savings Plan (RRSP): Annual Limits Formula for RRSP contribution limit: 18% of your previous year's earned income less your previous year's pension adjustment to an annual maximum. Registered Retirement Savings Plan (RRSP): Annual Limits Formula for RRSP contribution limit: 18% of your previous year's earned income less your previous year's pension adjustment to an annual maximum

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started