Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lindt, a Swiss chocolate producer, has sold fine chocolates in the United States. To win sales against other competitors, Lindt offers its overseas buyers

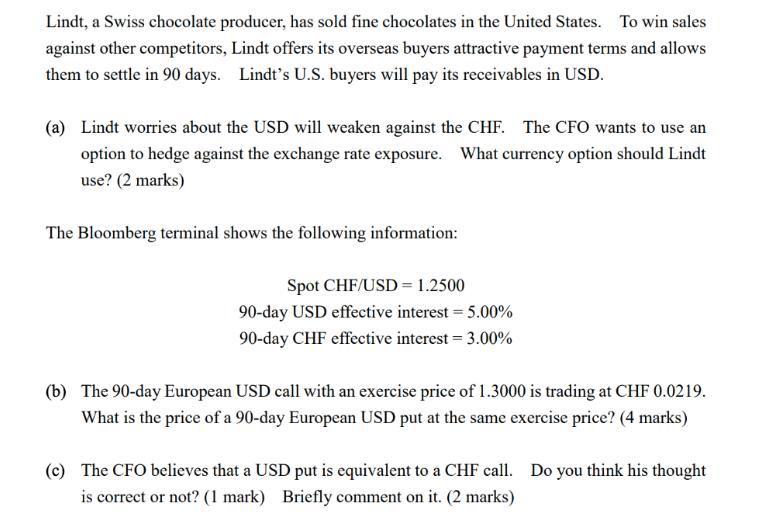

Lindt, a Swiss chocolate producer, has sold fine chocolates in the United States. To win sales against other competitors, Lindt offers its overseas buyers attractive payment terms and allows them to settle in 90 days. Lindt's U.S. buyers will pay its receivables in USD. (a) Lindt worries about the USD will weaken against the CHF. The CFO wants to use an option to hedge against the exchange rate exposure. What currency option should Lindt use? (2 marks) The Bloomberg terminal shows the following information: Spot CHF/USD 1.2500 90-day USD effective interest = 5.00% 90-day CHF effective interest = 3.00% (b) The 90-day European USD call with an exercise price of 1.3000 is trading at CHF 0.0219. What is the price of a 90-day European USD put at the same exercise price? (4 marks) (c) The CFO believes that a USD put is equivalent to a CHF call. Do you think his thought is correct or not? (1 mark) Briefly comment on it. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Lindt should use a USD put option to hedge against the exchange rate exposure as it receives USD f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664303954b04d_953074.pdf

180 KBs PDF File

664303954b04d_953074.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started