Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Liquidation of Partnerships) Question 1 of 1 Nicholas Jay, Kamla Paul, and Stephanie Ram plan to liquidate their partnership. They have always shared losses

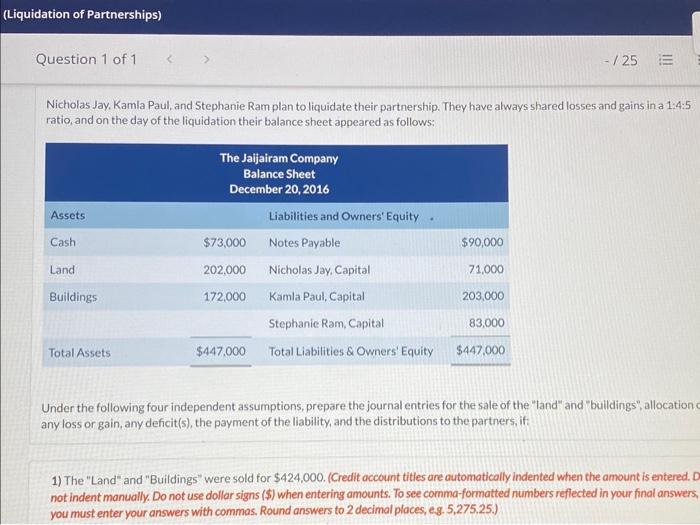

(Liquidation of Partnerships) Question 1 of 1 Nicholas Jay, Kamla Paul, and Stephanie Ram plan to liquidate their partnership. They have always shared losses and gains in a 1:4:5 ratio, and on the day of the liquidation their balance sheet appeared as follows: Assets Cash Land Buildings Total Assets The Jaijairam Company Balance Sheet December 20, 2016 Liabilities and Owners' Equity Notes Payable Nicholas Jay, Capital kamla Paul, Capital Stephanie Ram, Capital $447.000 Total Liabilities & Owners' Equity $73,000 202,000 172,000 .. $90,000 71,000 -/25 E 203,000 83,000 $447,000 Under the following four independent assumptions, prepare the journal entries for the sale of the "land" and "buildings", allocation c any loss or gain, any deficit (s), the payment of the liability, and the distributions to the partners, if: 1) The "Land" and "Buildings" were sold for $424,000. (Credit account titles are automatically indented when the amount is entered. De not indent manually. Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas. Round answers to 2 decimal places, e.g. 5,275.25.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image shows a snapshot of a computer screen displaying a balance sheet for The Jaijairam Company dated December 20 2016 Below the balance sheet th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started