Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Niagara Wine Co. Ltd. Niagara Wine Co. Ltd. (NWC) is a widely-held public corporation that has been well-received by customers, with many of its

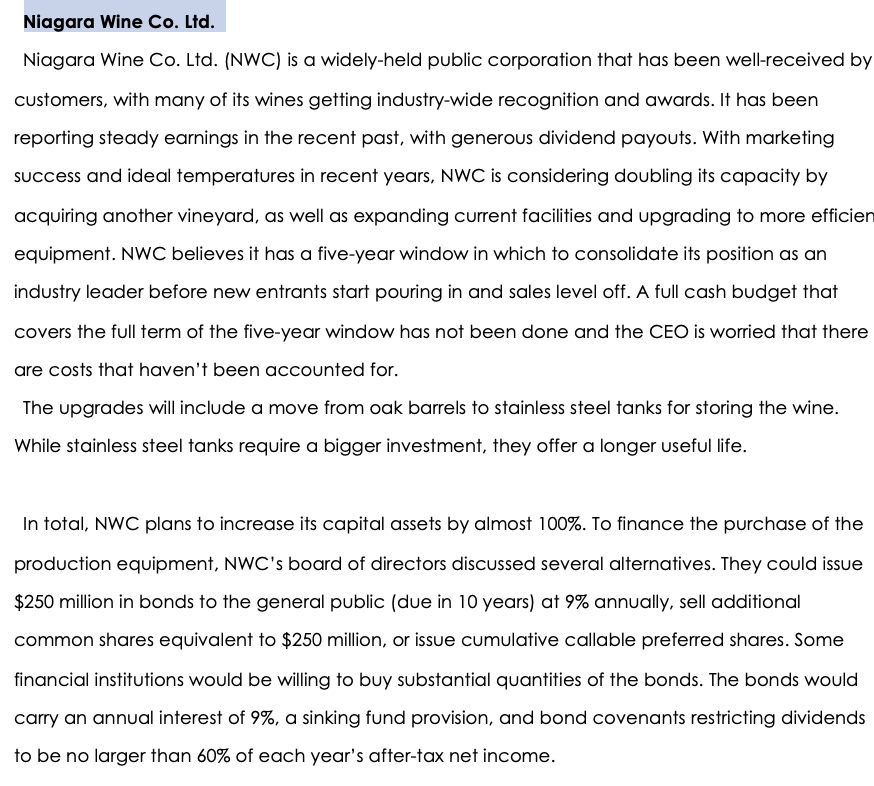

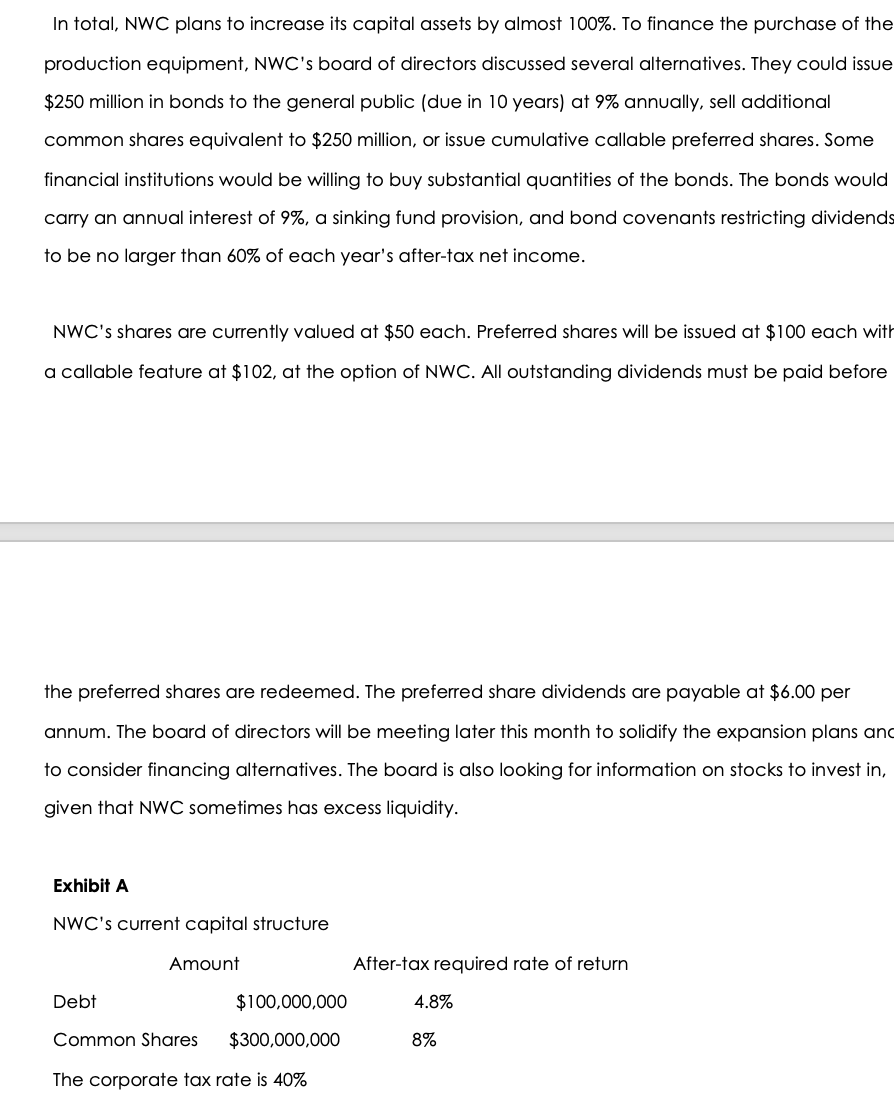

Niagara Wine Co. Ltd. Niagara Wine Co. Ltd. (NWC) is a widely-held public corporation that has been well-received by customers, with many of its wines getting industry-wide recognition and awards. It has been reporting steady earnings in the recent past, with generous dividend payouts. With marketing success and ideal temperatures in recent years, NWC is considering doubling its capacity by acquiring another vineyard, as well as expanding current facilities and upgrading to more efficien equipment. NWC believes it has a five-year window in which to consolidate its position as an industry leader before new entrants start pouring in and sales level off. A full cash budget that covers the full term of the five-year window has not been done and the CEO is worried that there are costs that haven't been accounted for. The upgrades will include a move from oak barrels to stainless steel tanks for storing the wine. While stainless steel tanks require a bigger investment, they offer a longer useful life. In total, NWC plans to increase its capital assets by almost 100%. To finance the purchase of the production equipment, NWC's board of directors discussed several alternatives. They could issue $250 million in bonds to the general public (due in 10 years) at 9% annually, sell additional common shares equivalent to $250 million, or issue cumulative callable preferred shares. Some financial institutions would be willing to buy substantial quantities of the bonds. The bonds would carry an annual interest of 9%, a sinking fund provision, and bond covenants restricting dividends to be no larger than 60% of each year's after-tax net income. In total, NWC plans to increase its capital assets by almost 100%. To finance the purchase of the production equipment, NWC's board of directors discussed several alternatives. They could issue $250 million in bonds to the general public (due in 10 years) at 9% annually, sell additional common shares equivalent to $250 million, or issue cumulative callable preferred shares. Some financial institutions would be willing to buy substantial quantities of the bonds. The bonds would carry an annual interest of 9%, a sinking fund provision, and bond covenants restricting dividends to be no larger than 60% of each year's after-tax net income. NWC's shares are currently valued at $50 each. Preferred shares will be issued at $100 each with a callable feature at $102, at the option of NWC. All outstanding dividends must be paid before the preferred shares are redeemed. The preferred share dividends are payable at $6.00 per annum. The board of directors will be meeting later this month to solidify the expansion plans and to consider financing alternatives. The board is also looking for information on stocks to invest in, given that NWC sometimes has excess liquidity. Exhibit A NWC's current capital structure Amount Debt $100,000,000 Common Shares $300,000,000 The corporate tax rate is 40% After-tax required rate of return 4.8% 8% Required You are a CPA in a public accounting firm, and you have been asked to prepare a memo for the board of directors explaining the following: (800-1,000 words) a. The factors influencing the choice of a depreciation policy for the new stainless steel tanks. b. The impact that each type of financing would have on Niagara Wine Co. Provide the WACC under each option. What other factors should the board consider when making its decision? Instructions: Demonstration of case analysis Step 1: Read the Case in Group Step 3: Identify major issues and problems Step 4: Analyze the case data Step 5: Generate alternatives Step 6: Select decision criteria Step 7: Analyze and evaluate the alternatives. Step 8: Make a recommendation. Step 9: Draft a response.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To the Board of Directors of Niagara Wine Co Ltd SUBJECT Factors to Consider for Expansion Financing The management team at Niagara Wine Co Ltd NWC ha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started