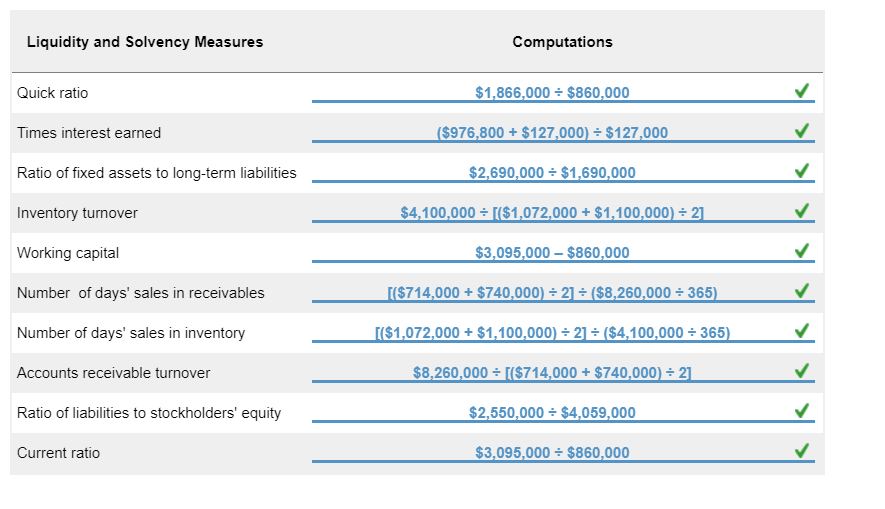

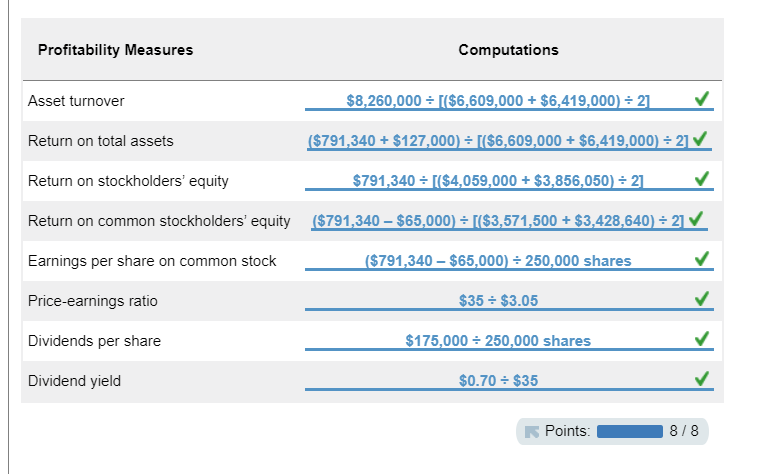

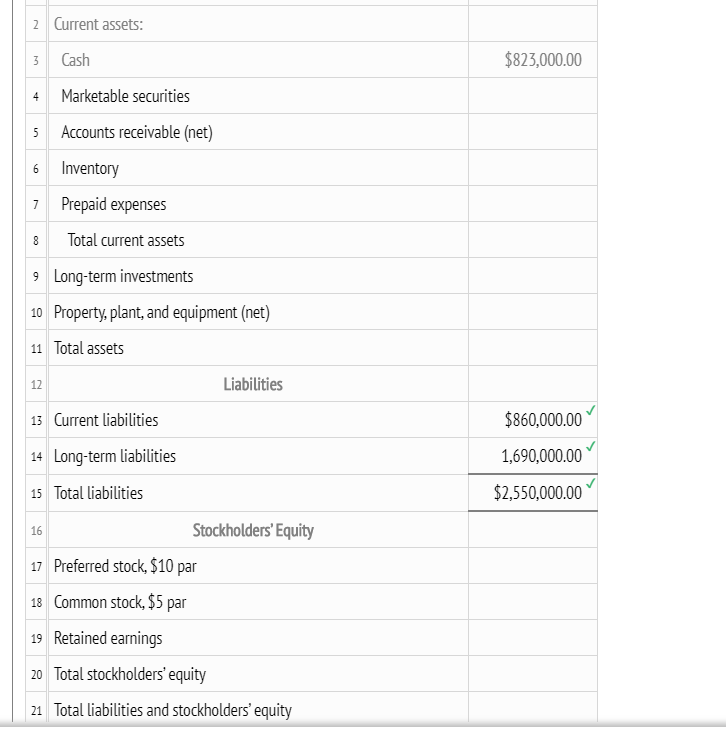

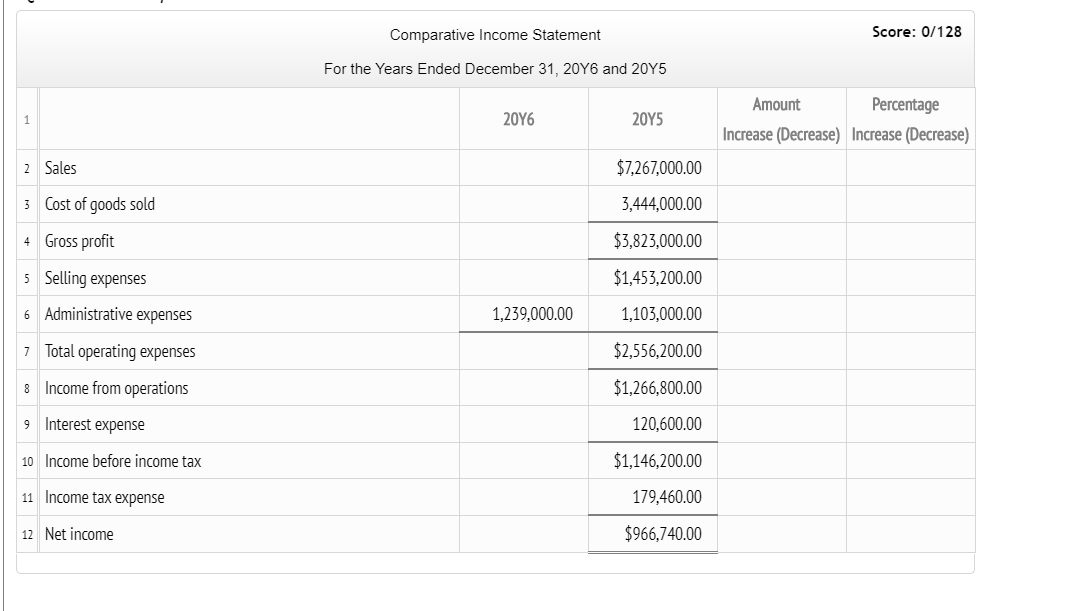

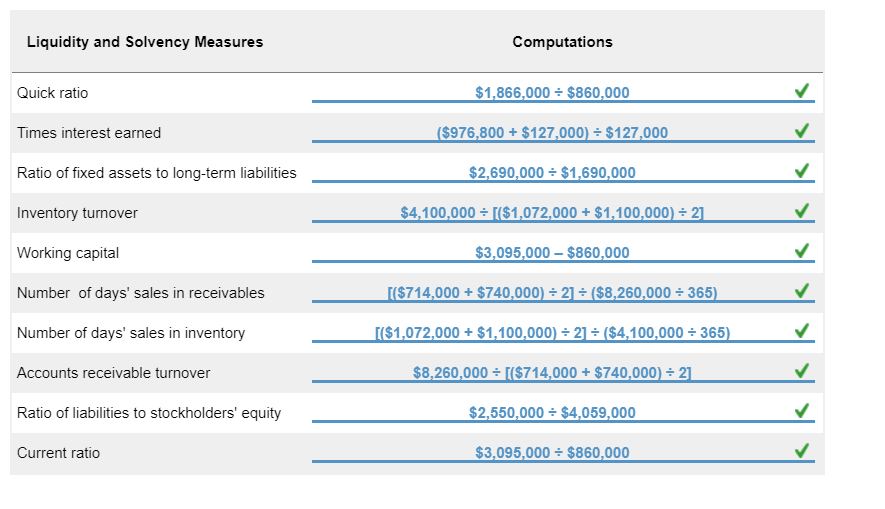

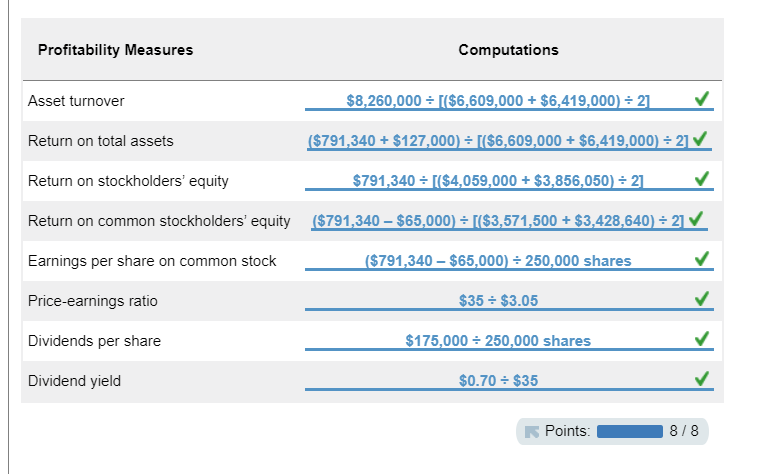

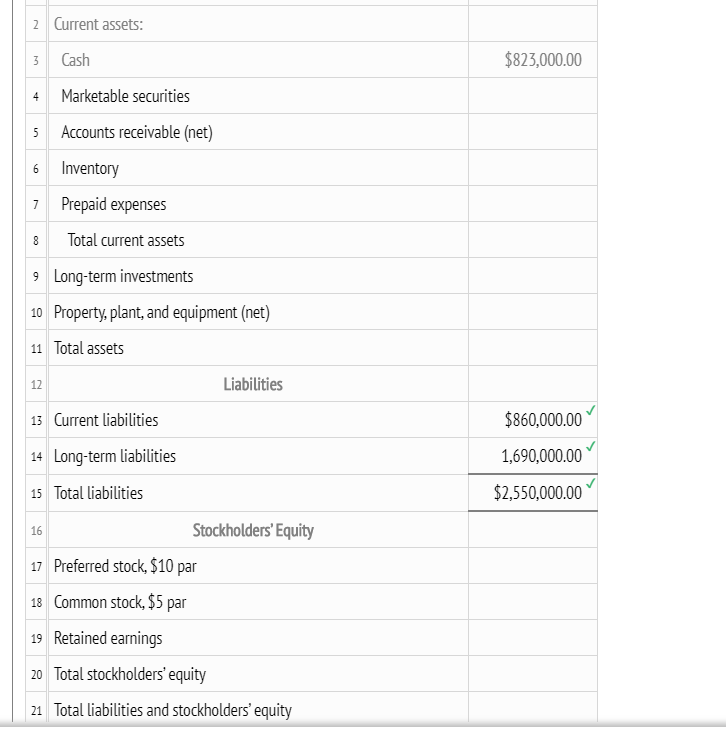

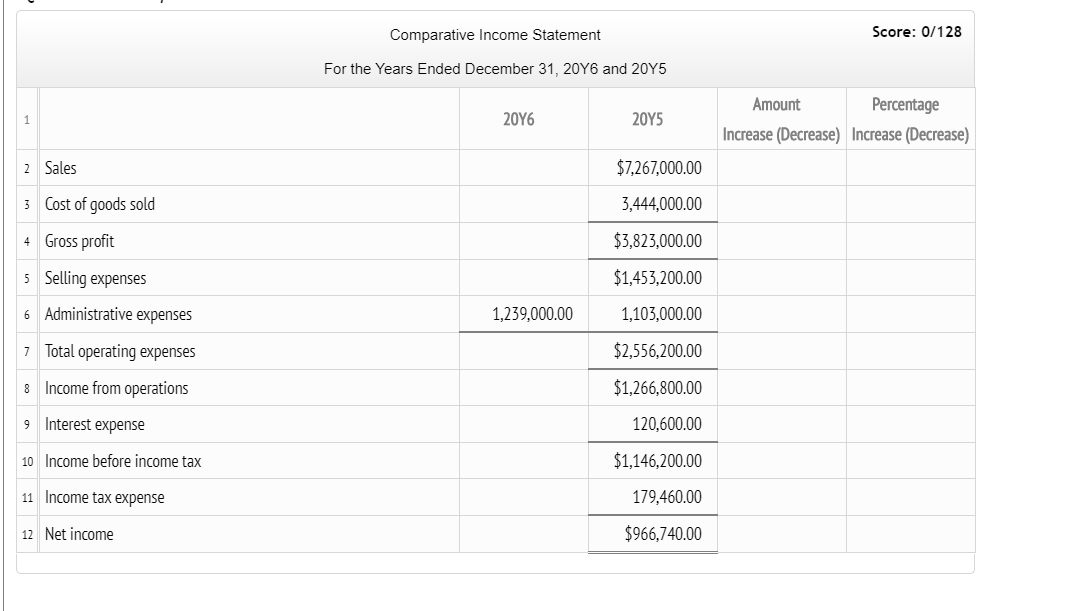

Liquidity and Solvency Measures Computations Quick ratio $1,866,000 = $860,000 Times interest earned ($976,800 + $127,000) = $127,000 Ratio of fixed assets to long-term liabilities $2,690,000 = $1,690,000 Inventory turnover $4,100,000 = [($1,072,000 + $1,100,000) = 21 Working capital $3,095,000 - $860,000 Number of days' sales in receivables [($714,000 + $740,000) = 2] = ($8,260,000 = 365) Number of days' sales in inventory [($1,072,000 + $1,100,000) = 21 = ($4,100,000 = 365) Accounts receivable turnover $8,260,000 = [($714,000 + $740,000) = 21 Ratio of liabilities to stockholders' equity $2,550,000 = $4,059,000 Current ratio $3,095,000 = $860,000 Profitability Measures Computations Asset turnover $8,260,000 = [($6,609,000 + $6,419,000) = 21 Return on total assets ($791,340 + $127,000) = [($6,609,000 + $6,419,000) = 2] V Return on stockholders' equity $791,340 = [($4,059,000 + $3,856,050) = 21 Return on common stockholders' equity ($791,340 $65,000) = [($3,571,500 + $3,428,640) = 2] V Earnings per share on common stock ($791,340 - $65,000) = 250,000 shares Price-earnings ratio $35 = $3.05 Dividends per share $175,000 = 250,000 shares Dividend yield $0.70 = $35 Points: 8/8 2 Current assets: 3 Cash $823,000.00 4 Marketable securities 5 Accounts receivable (net) Inventory Prepaid expenses 6 7 8 8 Total current assets 9 Long-term investments 10 Property, plant, and equipment (net) 11 Total assets 12 Liabilities 13 Current liabilities $860,000.00 14 Long-term liabilities 1,690,000.00 15 Total liabilities $2,550,000.00 16 Stockholders' Equity 17 Preferred stock, $10 par 18 Common stock, $5 par 19 Retained earnings 20 Total stockholders' equity 21 Total liabilities and stockholders' equity Comparative Income Statement Score: 0/128 For the Years Ended December 31, 20Y6 and 2045 1 2046 2045 Amount Percentage Increase (Decrease) Increase (Decrease) 2 Sales $7,267,000.00 3 Cost of goods sold 3,444,000.00 4 Gross profit $3,823,000.00 $1,453,200.00 5 Selling expenses 6 Administrative expenses 1,239,000.00 1,103,000.00 7 Total operating expenses $2,556,200.00 8 Income from operations $1,266,800.00 9 Interest expense 120,600.00 10 Income before income tax $1,146,200.00 11 Income tax expense 179,460.00 12 Net income $966,740.00 Liquidity and Solvency Measures Computations Quick ratio $1,866,000 = $860,000 Times interest earned ($976,800 + $127,000) = $127,000 Ratio of fixed assets to long-term liabilities $2,690,000 = $1,690,000 Inventory turnover $4,100,000 = [($1,072,000 + $1,100,000) = 21 Working capital $3,095,000 - $860,000 Number of days' sales in receivables [($714,000 + $740,000) = 2] = ($8,260,000 = 365) Number of days' sales in inventory [($1,072,000 + $1,100,000) = 21 = ($4,100,000 = 365) Accounts receivable turnover $8,260,000 = [($714,000 + $740,000) = 21 Ratio of liabilities to stockholders' equity $2,550,000 = $4,059,000 Current ratio $3,095,000 = $860,000 Profitability Measures Computations Asset turnover $8,260,000 = [($6,609,000 + $6,419,000) = 21 Return on total assets ($791,340 + $127,000) = [($6,609,000 + $6,419,000) = 2] V Return on stockholders' equity $791,340 = [($4,059,000 + $3,856,050) = 21 Return on common stockholders' equity ($791,340 $65,000) = [($3,571,500 + $3,428,640) = 2] V Earnings per share on common stock ($791,340 - $65,000) = 250,000 shares Price-earnings ratio $35 = $3.05 Dividends per share $175,000 = 250,000 shares Dividend yield $0.70 = $35 Points: 8/8 2 Current assets: 3 Cash $823,000.00 4 Marketable securities 5 Accounts receivable (net) Inventory Prepaid expenses 6 7 8 8 Total current assets 9 Long-term investments 10 Property, plant, and equipment (net) 11 Total assets 12 Liabilities 13 Current liabilities $860,000.00 14 Long-term liabilities 1,690,000.00 15 Total liabilities $2,550,000.00 16 Stockholders' Equity 17 Preferred stock, $10 par 18 Common stock, $5 par 19 Retained earnings 20 Total stockholders' equity 21 Total liabilities and stockholders' equity Comparative Income Statement Score: 0/128 For the Years Ended December 31, 20Y6 and 2045 1 2046 2045 Amount Percentage Increase (Decrease) Increase (Decrease) 2 Sales $7,267,000.00 3 Cost of goods sold 3,444,000.00 4 Gross profit $3,823,000.00 $1,453,200.00 5 Selling expenses 6 Administrative expenses 1,239,000.00 1,103,000.00 7 Total operating expenses $2,556,200.00 8 Income from operations $1,266,800.00 9 Interest expense 120,600.00 10 Income before income tax $1,146,200.00 11 Income tax expense 179,460.00 12 Net income $966,740.00