Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lisa in the middle of analyzing of her portfolio of Nexis stock and Vintage stock. Nexis stock currently is not paying dividend for next 2

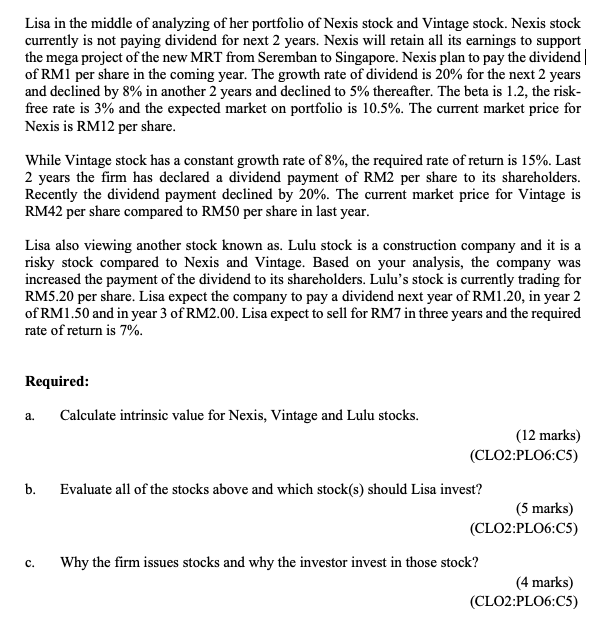

Lisa in the middle of analyzing of her portfolio of Nexis stock and Vintage stock. Nexis stock currently is not paying dividend for next 2 years. Nexis will retain all its earnings to support the mega project of the new MRT from Seremban to Singapore. Nexis plan to pay the dividend of RM1 per share in the coming year. The growth rate of dividend is 20% for the next 2 years and declined by 8% in another 2 years and declined to 5% thereafter. The beta is 1.2, the risk- free rate is 3% and the expected market on portfolio is 10.5%. The current market price for Nexis is RM12 per share. While Vintage stock has a constant growth rate of 8%, the required rate of return is 15%. Last 2 years the firm has declared a dividend payment of RM2 per share to its shareholders. Recently the dividend payment declined by 20%. The current market price for Vintage is RM42 per share compared to RM50 per share in last year. Lisa also viewing another stock known as. Lulu stock is a construction company and it is a risky stock compared to Nexis and Vintage. Based on your analysis, the company was increased the payment of the dividend to its shareholders. Lulu's stock is currently trading for RM5.20 per share. Lisa expect the company to pay a dividend next year of RM1.20, in year 2 of RM1.50 and in year 3 of RM2.00. Lisa expect to sell for RM7 in three years and the required rate of return is 7%. a. Required: Calculate intrinsic value for Nexis, Vintage and Lulu stocks. (12 marks) (CLO2:PLO6:05) b. Evaluate all of the stocks above and which stock(s) should Lisa invest? (5 marks) (CLO2:PLO6:05) Why the firm issues stocks and why the investor invest in those stock? (4 marks) (CLO2:PL06:05) c. Lisa in the middle of analyzing of her portfolio of Nexis stock and Vintage stock. Nexis stock currently is not paying dividend for next 2 years. Nexis will retain all its earnings to support the mega project of the new MRT from Seremban to Singapore. Nexis plan to pay the dividend of RM1 per share in the coming year. The growth rate of dividend is 20% for the next 2 years and declined by 8% in another 2 years and declined to 5% thereafter. The beta is 1.2, the risk- free rate is 3% and the expected market on portfolio is 10.5%. The current market price for Nexis is RM12 per share. While Vintage stock has a constant growth rate of 8%, the required rate of return is 15%. Last 2 years the firm has declared a dividend payment of RM2 per share to its shareholders. Recently the dividend payment declined by 20%. The current market price for Vintage is RM42 per share compared to RM50 per share in last year. Lisa also viewing another stock known as. Lulu stock is a construction company and it is a risky stock compared to Nexis and Vintage. Based on your analysis, the company was increased the payment of the dividend to its shareholders. Lulu's stock is currently trading for RM5.20 per share. Lisa expect the company to pay a dividend next year of RM1.20, in year 2 of RM1.50 and in year 3 of RM2.00. Lisa expect to sell for RM7 in three years and the required rate of return is 7%. a. Required: Calculate intrinsic value for Nexis, Vintage and Lulu stocks. (12 marks) (CLO2:PLO6:05) b. Evaluate all of the stocks above and which stock(s) should Lisa invest? (5 marks) (CLO2:PLO6:05) Why the firm issues stocks and why the investor invest in those stock? (4 marks) (CLO2:PL06:05) c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started