Answered step by step

Verified Expert Solution

Question

1 Approved Answer

List and record each 20X1 transaction under the accrual basis of accounting. Then develop a balance sheet for end-of-year 20X0 and 20X1 and a statement

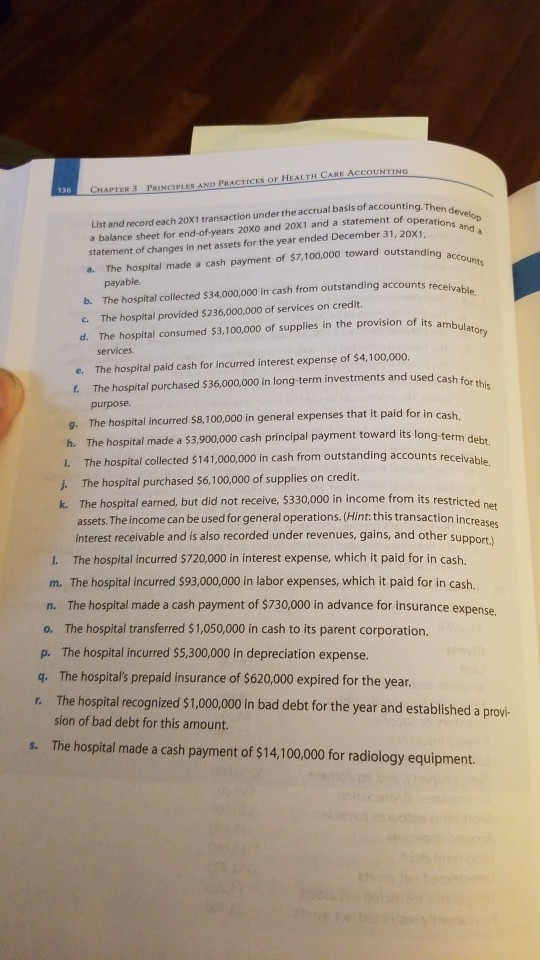

List and record each 20X1 transaction under the accrual basis of accounting. Then develop a balance sheet for end-of-year 20X0 and 20X1 and a statement of operators and a statement of changes in net assets for the year ended December 31, 20X1.

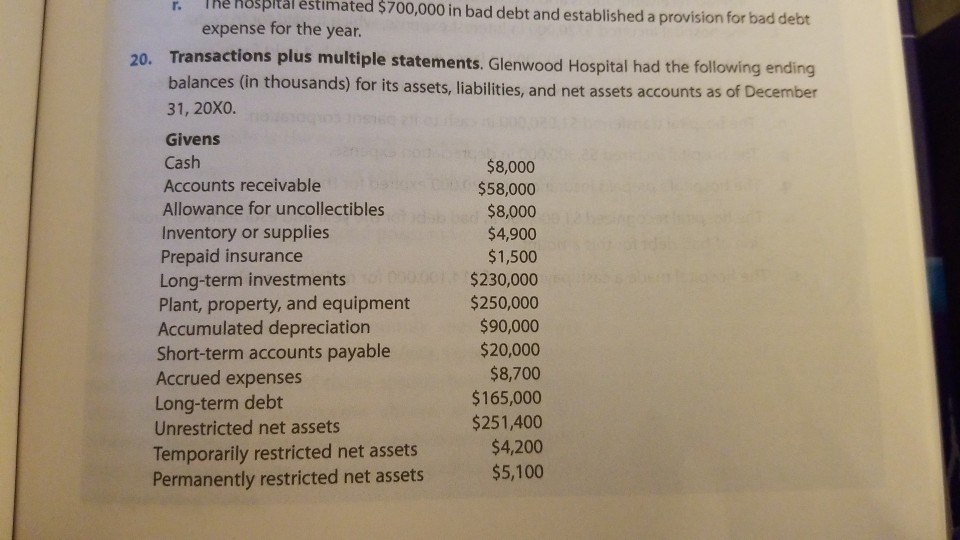

hospital ted $700,000 in bad debt and established a provision for bad debt r. expense for the year. 20. Transactions plus multiple statements. Glenwood Hospital had the following ending balances (in thousands) for its assets, liabilities, and net assets accounts as of December 31, 20X0. Givens Cash $8,000 $58,000 $8,000 $4,900 $1,500 $230,000 $250,000 $90,000 $20,000 $8,700 $165,000 $251,400 $4,200 $5,100 Accounts receivable Allowance for uncollectibles Inventory or supplies Prepaid insurance Long-term investments Plant, property, and equipment Accumulated depreciation Short-term accounts payable Accrued expenses Long-term debt Unrestricted net assets Temporarily restricted net assets Permanently restricted net assets CHAPTER 3 PRINCIPLES AND PRACTICES OF HEALTH CARE ACCOUNTING 136 List and record each 20X1 transaction under the accrual basis of accounting.Then develop a balance sheet for end-of-years 20XO and 20X1 and a statement of operations and a statement of changes in net assets for the year ended December 31, 20X1. The hospital made a cash payment of $7,100,000 toward outstanding accounts al payable b. The hospital collected $34,000,000 in cash from outstanding accounts receivable. The hospital provided $236,000,000 of services on credit. c. d. The hospital consumed $3,100,000 of supplies in the provision of its ambulatory services The hospital paid cash for incurred interest expense of $4,100,000. e. The hospital purchased $36,000,000 in long-term investments and used cash for this f. purpose. g. The hospital incurred $8,100,000 in general expenses that it paid for in cash h. The hospital made a $3,900,000 cash principal payment toward its long-term debt. The hospital collected $141,000,000 in cash from outstanding accounts receivable. i. The hospital purchased $6,100,000 of supplies k. The hospital earned, but did not receive, $330,000 in income from its restricted net assets. The income can be used for general operations. (Hint: this transaction increasor interest receivable and is also recorded under revenues, gains, and other support.) on credit. The hospital incurred $720,000 in interest expense, which it paid for in cash. m. The hospital incurred $93,000,000 in labor expenses, which it paid for in cash n. The hospital made a cash payment of $730,000 in advance for insurance expense The hospital transferred $1,050,000 in cash to its parent corporation. o. The hospital incurred $5,300,000 in depreciation expense. p. The hospital's prepaid insurance of $620,000 expired for the year. q. The hospital recognized $1,000,000 in bad debt for the year and established a provi- sion of bad debt for this amount. The hospital made a cash payment of $14,1 00,000 for radiology equipment. s

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started