Question

list of accounts are: Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Accumulated Depreciation-Vehicles Advertising Expense Buildings Cash Common Shares Cost of Goods Sold Depreciation

list of accounts are:

Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Accumulated Depreciation-Vehicles Advertising Expense Buildings Cash Common Shares Cost of Goods Sold Depreciation Expense Dividends Payable Equipment Income Tax Payable Interest Expense Interest Payable Inventory Land Miscellaneous Expense Notes Payable Operating Expense Other Expenses Prepaid Insurance Prepaid Rent Rent Expense Rent Revenue Retained Earnings Selling and Administrative Expenses Supplies Expense Wages Payable Wages Expense Advances to Employees Bank Loan Payable Deposits Dividend Revenue Dividends Declared Income Tax Expense Income Summary Insurance Expense Interest Revenue Interest Receivable License Expense Long-Term Investments Mortgage Payable No Entry Notes Receivable Supplies Prepaid Expenses Prepaid License Prepaid Property Tax Property Tax Expense Repair and Maintenance Expense Salaries Payable Salaries Expense Sales Revenue Service Revenue Short-Term Investments Telephone Expense Unearned Rent Revenue Unearned Revenue Utilities Expense Vehicles

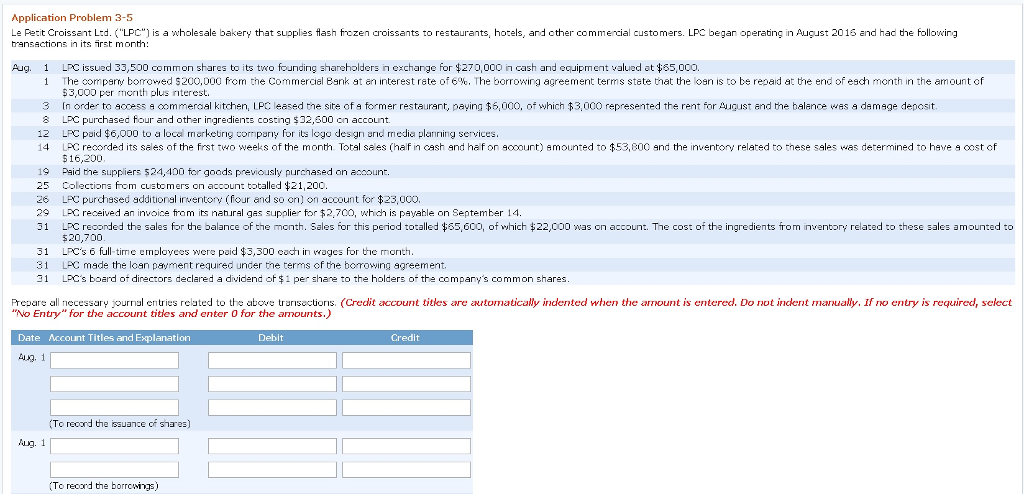

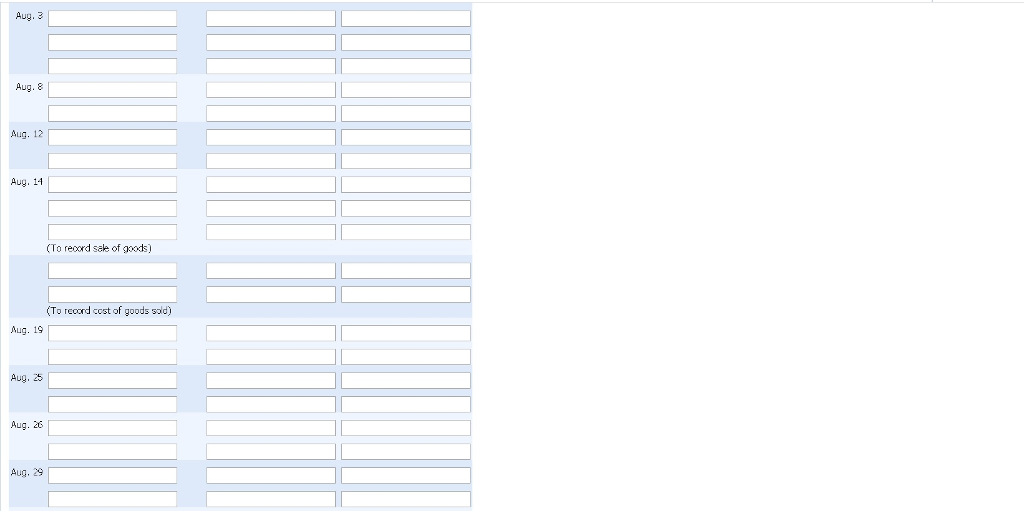

Application Problem 3-5 Le Fetit Croissant L:d. "LPC s a holesale bakery that supplies lash frozen croissants to restaurants, hotels, and other commercial customers. LPC began operating in August 2015 and had the holloxing transactions in its irst month: Aug. 1 LPC issued 33,500 common shares to its two founding shareholders n exchange for $270,000 n cash and equipment valued at $65,000. The compare borrowed S 200 DOC from the Commercial Bank at en interest rate of 6% The borrowing agreement terms state t at the on s to be rerad at the end of each month in the amount of 53,000 per meth plus nterest. 1 3 In order to eocess a commeroal kitchen, LPC leased the site of a former restaurant, paying $6,000, of which $3,000 represented the rent for August and the belance wes a demage depcsit a LPC purchased four and other ingredients costing $32,600 on account. 12 LPC psid $6,000 to a local merketirig cormpany for its logo desgn and rriedia planning services. 14 LPC reoorded its sales of the frst two weeks of the month. Total saes (haf in cash and hafon sooount) smounted to $53,800 and the inventory related to these sales was determined to hse a oost of 16,200 19 Paid the suppliers $24,400 for goads previously purchased on account. 25 Colections fom customers on account totalled 21,200. 26 LPC purchssed additionsl iventoy(four and so cn on aocount fer $23,00o. 29 LPC received an invoice from its natural gas supplier for2.700, whch is payable on September 14. 31 LPC recorded the sales for the oalance of the month. Sales rpr this penod totalled $65,6C , of which22,010 was on account The cost ot the ingredients rom nventor related to these sales amounted to $20,700 31 LPCs 6 full-time employees were paid $3,300 each in wages for the month 31 LPC made the lcen peyment required under the terms of the borovwing agreement. 31 LPC's board of directors declared a dividend of 1 per share to the holders o-the company's common shares Prepare all necessary juentries relsted to the abve tranisectionis. (Credit account titles are tomatically indented when the arnount is entered. Do not incent maually, If ro entry is required, select No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Aug. 1 Debit Credit To record the issuante of shar es) u. 1 To reord the borrowings)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started