List the industry segments that EPC operates. Do you think we should use the same WACC or separate WACC for each division?

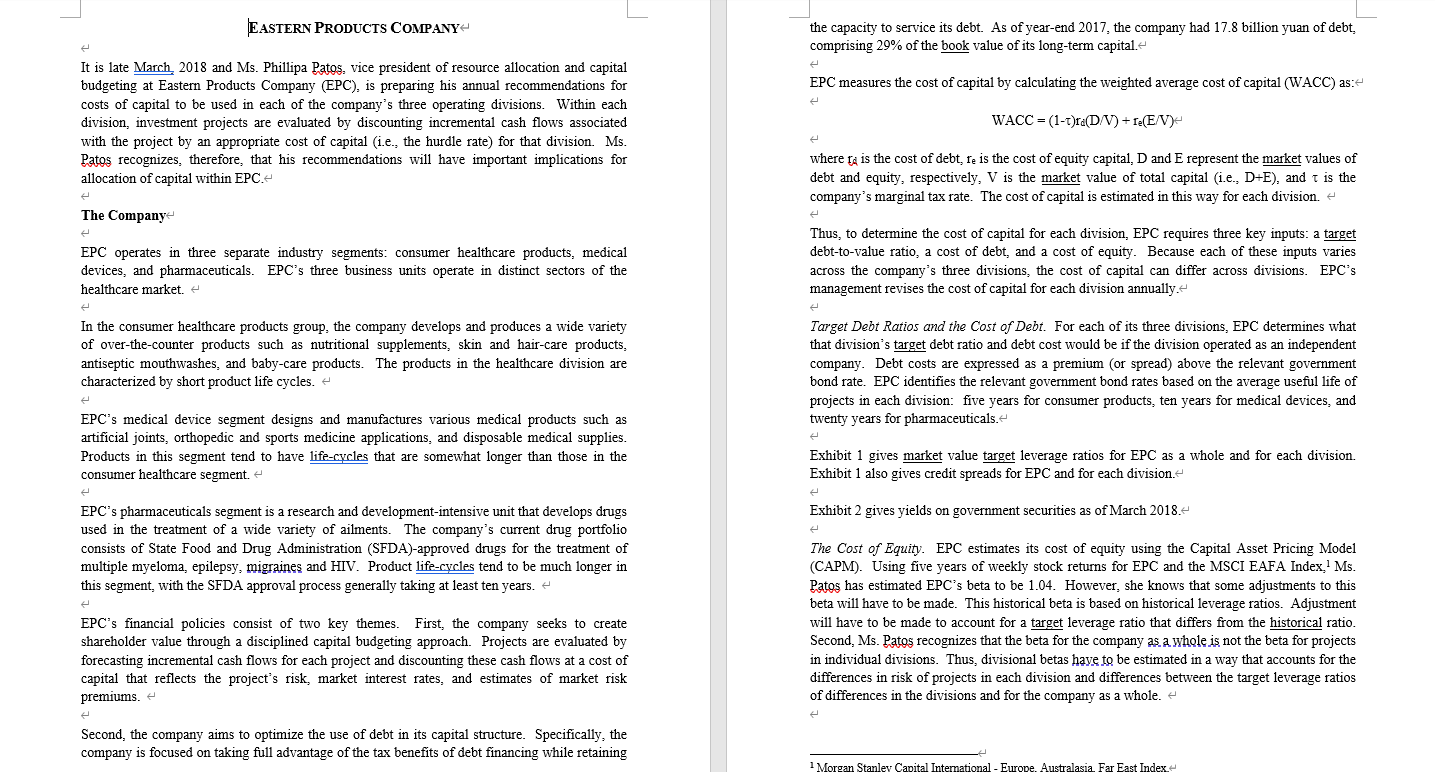

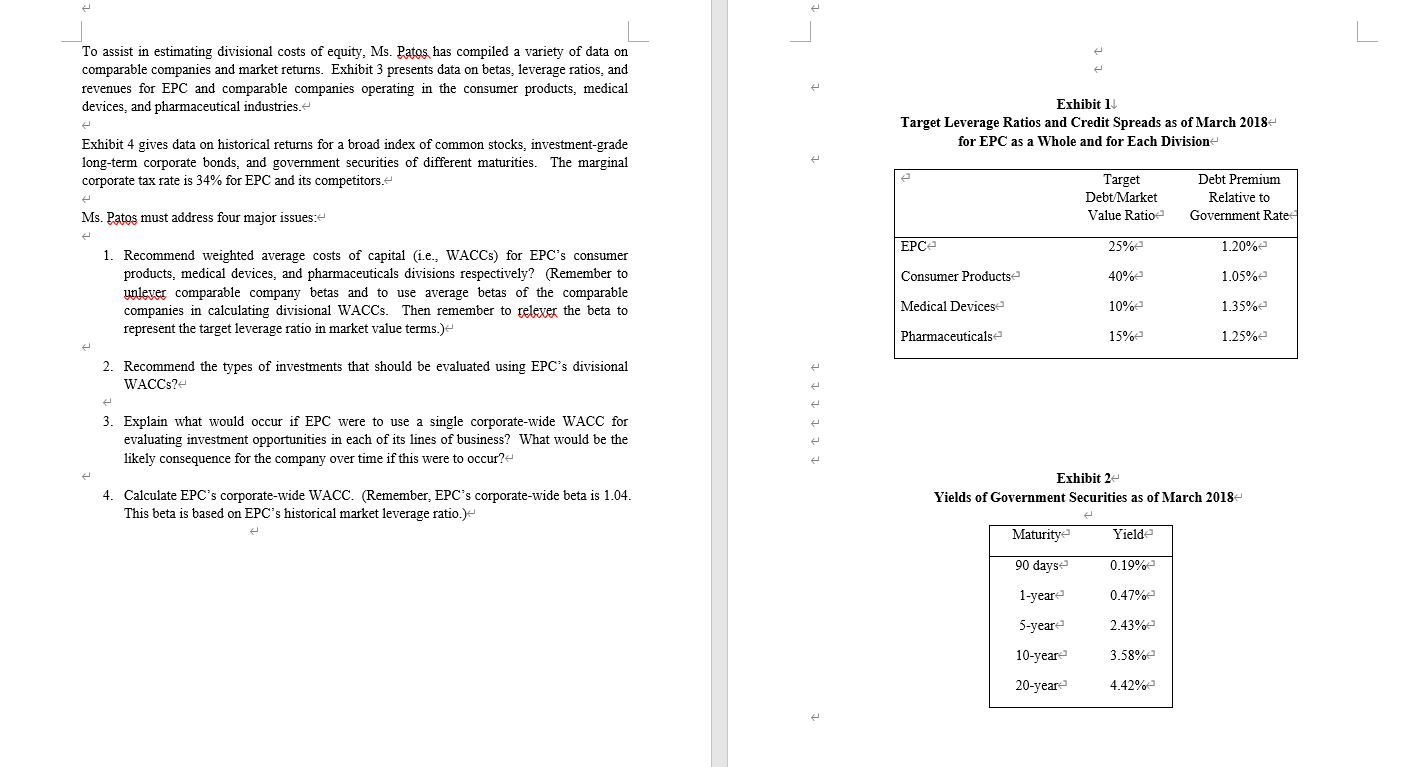

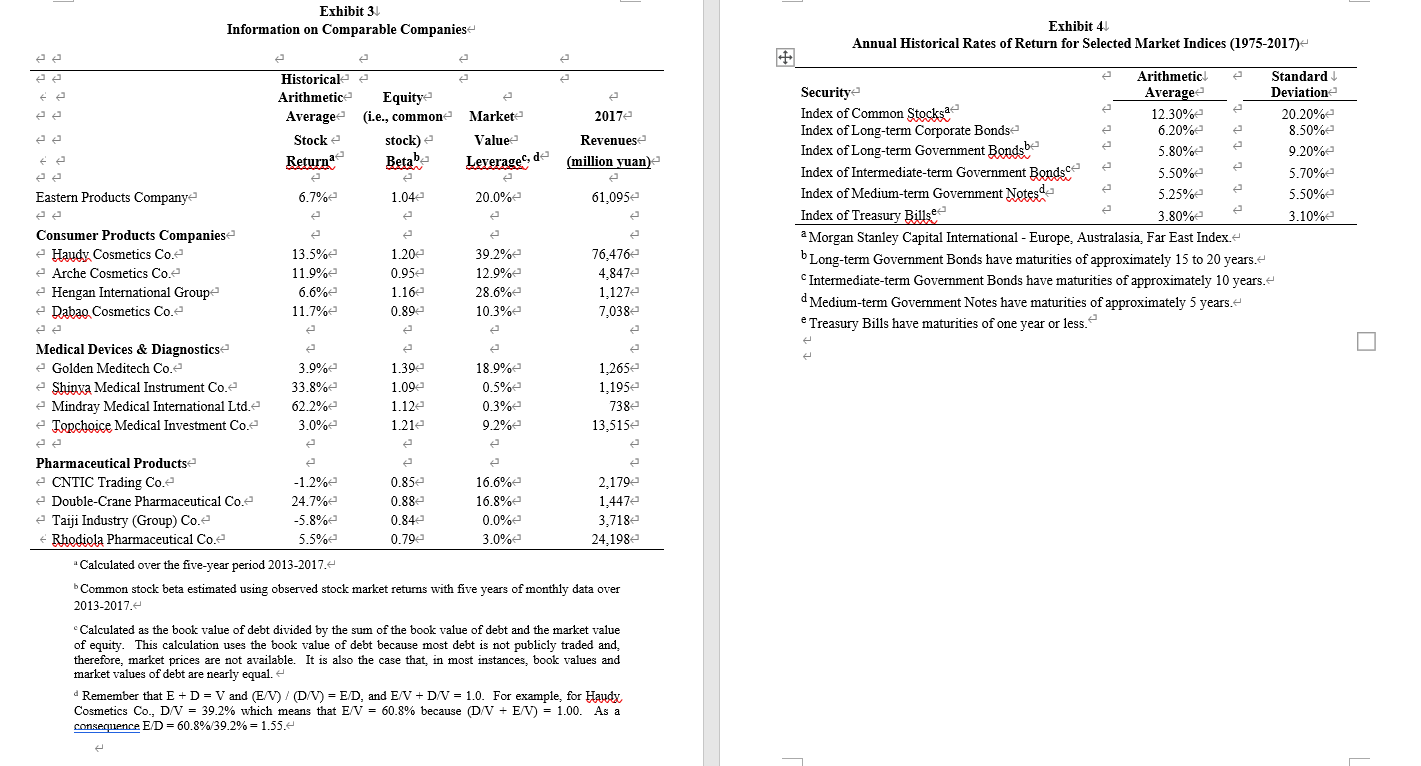

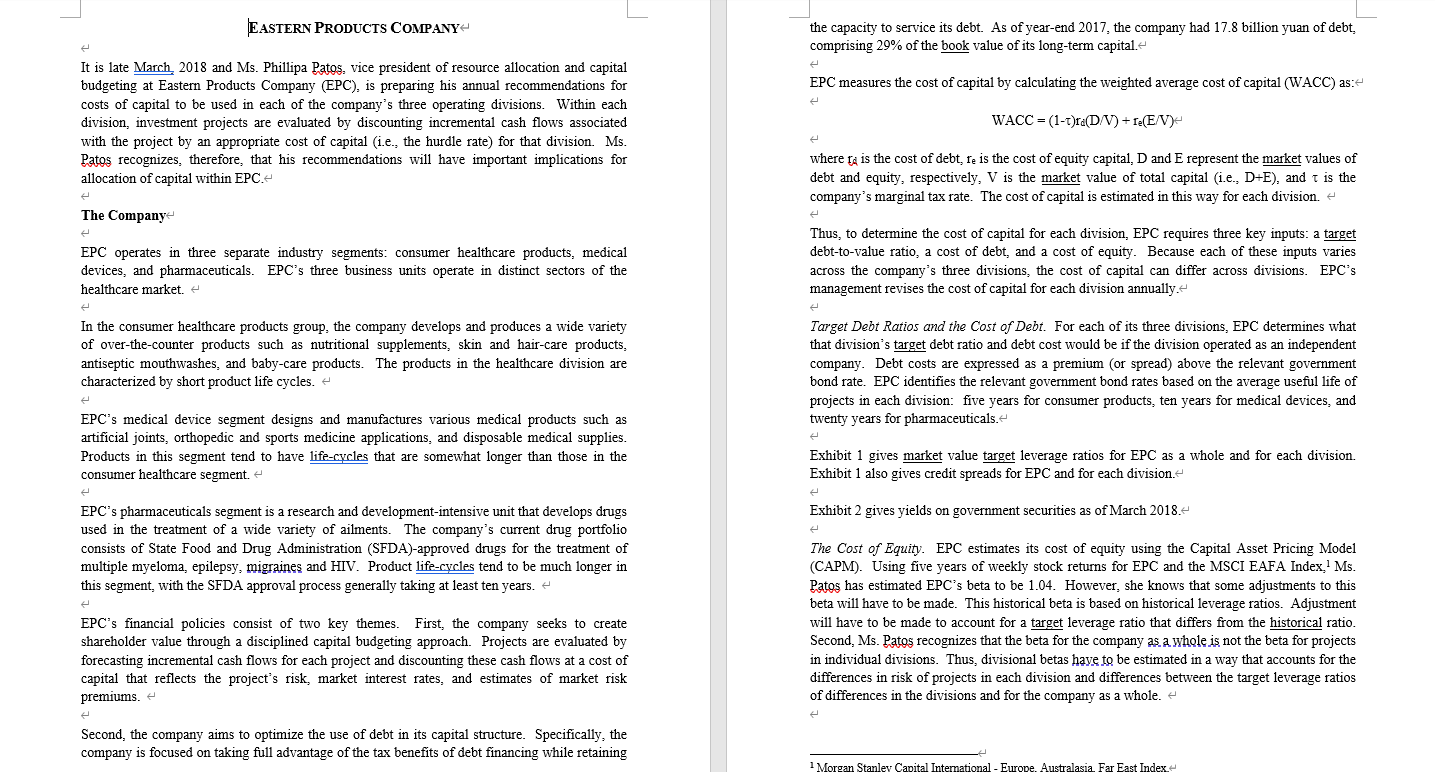

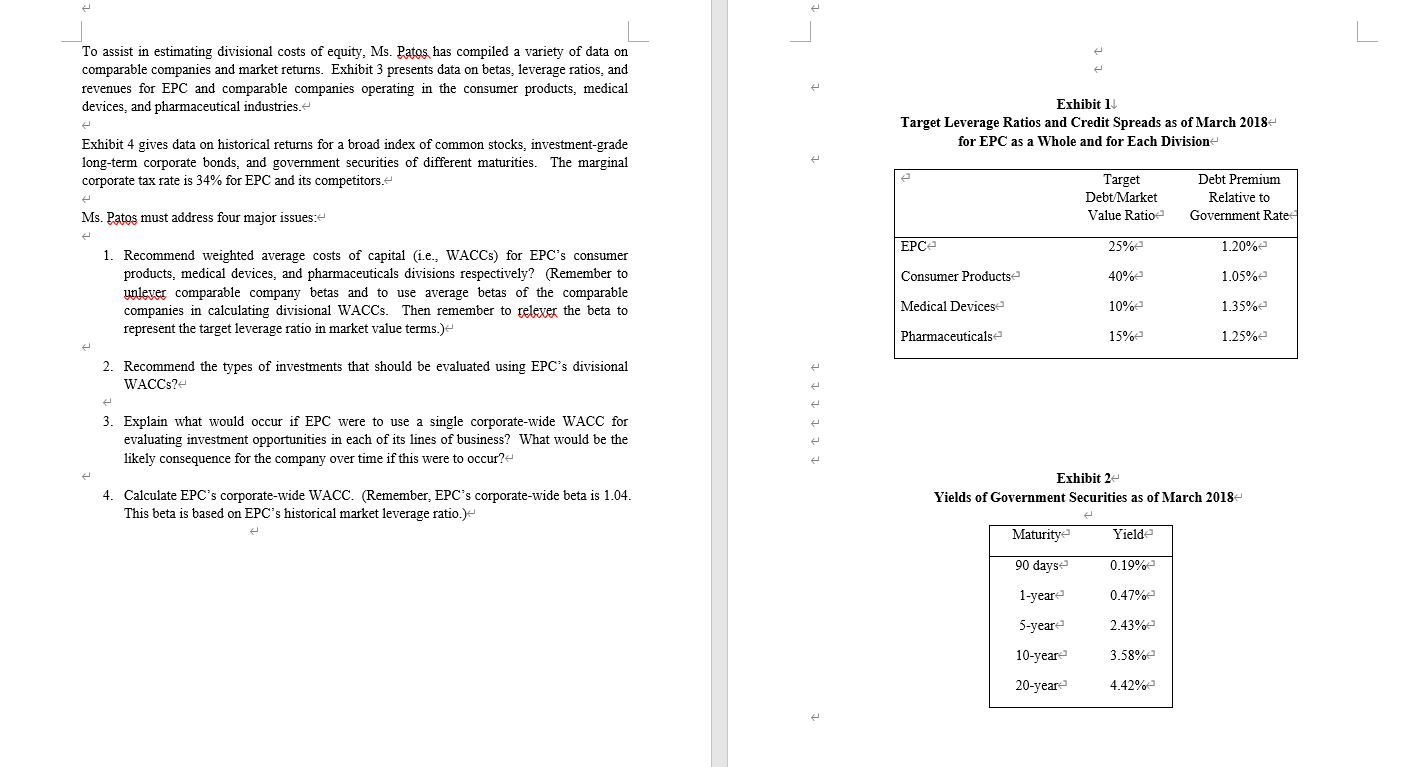

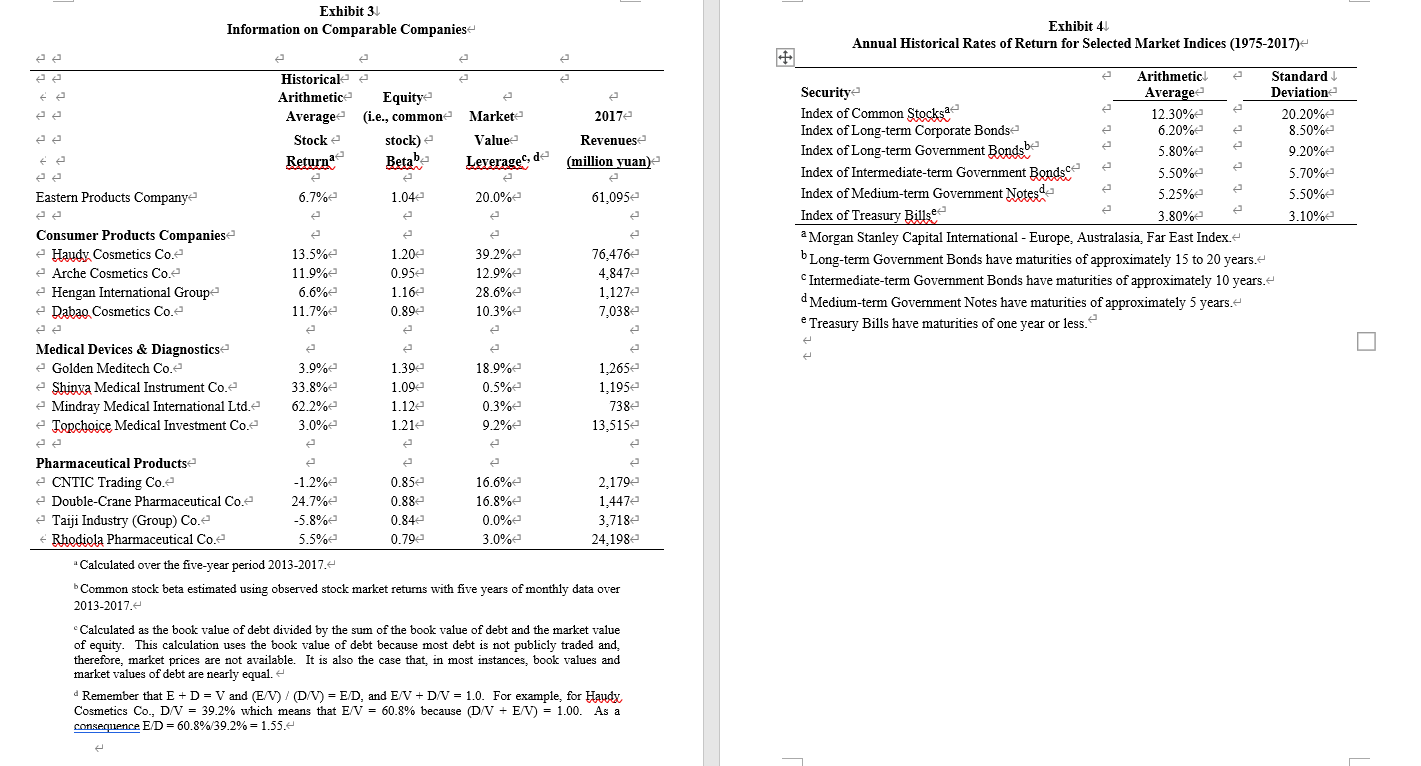

EASTERN PRODUCTS COMPANY the capacity to service its debt. As of year-end 2017, the company had 17.8 billion yuan of debt. comprising 29% of the book value of its long-term capital. EPC measures the cost of capital by calculating the weighted average cost of capital (WACC) as: It is late March2018 and Ms. Phillipa Patos, vice president of resource allocation and capital budgeting at Eastern Products Company (EPC), is preparing his annual recommendations for costs of capital to be used in each of the company's three operating divisions. Within each division, investment projects are evaluated by discounting incremental cash flows associated with the project by an appropriate cost of capital (i.e., the hurdle rate) for that division. Ms. Patos recognizes, therefore, that his recommendations will have important implications for allocation of capital within EPC. WACC = (1-1)ra(D/V) + Te(E/V) e where ra is the cost of debt re is the cost of equity capital, D and E represent the market values of debt and equity, respectively, V is the market value of total capital (i.e., D+E), and t is the company's marginal tax rate. The cost of capital is estimated in this way for each division The Company EPC operates in three separate industry segments: consumer healthcare products, medical devices, and pharmaceuticals. EPC's three business units operate in distinct sectors of the healthcare market. Thus, to determine the cost of capital for each division, EPC requires three key inputs: a target debt-to-value ratio, a cost of debt, and a cost of equity. Because each of these inputs varies across the company's three divisions, the cost of capital can differ across divisions. EPC's management revises the cost of capital for each division annually. In the consumer healthcare products group, the company develops and produces a wide variety of over-the-counter products such as nutritional supplements, skin and hair care products, antiseptic mouthwashes, and baby-care products. The products in the healthcare division are characterized by short product life cycles. Target Debt Ratios and the Cost of Debt. For each of its three divisions, EPC determines what that division's target debt ratio and debt cost would be if the division operated as an independent company. Debt costs are expressed as a premium (or spread) above the relevant government bond rate. EPC identifies the relevant government bond rates based on the average useful life of projects in each division: five years for consumer products, ten years for medical devices, and twenty years for pharmaceuticals. EPC's medical device segment designs and manufactures various medical products such as artificial joints, orthopedic and sports medicine applications, and disposable medical supplies. Products in this segment tend to have life-cycles that are somewhat longer than those in the consumer healthcare segment. Exhibit 1 gives market value target leverage ratios for EPC as a whole and for each division. Exhibit 1 also gives credit spreads for EPC and for each division Exhibit 2 gives yields on government securities as of March 2018. EPC's pharmaceuticals segment is a research and development-intensive unit that develops drugs used in the treatment of a wide variety of ailments. The company's current drug portfolio consists of State Food and Drug Administration (SFDA)-approved drugs for the treatment of multiple myeloma, epilepsy, migraines and HIV. Product life-cycles tend to be much longer in this segment with the SFDA approval process generally taking at least ten years. EPC's financial policies consist of two key themes. First, the company seeks to create shareholder value through a disciplined capital budgeting approach. Projects are evaluated by forecasting incremental cash flows for each project and discounting these cash flows at a cost of capital that reflects the project's risk, market interest rates, and estimates of market risk premiums. The Cost of Equity. EPC estimates its cost of equity using the Capital Asset Pricing Model (CAPM). Using five years of weekly stock returns for EPC and the MSCI EAFA Index? Ms. Patos has estimated EPC's beta to be 1.04. However, she knows that some adjustments to this beta will have to be made. This historical beta is based on historical leverage ratios. Adjustment will have to be made to account for a target leverage ratio that differs from the historical ratio. Second, Ms. Patos recognizes that the beta for the company as a whole is not the beta for projects in individual divisions. Thus, divisional betas have to be estimated in a way that accounts for the differences in risk of projects in each division and differences between the target leverage ratios of differences in the divisions and for the company as a whole. Second, the company aims to optimize the use of debt in its capital structure. Specifically, the company is focused on taking full advantage of the tax benefits of debt financing while retaining 1 Morgan Stanley Capital Interational - Europe Australasia Far East Index To assist in estimating divisional costs of equity, Ms. Patos has compiled a variety of data on comparable companies and market returns. Exhibit 3 presents data on betas, leverage ratios, and revenues for EPC and comparable companies operating in the consumer products, medical devices, and pharmaceutical industries. Exhibit 1 Target Leverage Ratios and Credit Spreads as of March 2018 for EPC as a whole and for Each Division Exhibit 4 gives data on historical returns for a broad index of common stocks, investment-grade long-term corporate bonds, and government securities of different maturities. The marginal corporate tax rate is 34% for EPC and its competitors. Target Debt/Market Value Ratio Debt Premium Relative to Government Rate Ms. Patos must address four major issues: EPCe 25% 1.20% Consumer Products 40% 1.05% 1. Recommend weighted average costs of capital (i.e., WACCs) for EPC's consumer products, medical devices, and pharmaceuticals divisions respectively? (Remember to unlever comparable company betas and to use average betas of the comparable companies in calculating divisional WACCs. Then remember to relever the beta to represent the target leverage ratio in market value terms.) Medical Devicese 10% 1.35% Pharmaceuticals 15% 1.25% 2. Recommend the types of investments that should be evaluated using EPC's divisional WACCs? * * * * * * 3. Explain what would occur if EPC were to use a single corporate-wide WACC for evaluating investment opportunities in each of its lines of business? What would be the likely consequence for the company over time if this were to occur? 4. Calculate EPC's corporate-wide WACC. (Remember, EPC's corporate-wide beta is 1.04. This beta is based on EPC's historical market leverage ratio. Exhibit 2 Yields of Government Securities as of March 2018 Maturity Yield 90 days 0.19% 1-year 0.47% 5-year 2.43% 10-year 3.58% 20-yeare 4.42% Exhibit 3 Information on Comparable Companies Exhibit 4 Annual Historical Rates of Return for Selected Market Indices (1975-2017) Market Historicale e Arithmetice Equity Average (i.e., common Stocke stock) Returna Betabe Value Leverages, de 2017e Revenuese (million yuan) 5.50% Eastern Products Companye 6.7% 1.042 20.0% 61,095e Arithmetic Standard Security Average Deviation Index of Common Stocksae 12.30% 20.20% Index of Long-term Corporate Bondse 6.20% 8.50% Index of Long-term Government Bondsbe 5.80% 9.20% Index of Intermediate-term Government Bondage 5.70% Index of Medium-term Government Notesde 5.25% 5.50% Index of Treasury Bills 3.80% 3.10% a Morgan Stanley Capital International - Europe, Australasia, Far East Index Long-term Government Bonds have maturities of approximately 15 to 20 years. Intermediate-term Government Bonds have maturities of approximately 10 years. d Medium-term Government Notes have maturities of approximately 5 years. e Treasury Bills have maturities of one year or less % Consumer Products Companies Haudy Cosmetics Co.e e Arche Cosmetics Co. Hengan International Group Dabao Cosmetics Co.e 13.5% 11.9% 6.6% 11.7% 1.20 0.95e 1.16 0.89 39.2% 12.9% 28.6%e 10.3% 76,4762 4,8472 1,127e 7,038 Medical Devices & Diagnostics e Golden Meditech Co. Shinya Medical Instrument Co. e Mindray Medical International Ltde Topchoice Medical Investment Coe 3.9% 33.8% 62.2% 3.0% 1.39 1.092 1.12e 1.21e 18.9% 0.5% 0.3% 9.2% 1,2652 1,1952 738 13,515e % Pharmaceutical Products e CNTIC Trading Co.e -1.2% 0.85e 16.6% 2,1792 e Double-Crane Pharmaceutical Co.e 24.7% 0.88 16.8% 1,447e Taiji Industry (Group) Co. -5.8% 0.84 0.0% 3,7182 Rhodiola Pharmaceutical Co. 5.5% 0.792 3.0% 24.1982 Calculated over the five-year period 2013-2017 Common stock beta estimated using observed stock market returns with five years of monthly data over 2013-2017 Calculated as the book value of debt divided by the sum of the book value of debt and the market value of equity. This calculation uses the book value of debt because most debt is not publicly traded and, therefore, market prices are not available. It is also the case that, in most instances, book values and market values of debt are nearly equal. Remember that E + D = V and (E/V)/(D/V) = E/D, and E/V + D/V = 1.0. For example, for Haudy Cosmetics Co., D/V = 39.2% which means that E/V = 60.8% because (D/V + E/V) = 1.00. As a consequence E/D = 60.8%/39.2%= 1.55. EASTERN PRODUCTS COMPANY the capacity to service its debt. As of year-end 2017, the company had 17.8 billion yuan of debt. comprising 29% of the book value of its long-term capital. EPC measures the cost of capital by calculating the weighted average cost of capital (WACC) as: It is late March2018 and Ms. Phillipa Patos, vice president of resource allocation and capital budgeting at Eastern Products Company (EPC), is preparing his annual recommendations for costs of capital to be used in each of the company's three operating divisions. Within each division, investment projects are evaluated by discounting incremental cash flows associated with the project by an appropriate cost of capital (i.e., the hurdle rate) for that division. Ms. Patos recognizes, therefore, that his recommendations will have important implications for allocation of capital within EPC. WACC = (1-1)ra(D/V) + Te(E/V) e where ra is the cost of debt re is the cost of equity capital, D and E represent the market values of debt and equity, respectively, V is the market value of total capital (i.e., D+E), and t is the company's marginal tax rate. The cost of capital is estimated in this way for each division The Company EPC operates in three separate industry segments: consumer healthcare products, medical devices, and pharmaceuticals. EPC's three business units operate in distinct sectors of the healthcare market. Thus, to determine the cost of capital for each division, EPC requires three key inputs: a target debt-to-value ratio, a cost of debt, and a cost of equity. Because each of these inputs varies across the company's three divisions, the cost of capital can differ across divisions. EPC's management revises the cost of capital for each division annually. In the consumer healthcare products group, the company develops and produces a wide variety of over-the-counter products such as nutritional supplements, skin and hair care products, antiseptic mouthwashes, and baby-care products. The products in the healthcare division are characterized by short product life cycles. Target Debt Ratios and the Cost of Debt. For each of its three divisions, EPC determines what that division's target debt ratio and debt cost would be if the division operated as an independent company. Debt costs are expressed as a premium (or spread) above the relevant government bond rate. EPC identifies the relevant government bond rates based on the average useful life of projects in each division: five years for consumer products, ten years for medical devices, and twenty years for pharmaceuticals. EPC's medical device segment designs and manufactures various medical products such as artificial joints, orthopedic and sports medicine applications, and disposable medical supplies. Products in this segment tend to have life-cycles that are somewhat longer than those in the consumer healthcare segment. Exhibit 1 gives market value target leverage ratios for EPC as a whole and for each division. Exhibit 1 also gives credit spreads for EPC and for each division Exhibit 2 gives yields on government securities as of March 2018. EPC's pharmaceuticals segment is a research and development-intensive unit that develops drugs used in the treatment of a wide variety of ailments. The company's current drug portfolio consists of State Food and Drug Administration (SFDA)-approved drugs for the treatment of multiple myeloma, epilepsy, migraines and HIV. Product life-cycles tend to be much longer in this segment with the SFDA approval process generally taking at least ten years. EPC's financial policies consist of two key themes. First, the company seeks to create shareholder value through a disciplined capital budgeting approach. Projects are evaluated by forecasting incremental cash flows for each project and discounting these cash flows at a cost of capital that reflects the project's risk, market interest rates, and estimates of market risk premiums. The Cost of Equity. EPC estimates its cost of equity using the Capital Asset Pricing Model (CAPM). Using five years of weekly stock returns for EPC and the MSCI EAFA Index? Ms. Patos has estimated EPC's beta to be 1.04. However, she knows that some adjustments to this beta will have to be made. This historical beta is based on historical leverage ratios. Adjustment will have to be made to account for a target leverage ratio that differs from the historical ratio. Second, Ms. Patos recognizes that the beta for the company as a whole is not the beta for projects in individual divisions. Thus, divisional betas have to be estimated in a way that accounts for the differences in risk of projects in each division and differences between the target leverage ratios of differences in the divisions and for the company as a whole. Second, the company aims to optimize the use of debt in its capital structure. Specifically, the company is focused on taking full advantage of the tax benefits of debt financing while retaining 1 Morgan Stanley Capital Interational - Europe Australasia Far East Index To assist in estimating divisional costs of equity, Ms. Patos has compiled a variety of data on comparable companies and market returns. Exhibit 3 presents data on betas, leverage ratios, and revenues for EPC and comparable companies operating in the consumer products, medical devices, and pharmaceutical industries. Exhibit 1 Target Leverage Ratios and Credit Spreads as of March 2018 for EPC as a whole and for Each Division Exhibit 4 gives data on historical returns for a broad index of common stocks, investment-grade long-term corporate bonds, and government securities of different maturities. The marginal corporate tax rate is 34% for EPC and its competitors. Target Debt/Market Value Ratio Debt Premium Relative to Government Rate Ms. Patos must address four major issues: EPCe 25% 1.20% Consumer Products 40% 1.05% 1. Recommend weighted average costs of capital (i.e., WACCs) for EPC's consumer products, medical devices, and pharmaceuticals divisions respectively? (Remember to unlever comparable company betas and to use average betas of the comparable companies in calculating divisional WACCs. Then remember to relever the beta to represent the target leverage ratio in market value terms.) Medical Devicese 10% 1.35% Pharmaceuticals 15% 1.25% 2. Recommend the types of investments that should be evaluated using EPC's divisional WACCs? * * * * * * 3. Explain what would occur if EPC were to use a single corporate-wide WACC for evaluating investment opportunities in each of its lines of business? What would be the likely consequence for the company over time if this were to occur? 4. Calculate EPC's corporate-wide WACC. (Remember, EPC's corporate-wide beta is 1.04. This beta is based on EPC's historical market leverage ratio. Exhibit 2 Yields of Government Securities as of March 2018 Maturity Yield 90 days 0.19% 1-year 0.47% 5-year 2.43% 10-year 3.58% 20-yeare 4.42% Exhibit 3 Information on Comparable Companies Exhibit 4 Annual Historical Rates of Return for Selected Market Indices (1975-2017) Market Historicale e Arithmetice Equity Average (i.e., common Stocke stock) Returna Betabe Value Leverages, de 2017e Revenuese (million yuan) 5.50% Eastern Products Companye 6.7% 1.042 20.0% 61,095e Arithmetic Standard Security Average Deviation Index of Common Stocksae 12.30% 20.20% Index of Long-term Corporate Bondse 6.20% 8.50% Index of Long-term Government Bondsbe 5.80% 9.20% Index of Intermediate-term Government Bondage 5.70% Index of Medium-term Government Notesde 5.25% 5.50% Index of Treasury Bills 3.80% 3.10% a Morgan Stanley Capital International - Europe, Australasia, Far East Index Long-term Government Bonds have maturities of approximately 15 to 20 years. Intermediate-term Government Bonds have maturities of approximately 10 years. d Medium-term Government Notes have maturities of approximately 5 years. e Treasury Bills have maturities of one year or less % Consumer Products Companies Haudy Cosmetics Co.e e Arche Cosmetics Co. Hengan International Group Dabao Cosmetics Co.e 13.5% 11.9% 6.6% 11.7% 1.20 0.95e 1.16 0.89 39.2% 12.9% 28.6%e 10.3% 76,4762 4,8472 1,127e 7,038 Medical Devices & Diagnostics e Golden Meditech Co. Shinya Medical Instrument Co. e Mindray Medical International Ltde Topchoice Medical Investment Coe 3.9% 33.8% 62.2% 3.0% 1.39 1.092 1.12e 1.21e 18.9% 0.5% 0.3% 9.2% 1,2652 1,1952 738 13,515e % Pharmaceutical Products e CNTIC Trading Co.e -1.2% 0.85e 16.6% 2,1792 e Double-Crane Pharmaceutical Co.e 24.7% 0.88 16.8% 1,447e Taiji Industry (Group) Co. -5.8% 0.84 0.0% 3,7182 Rhodiola Pharmaceutical Co. 5.5% 0.792 3.0% 24.1982 Calculated over the five-year period 2013-2017 Common stock beta estimated using observed stock market returns with five years of monthly data over 2013-2017 Calculated as the book value of debt divided by the sum of the book value of debt and the market value of equity. This calculation uses the book value of debt because most debt is not publicly traded and, therefore, market prices are not available. It is also the case that, in most instances, book values and market values of debt are nearly equal. Remember that E + D = V and (E/V)/(D/V) = E/D, and E/V + D/V = 1.0. For example, for Haudy Cosmetics Co., D/V = 39.2% which means that E/V = 60.8% because (D/V + E/V) = 1.00. As a consequence E/D = 60.8%/39.2%= 1.55