Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Little Bob's Custom Tables produces expensive custom tables with intricate inlay. The primary customers of the firm are wealthy individuals and corporations that want large

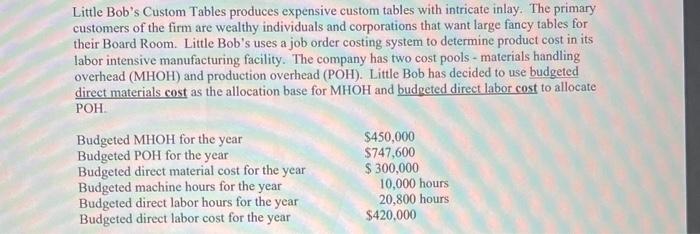

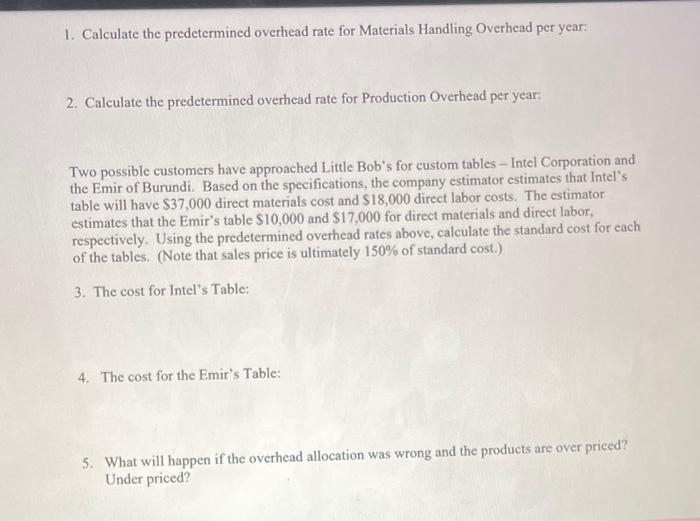

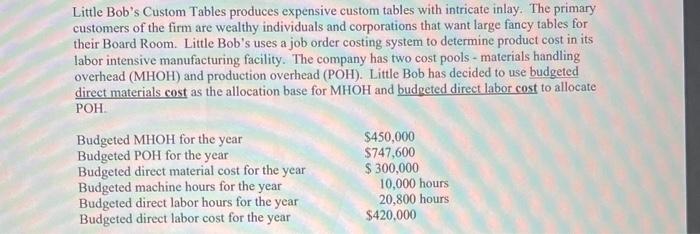

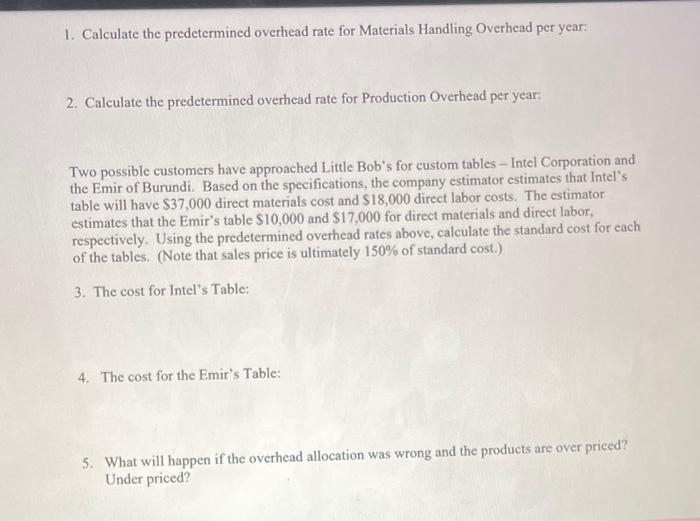

Little Bob's Custom Tables produces expensive custom tables with intricate inlay. The primary customers of the firm are wealthy individuals and corporations that want large fancy tables for their Board Room. Little Bob's uses a job order costing system to determine product cost in its labor intensive manufacturing facility. The company has two cost pools-materials handling overhead (MHOH) and production overhead (POH). Little Bob has decided to use budgeted direct materials cost as the allocation base for MHOH and budgeted direct labor cost to allocate POH. 1. Calculate the predetermined overhead rate for Materials Handling Overhead per year: 2. Calculate the predetermined overhead rate for Production Overhead per year: Two possible customers have approached Little Bob's for custom tables - Intel Corporation and the Emir of Burundi. Based on the specifications, the company estimator estimates that Intel's table will have $37,000 direct materials cost and $18,000 direct labor costs. The estimator estimates that the Emir's table $10,000 and $17,000 for direct materials and direct labor, respectively. Using the predetermined overhead rates above, calculate the standard cost for each of the tables. (Note that sales price is ultimately 150% of standard cost.) 3. The cost for Intel's Table: 4. The cost for the Emir's Table: 5. What will happen if the overhead allocation was wrong and the products are over priced? Under priced

Little Bob's Custom Tables produces expensive custom tables with intricate inlay. The primary customers of the firm are wealthy individuals and corporations that want large fancy tables for their Board Room. Little Bob's uses a job order costing system to determine product cost in its labor intensive manufacturing facility. The company has two cost pools-materials handling overhead (MHOH) and production overhead (POH). Little Bob has decided to use budgeted direct materials cost as the allocation base for MHOH and budgeted direct labor cost to allocate POH. 1. Calculate the predetermined overhead rate for Materials Handling Overhead per year: 2. Calculate the predetermined overhead rate for Production Overhead per year: Two possible customers have approached Little Bob's for custom tables - Intel Corporation and the Emir of Burundi. Based on the specifications, the company estimator estimates that Intel's table will have $37,000 direct materials cost and $18,000 direct labor costs. The estimator estimates that the Emir's table $10,000 and $17,000 for direct materials and direct labor, respectively. Using the predetermined overhead rates above, calculate the standard cost for each of the tables. (Note that sales price is ultimately 150% of standard cost.) 3. The cost for Intel's Table: 4. The cost for the Emir's Table: 5. What will happen if the overhead allocation was wrong and the products are over priced? Under priced

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started