Answered step by step

Verified Expert Solution

Question

1 Approved Answer

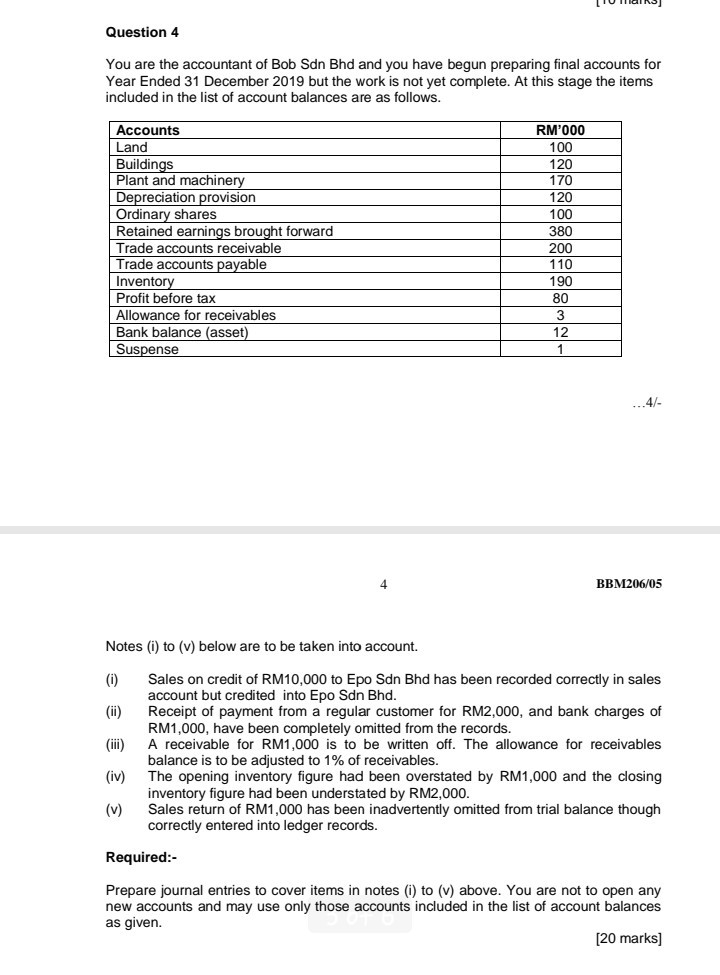

LIU TAINS Question 4 You are the accountant of Bob Sdn Bhd and you have begun preparing final accounts for Year Ended 31 December 2019

LIU TAINS Question 4 You are the accountant of Bob Sdn Bhd and you have begun preparing final accounts for Year Ended 31 December 2019 but the work is not yet complete. At this stage the items included in the list of account balances are as follows. Accounts Land Buildings Plant and machinery Depreciation provision Ordinary shares Retained earnings brought forward Trade accounts receivable Trade accounts payable Inventory Profit before tax Allowance for receivables Bank balance (asset) Suspense RM'000 100 120 170 120 100 380 200 110 190 80 BBM206/05 Notes (i) to (v) below are to be taken into account. Sales on credit of RM10,000 to Epo Sdn Bhd has been recorded correctly in sales account but credited into Epo Sdn Bhd. Receipt of payment from a regular customer for RM2,000, and bank charges of RM1,000, have been completely omitted from the records. A receivable for RM1,000 is to be written off. The allowance for receivables balance is to be adjusted to 1% of receivables. The opening inventory figure had been overstated by RM1,000 and the closing inventory figure had been understated by RM2,000. Sales return of RM1,000 has been inadvertently omitted from trial balance though correctly entered into ledger records. (iv) (v) Required:- Prepare journal entries to cover items in notes (i) to (v) above. You are not to open any new accounts and may use only those accounts included in the list of account balances as given. [20 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started