Answered step by step

Verified Expert Solution

Question

1 Approved Answer

..ll du 10:23 PM 7% Done ASSIGNMENT 4 - Female_ec3b1fo... 7 2 of 4 Andrew QUESTION 1 John and Tara Smith are married couples and

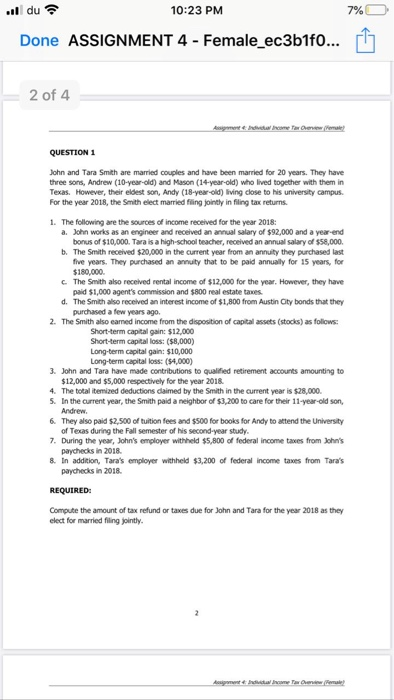

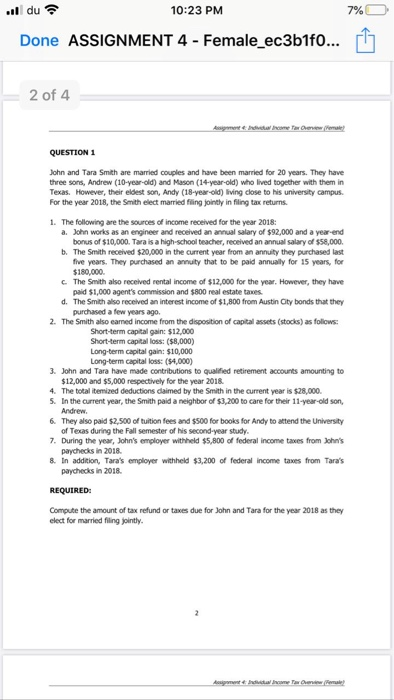

..ll du 10:23 PM 7% Done ASSIGNMENT 4 - Female_ec3b1fo... 7 2 of 4 Andrew QUESTION 1 John and Tara Smith are married couples and have been married for 20 years. They have three sons, Andrew (10-year-old) and Mason (14-year-old) who lived together with them in Texas. However, their eldest son, Andy (18-year-old) living close to his university Campus. For the year 2018, the Smith elect married filing jointly in filing tax returns 1. The following are the sources of income received for the year 2018: a. John works as an engineer and received an annual salary of $92,000 and a year-end bonus of $10,000. Tara is a high-school teacher, received an annual salary of $58,000 b. The Smith received $20,000 in the current year from an annuity they purchased last five years. They purchased an annuity that to be paid annually for 15 years, for $180.000 C. The Smith also received rental income of $12,000 for the year. However, they have paid $1,000 agent's commission and $800 real estate taxes. d. The Smith also received an interest income of $1,800 from Austin City bonds that they purchased a few years ago 2. The Smith also earned income from the disposition of capital assets stocks) as follows: Short-term capital gain: $12,000 Short-term capital loss: ($8,000) Long-term capital gain: $10,000 Long-term capital loss: $4,000) 3. John and Tara have made contributions to qualified retirement accounts amounting to $12,000 and $5,000 respectively for the year 2018 4. The total itemized deductions claimed by the Smith in the current year is $28,000 5. In the current year, the Smith paid a neighbor of $3,200 to care for their 11-year-old son, Andrew 6. They also paid $2.500 of tuition fees and $500 for books for Andy to attend the University of Texas during the Fall semester of Nis second-year study 7. During the year, John's employer withheld $5,800 of federal income taxes from John's paychecks in 2018. 8. In addition, Tara's employer withheld $3,200 of federal income taxes from Tara's paychecks in 2018 REQUIRED: Compute the amount of tax refund or taxes due for John and Tara for the year 2018 as they elect for married filing jointly. As daar ..ll du 10:23 PM 7% Done ASSIGNMENT 4 - Female_ec3b1fo... 7 2 of 4 Andrew QUESTION 1 John and Tara Smith are married couples and have been married for 20 years. They have three sons, Andrew (10-year-old) and Mason (14-year-old) who lived together with them in Texas. However, their eldest son, Andy (18-year-old) living close to his university Campus. For the year 2018, the Smith elect married filing jointly in filing tax returns 1. The following are the sources of income received for the year 2018: a. John works as an engineer and received an annual salary of $92,000 and a year-end bonus of $10,000. Tara is a high-school teacher, received an annual salary of $58,000 b. The Smith received $20,000 in the current year from an annuity they purchased last five years. They purchased an annuity that to be paid annually for 15 years, for $180.000 C. The Smith also received rental income of $12,000 for the year. However, they have paid $1,000 agent's commission and $800 real estate taxes. d. The Smith also received an interest income of $1,800 from Austin City bonds that they purchased a few years ago 2. The Smith also earned income from the disposition of capital assets stocks) as follows: Short-term capital gain: $12,000 Short-term capital loss: ($8,000) Long-term capital gain: $10,000 Long-term capital loss: $4,000) 3. John and Tara have made contributions to qualified retirement accounts amounting to $12,000 and $5,000 respectively for the year 2018 4. The total itemized deductions claimed by the Smith in the current year is $28,000 5. In the current year, the Smith paid a neighbor of $3,200 to care for their 11-year-old son, Andrew 6. They also paid $2.500 of tuition fees and $500 for books for Andy to attend the University of Texas during the Fall semester of Nis second-year study 7. During the year, John's employer withheld $5,800 of federal income taxes from John's paychecks in 2018. 8. In addition, Tara's employer withheld $3,200 of federal income taxes from Tara's paychecks in 2018 REQUIRED: Compute the amount of tax refund or taxes due for John and Tara for the year 2018 as they elect for married filing jointly. As daar

..ll du 10:23 PM 7% Done ASSIGNMENT 4 - Female_ec3b1fo... 7 2 of 4 Andrew QUESTION 1 John and Tara Smith are married couples and have been married for 20 years. They have three sons, Andrew (10-year-old) and Mason (14-year-old) who lived together with them in Texas. However, their eldest son, Andy (18-year-old) living close to his university Campus. For the year 2018, the Smith elect married filing jointly in filing tax returns 1. The following are the sources of income received for the year 2018: a. John works as an engineer and received an annual salary of $92,000 and a year-end bonus of $10,000. Tara is a high-school teacher, received an annual salary of $58,000 b. The Smith received $20,000 in the current year from an annuity they purchased last five years. They purchased an annuity that to be paid annually for 15 years, for $180.000 C. The Smith also received rental income of $12,000 for the year. However, they have paid $1,000 agent's commission and $800 real estate taxes. d. The Smith also received an interest income of $1,800 from Austin City bonds that they purchased a few years ago 2. The Smith also earned income from the disposition of capital assets stocks) as follows: Short-term capital gain: $12,000 Short-term capital loss: ($8,000) Long-term capital gain: $10,000 Long-term capital loss: $4,000) 3. John and Tara have made contributions to qualified retirement accounts amounting to $12,000 and $5,000 respectively for the year 2018 4. The total itemized deductions claimed by the Smith in the current year is $28,000 5. In the current year, the Smith paid a neighbor of $3,200 to care for their 11-year-old son, Andrew 6. They also paid $2.500 of tuition fees and $500 for books for Andy to attend the University of Texas during the Fall semester of Nis second-year study 7. During the year, John's employer withheld $5,800 of federal income taxes from John's paychecks in 2018. 8. In addition, Tara's employer withheld $3,200 of federal income taxes from Tara's paychecks in 2018 REQUIRED: Compute the amount of tax refund or taxes due for John and Tara for the year 2018 as they elect for married filing jointly. As daar ..ll du 10:23 PM 7% Done ASSIGNMENT 4 - Female_ec3b1fo... 7 2 of 4 Andrew QUESTION 1 John and Tara Smith are married couples and have been married for 20 years. They have three sons, Andrew (10-year-old) and Mason (14-year-old) who lived together with them in Texas. However, their eldest son, Andy (18-year-old) living close to his university Campus. For the year 2018, the Smith elect married filing jointly in filing tax returns 1. The following are the sources of income received for the year 2018: a. John works as an engineer and received an annual salary of $92,000 and a year-end bonus of $10,000. Tara is a high-school teacher, received an annual salary of $58,000 b. The Smith received $20,000 in the current year from an annuity they purchased last five years. They purchased an annuity that to be paid annually for 15 years, for $180.000 C. The Smith also received rental income of $12,000 for the year. However, they have paid $1,000 agent's commission and $800 real estate taxes. d. The Smith also received an interest income of $1,800 from Austin City bonds that they purchased a few years ago 2. The Smith also earned income from the disposition of capital assets stocks) as follows: Short-term capital gain: $12,000 Short-term capital loss: ($8,000) Long-term capital gain: $10,000 Long-term capital loss: $4,000) 3. John and Tara have made contributions to qualified retirement accounts amounting to $12,000 and $5,000 respectively for the year 2018 4. The total itemized deductions claimed by the Smith in the current year is $28,000 5. In the current year, the Smith paid a neighbor of $3,200 to care for their 11-year-old son, Andrew 6. They also paid $2.500 of tuition fees and $500 for books for Andy to attend the University of Texas during the Fall semester of Nis second-year study 7. During the year, John's employer withheld $5,800 of federal income taxes from John's paychecks in 2018. 8. In addition, Tara's employer withheld $3,200 of federal income taxes from Tara's paychecks in 2018 REQUIRED: Compute the amount of tax refund or taxes due for John and Tara for the year 2018 as they elect for married filing jointly. As daar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started