Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lloyd and Manuel want to buy a home. Their bank requires borrowers to pay 10% of the purchase price as a down payment. They have

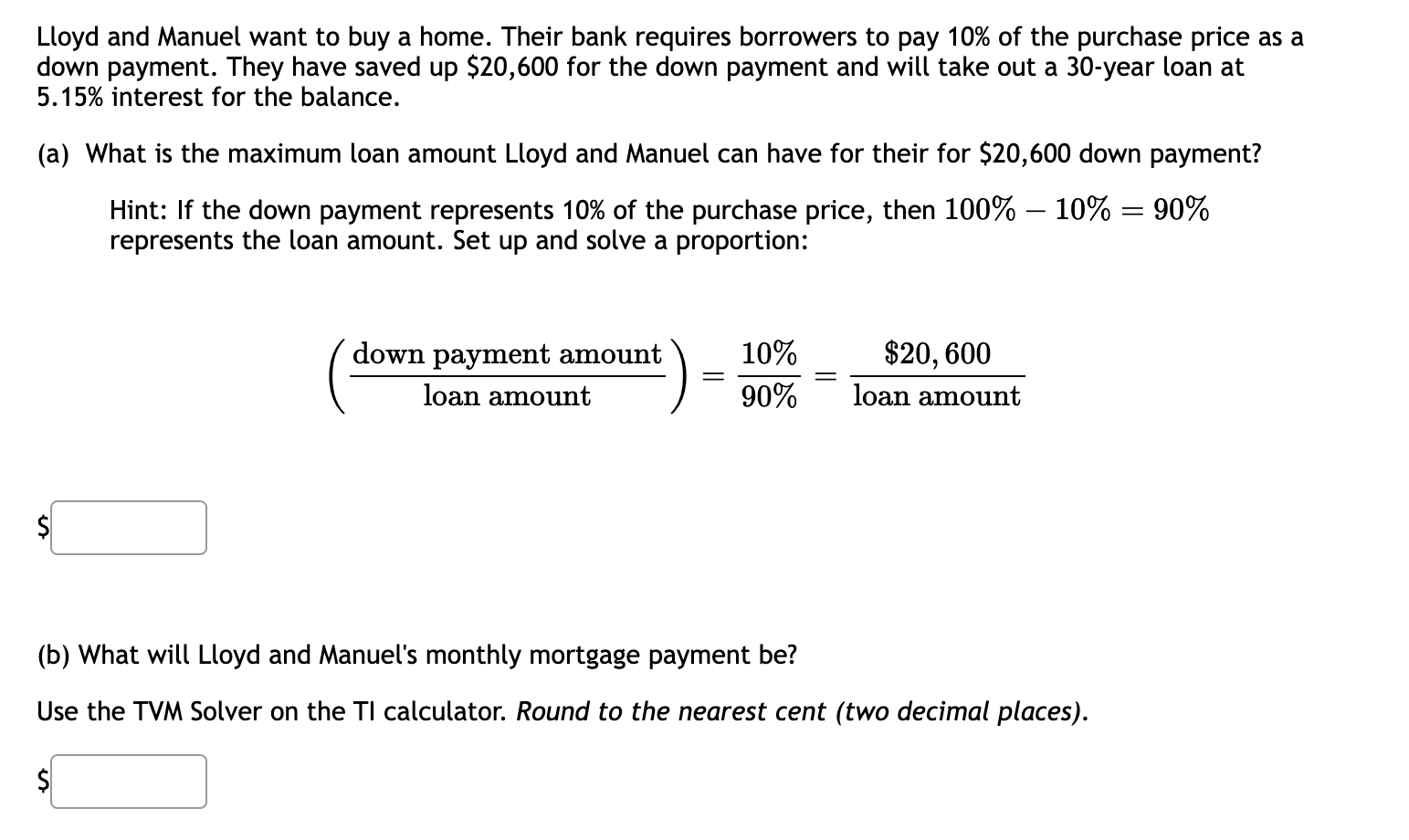

Lloyd and Manuel want to buy a home. Their bank requires borrowers to pay 10% of the purchase price as a down payment. They have saved up $20,600 for the down payment and will take out a 30-year loan at 5.15% interest for the balance.

(a) What is the maximum loan amount Lloyd and Manuel can have for their for $20,600 down payment?

Lloyd and Manuel want to buy a home. Their bank requires borrowers to pay 10% of the purchase price as a down payment. They have saved up $20,600 for the down payment and will take out a 30 -year loan at 5.15\% interest for the balance. (a) What is the maximum loan amount Lloyd and Manuel can have for their for $20,600 down payment? Hint: If the down payment represents 10% of the purchase price, then 100%10%=90% represents the loan amount. Set up and solve a proportion: (loanamountdownpaymentamount)=90%10%=loanamount$20,600 (b) What will Lloyd and Manuel's monthly mortgage payment be? Use the TVM Solver on the TI calculator. Round to the nearest cent (two decimal places)

Lloyd and Manuel want to buy a home. Their bank requires borrowers to pay 10% of the purchase price as a down payment. They have saved up $20,600 for the down payment and will take out a 30 -year loan at 5.15\% interest for the balance. (a) What is the maximum loan amount Lloyd and Manuel can have for their for $20,600 down payment? Hint: If the down payment represents 10% of the purchase price, then 100%10%=90% represents the loan amount. Set up and solve a proportion: (loanamountdownpaymentamount)=90%10%=loanamount$20,600 (b) What will Lloyd and Manuel's monthly mortgage payment be? Use the TVM Solver on the TI calculator. Round to the nearest cent (two decimal places) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started