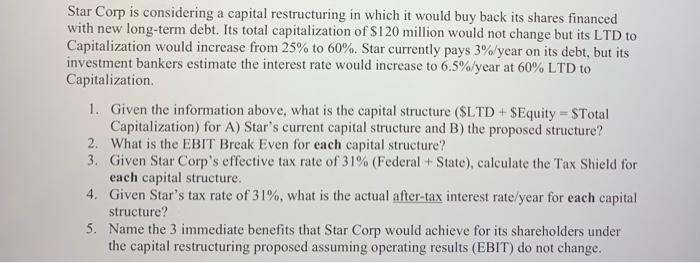

Star Corp is considering a capital restructuring in which it would buy back its shares financed with new long-term debt. Its total capitalization of $120 million would not change but its LTD to Capitalization would increase from 25% to 60%. Star currently pays 3%/year on its debt, but its investment bankers estimate the interest rate would increase to 6.5%/year at 60% LTD to Capitalization 1. Given the information above, what is the capital structure (SLTD + $Equity = STotal Capitalization) for A) Star's current capital structure and B) the proposed structure? 2. What is the EBIT Break Even for each capital structure? 3. Given Star Corp's effective tax rate of 31% (Federal + State), calculate the Tax Shield for each capital structure. 4. Given Star's tax rate of 31%, what is the actual after-tax interest rate/year for each capital structure? 5. Name the 3 immediate benefits that Star Corp would achieve for its shareholders und the capital restructuring proposed assuming operating results (EBIT) do not change. Star Corp is considering a capital restructuring in which it would buy back its shares financed with new long-term debt. Its total capitalization of $120 million would not change but its LTD to Capitalization would increase from 25% to 60%. Star currently pays 3%/year on its debt, but its investment bankers estimate the interest rate would increase to 6.5%/year at 60% LTD to Capitalization 1. Given the information above, what is the capital structure (SLTD + $Equity = STotal Capitalization) for A) Star's current capital structure and B) the proposed structure? 2. What is the EBIT Break Even for each capital structure? 3. Given Star Corp's effective tax rate of 31% (Federal + State), calculate the Tax Shield for each capital structure. 4. Given Star's tax rate of 31%, what is the actual after-tax interest rate/year for each capital structure? 5. Name the 3 immediate benefits that Star Corp would achieve for its shareholders und the capital restructuring proposed assuming operating results (EBIT) do not change