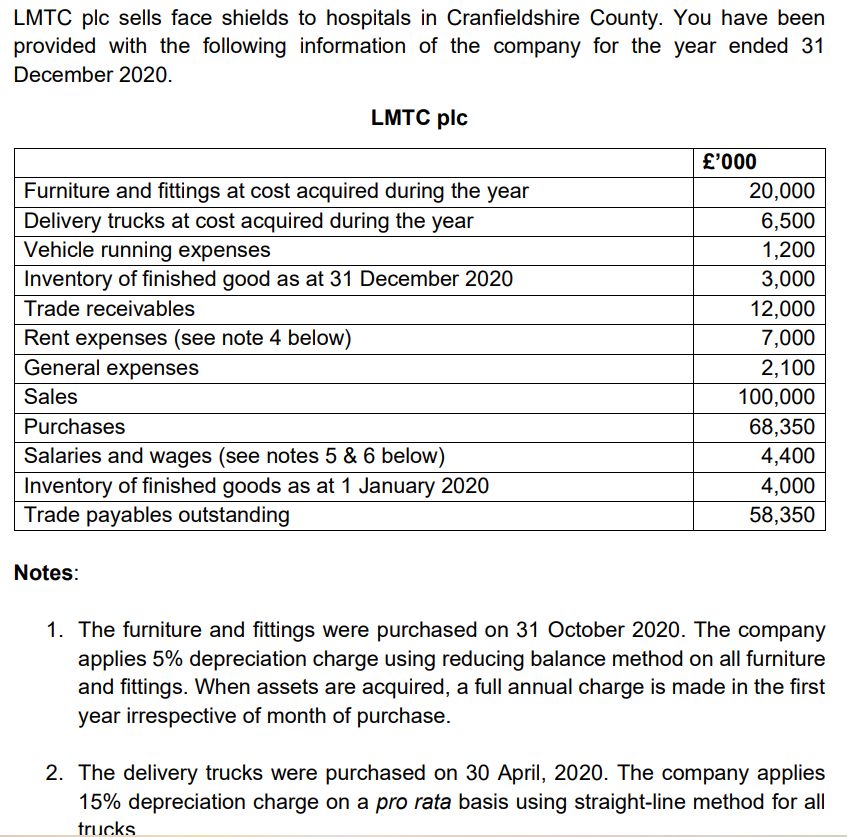

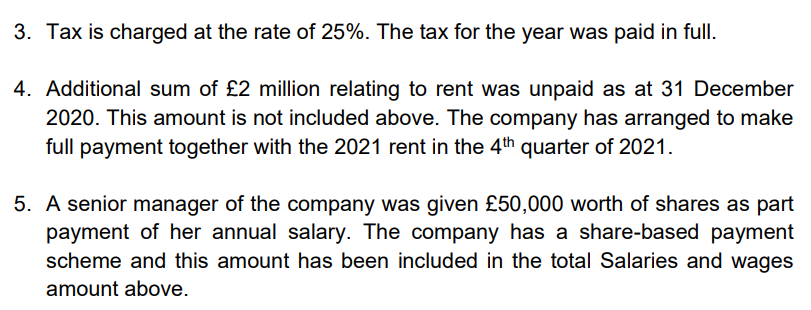

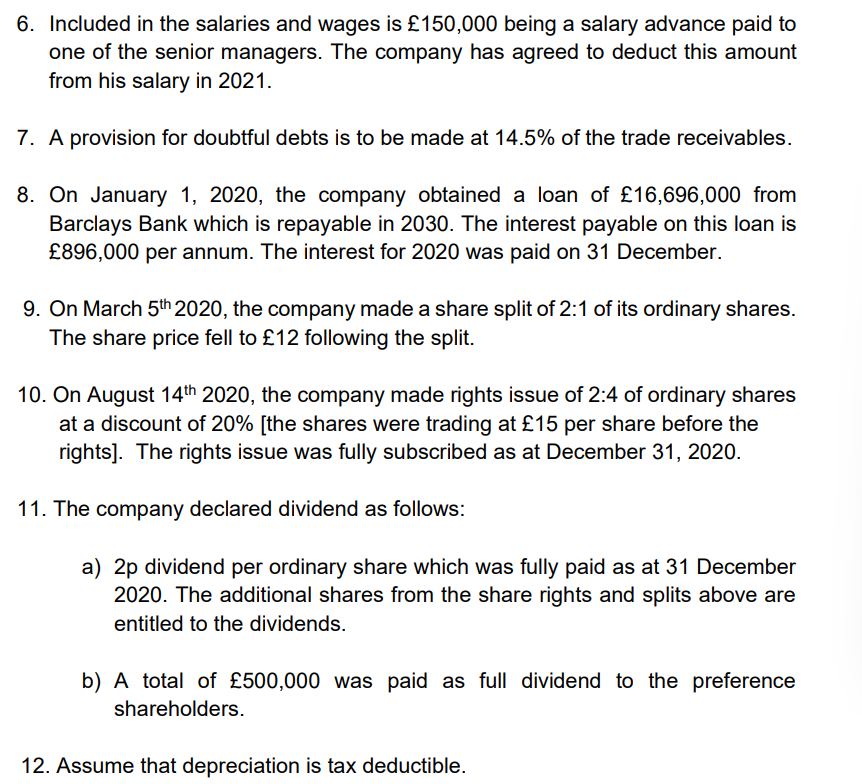

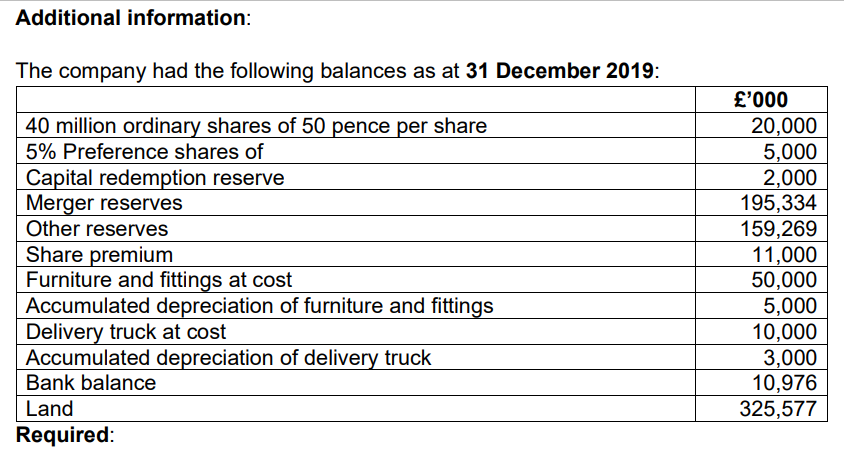

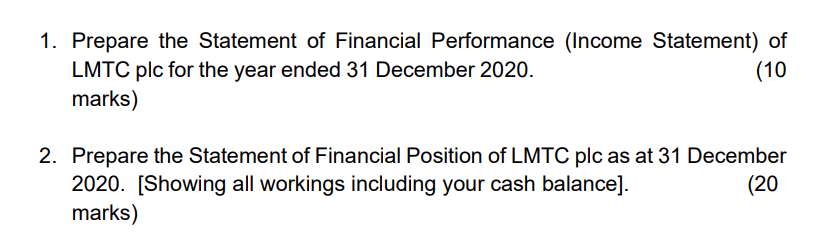

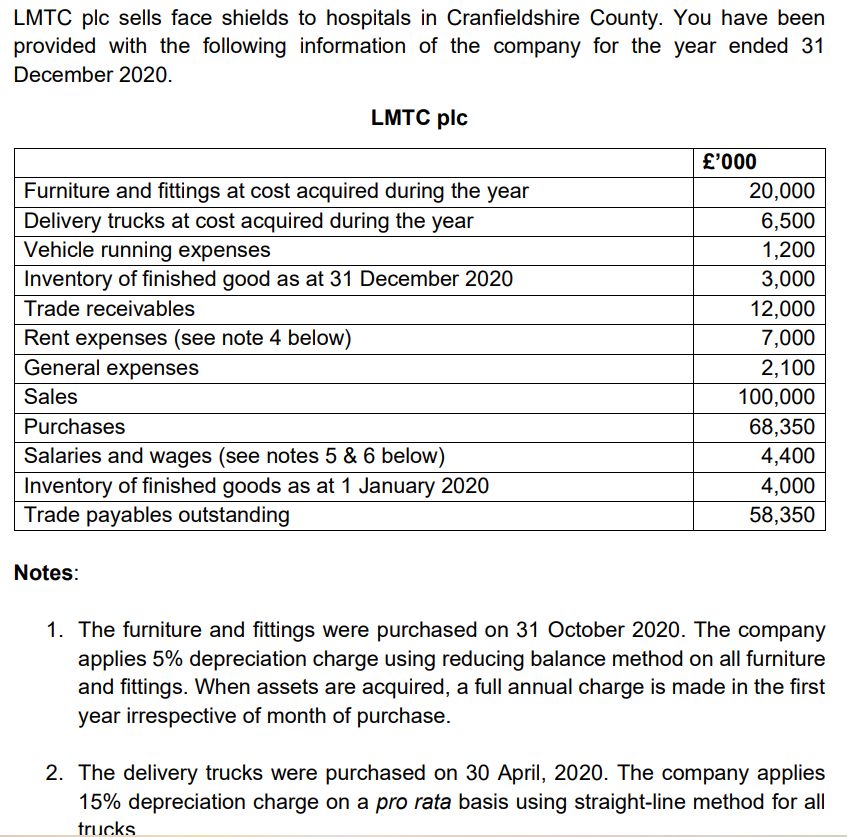

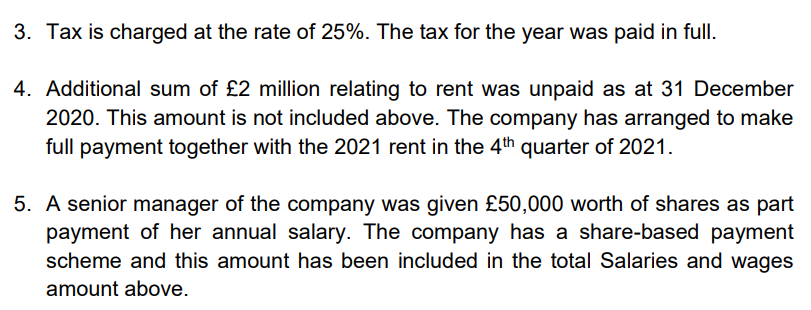

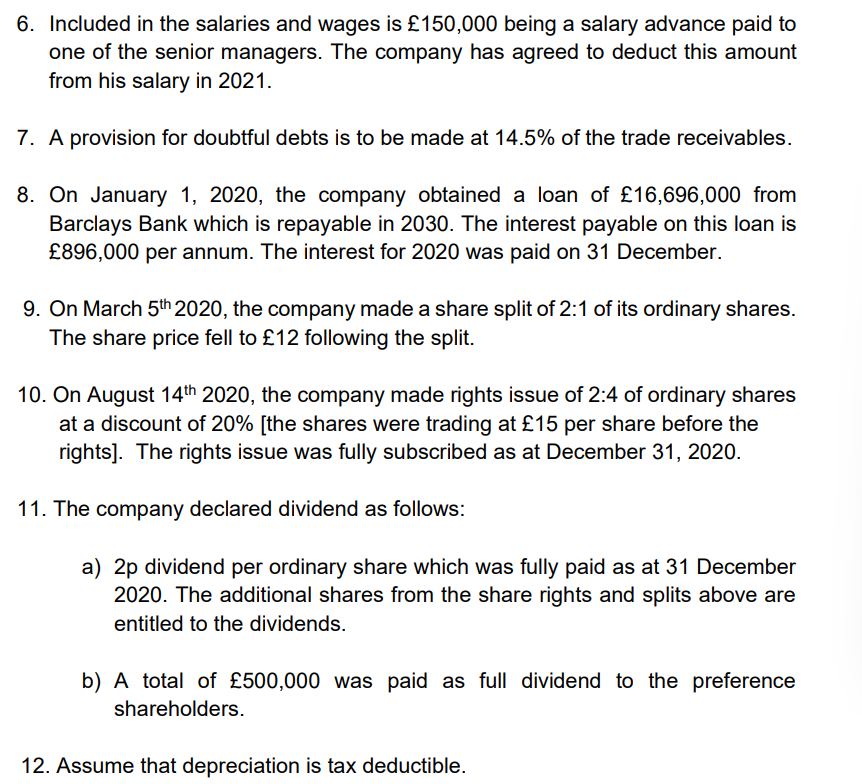

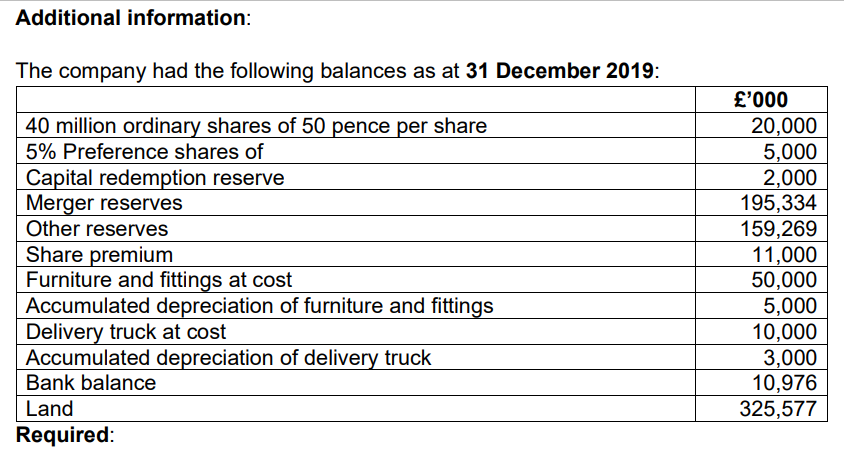

LMTC plc sells face shields to hospitals in Cranfieldshire County. You have been provided with the following information of the company for the year ended 31 December 2020. LMTC plc Notes: 1. The furniture and fittings were purchased on 31 October 2020. The company applies 5% depreciation charge using reducing balance method on all furniture and fittings. When assets are acquired, a full annual charge is made in the first year irrespective of month of purchase. 2. The delivery trucks were purchased on 30 April, 2020. The company applies 15% depreciation charge on a pro rata basis using straight-line method for all trucks 3. Tax is charged at the rate of 25%. The tax for the year was paid in full. 4. Additional sum of 2 million relating to rent was unpaid as at 31 December 2020. This amount is not included above. The company has arranged to make full payment together with the 2021 rent in the 4th quarter of 2021 . 5. A senior manager of the company was given 50,000 worth of shares as part payment of her annual salary. The company has a share-based payment scheme and this amount has been included in the total Salaries and wages amount above. 6. Included in the salaries and wages is 150,000 being a salary advance paid to one of the senior managers. The company has agreed to deduct this amount from his salary in 2021. 7. A provision for doubtful debts is to be made at 14.5% of the trade receivables. 8. On January 1, 2020, the company obtained a loan of 16,696,000 from Barclays Bank which is repayable in 2030 . The interest payable on this loan is 896,000 per annum. The interest for 2020 was paid on 31 December. 9. On March 5th2020, the company made a share split of 2:1 of its ordinary shares. The share price fell to 12 following the split. 10. On August 14th2020, the company made rights issue of 2:4 of ordinary shares at a discount of 20% [the shares were trading at 15 per share before the rights]. The rights issue was fully subscribed as at December 31,2020. 11. The company declared dividend as follows: a) 2p dividend per ordinary share which was fully paid as at 31 December 2020. The additional shares from the share rights and splits above are entitled to the dividends. b) A total of 500,000 was paid as full dividend to the preference shareholders. 12. Assume that depreciation is tax deductible. Additional information: The company had the following balances as at 31 December 2019: 1. Prepare the Statement of Financial Performance (Income Statement) of LMTC plc for the year ended 31 December 2020. (10 marks) 2. Prepare the Statement of Financial Position of LMTC plc as at 31 December 2020. [Showing all workings including your cash balance]. (20 marks)