Answered step by step

Verified Expert Solution

Question

1 Approved Answer

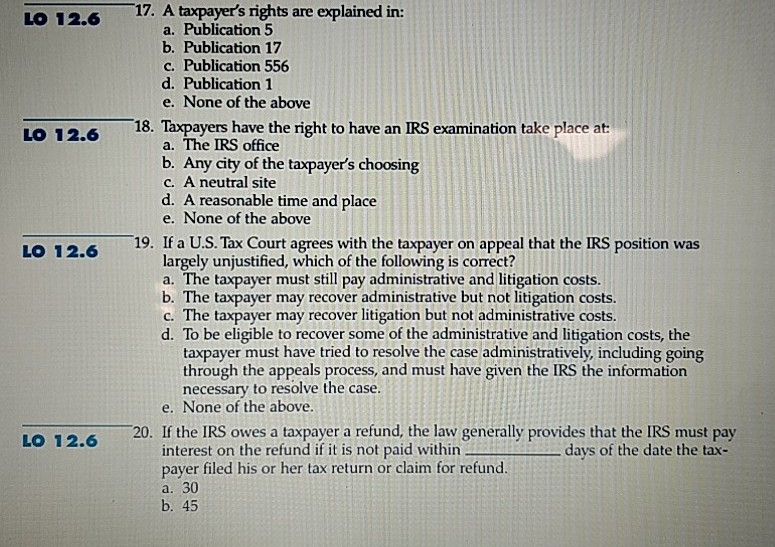

LO 12.617. A taxpayer's rights are explained in: a. Publication 5 b. Publication 17 c. Publication 556 d. Publication 1 e. None of the above

LO 12.617. A taxpayer's rights are explained in: a. Publication 5 b. Publication 17 c. Publication 556 d. Publication 1 e. None of the above 18. Taxpayers have the right to have an IRS examination take place at: a. The IRS office b. Any city of the taxpayers choosing c. A neutral site d. A reasonable time and place e. None of the above LO 12.619. If a U.S. Tax Court agrees with the taxpayer on appeal that the IRS position was largely unjustified, which of the following is correct? a. The taxpayer must still pay administrative and litigation costs. b. The taxpayer may recover administrative but not litigation costs c. The taxpayer may recover litigation but not administrative costs d. To be eligible to recover some of the administrative and litigation costs, the taxpayer must have tried to resolve the case administratively, including going through the appeals process, and must have given the IRS the information necessary to resolve the case. e. None of the above Lo 12.620. If the IRS interest on the refund if it is not paid within payer filed his or her tax return or claim for refund. a. 30 b. 45 days of the date the tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started