Answered step by step

Verified Expert Solution

Question

1 Approved Answer

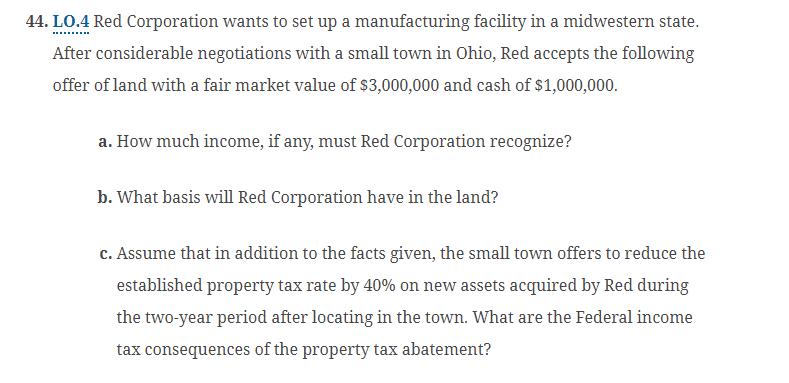

LO . 4 Red Corporation wants to set up a manufacturing facility in a midwestern state. After considerable negotiations with a small town in Ohio,

LO Red Corporation wants to set up a manufacturing facility in a midwestern state.

After considerable negotiations with a small town in Ohio, Red accepts the following

offer of land with a fair market value of $ and cash of $

a How much income, if any, must Red Corporation recognize?

b What basis will Red Corporation have in the land?

c Assume that in addition to the facts given, the small town offers to reduce the

established property tax rate by on new assets acquired by Red during

the twoyear period after locating in the town. What are the Federal income

tax consequences of the property tax abatement?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started