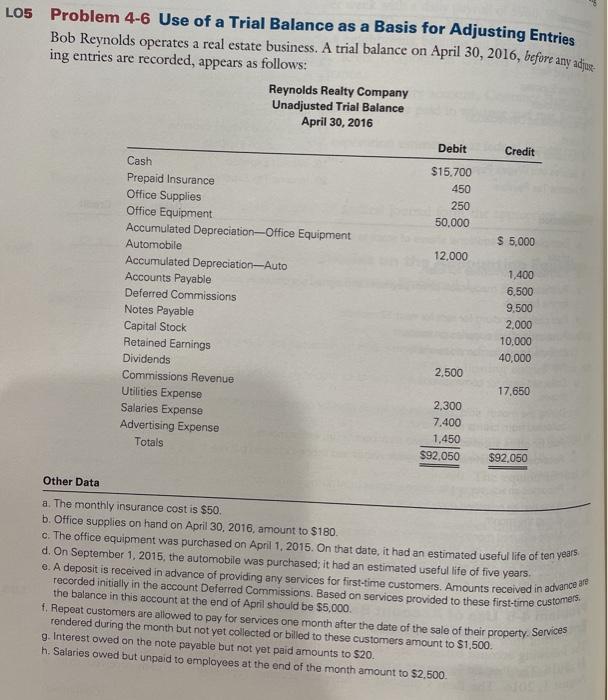

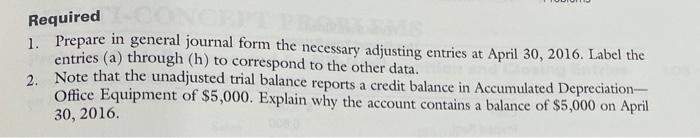

LO5 Problem 4-6 Use of a Trial Balance as a basis for Adjusting Entries Bob Reynolds operates a real estate business. A trial balance on April 30, 2016, before any adjue ing entries are recorded, appears as follows: Reynolds Realty Company Unadjusted Trial Balance April 30, 2016 Debit Credit $15.700 450 250 50.000 $ 5,000 12.000 12.000 Cash Prepaid Insurance Office Supplies Office Equipment Accumulated Depreciation-Office Equipment Automobile Accumulated Depreciation-Auto Accounts Payable Deferred Commissions Notes Payable Capital Stock Retained Earnings Dividends Commissions Revenue Utilities Expense Salaries Expense Advertising Expense Totals 1,400 6.500 9.500 2,000 10.000 40,000 2.500 17,650 2.300 7,400 1,450 $92,050 $92,050 Other Data a. The monthly insurance cost is $50. b. Office supplies on hand on April 30, 2016, amount to $180 c. The office equipment was purchased on April 1, 2015. On that date, it had an estimated useful life of ten years d. On September 1, 2015, the automobile was purchased; it had an estimated useful life of five years. e. A deposit is received in advance of providing any services for first-time customers. Amounts received in advance are recorded initially in the account Deferred Commissions. Based on services provided to these first-time customers, the balance in this account at the end of April should be $5,000 1. Repeat customers are allowed to pay for services one month after the date of the sale of their property Services Tondered during the month but not yet collected or billed to these customers amount to $1.500 g. Interest owed on the note payable but not yet paid amounts to $20. h. Salaries owed but unpaid to employees at the end of the month amount to $2.500 Required 1. Prepare in general journal form the necessary adjusting entries at April 30, 2016. Label the entries (a) through (h) to correspond to the other data. 2. Note that the unadjusted trial balance reports a credit balance in Accumulated Depreciation- Office Equipment of $5,000. Explain why the account contains a balance of $5,000 on April 30, 2016