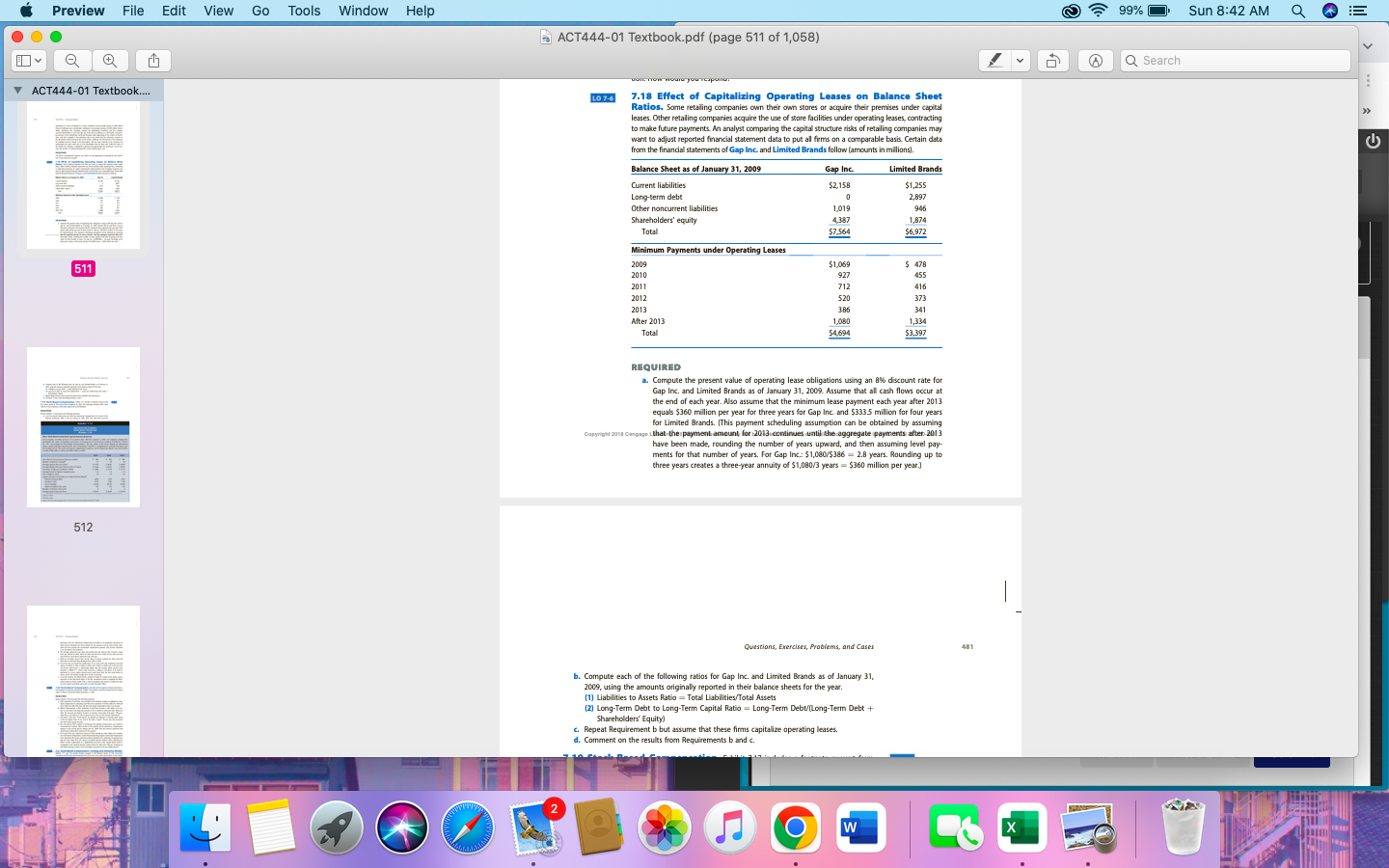

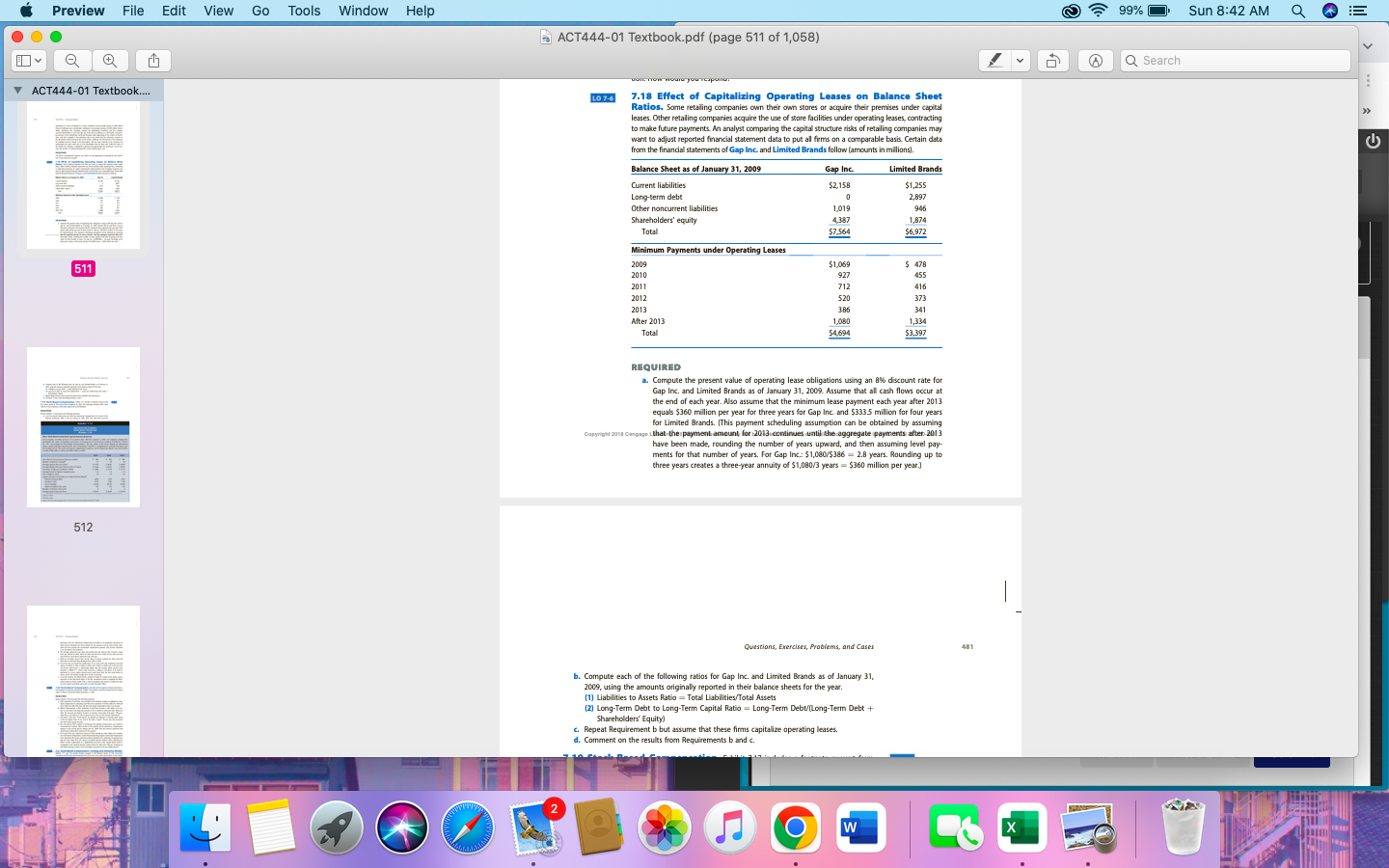

Lo7-6 7.18 Effect of Capitalizing Operating Leases on Balance Sheet Ratios. Some retaling companies own their own stores or acquire their premises under capital leases. Other retaling companies acquire the use of store facilities under operating leases, contracting to make future payments. An analyst comparing the capital structure risks of retaling companies may want to adjust reported finencial statement data to put al firms on a comparable basis. Certain data RRQUIRED a. Compute the present value of operating lease obligations using an 8% discount rate for Gap Inc. and Limited Brands as of January 31, 2009. Assume that all cash flows occur at the end of each year. Also assume that the minimum lease payment each year after 2013 equals $360 million per year for three years for Gap Inc and $333.5 milion for four years for Limited Brands. (This payment scheduling assumption can be obtained by assuming that-the payment ameunt for 2013 icominues dutil the aggregate payments after 2013 have been made, rounding the number of years upward, and then assuming level payments for that number of years. For Gap Inc.: $1,000$386=2.8 years. Rounding up to three years creates a three-year annuity of $1,080/3 years =$360 million per year.] Lo7-6 7.18 Effect of Capitalizing Operating Leases on Balance Sheet Ratios. Some retaling companies own their own stores or acquire their premises under capital leases. Other retaling companies acquire the use of store facilities under operating leases, contracting to make future payments. An analyst comparing the capital structure risks of retaling companies may want to adjust reported finencial statement data to put al firms on a comparable basis. Certain data RRQUIRED a. Compute the present value of operating lease obligations using an 8% discount rate for Gap Inc. and Limited Brands as of January 31, 2009. Assume that all cash flows occur at the end of each year. Also assume that the minimum lease payment each year after 2013 equals $360 million per year for three years for Gap Inc and $333.5 milion for four years for Limited Brands. (This payment scheduling assumption can be obtained by assuming that-the payment ameunt for 2013 icominues dutil the aggregate payments after 2013 have been made, rounding the number of years upward, and then assuming level payments for that number of years. For Gap Inc.: $1,000$386=2.8 years. Rounding up to three years creates a three-year annuity of $1,080/3 years =$360 million per year.]