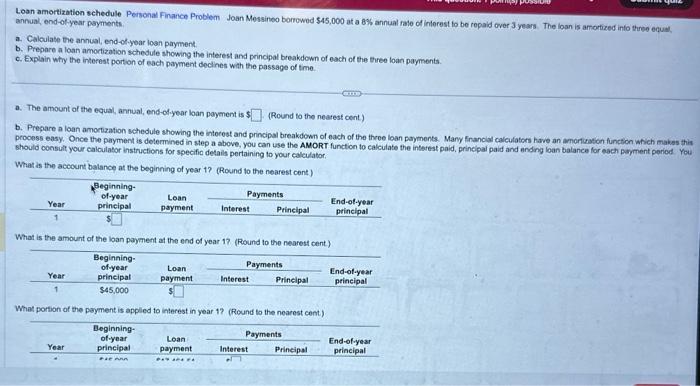

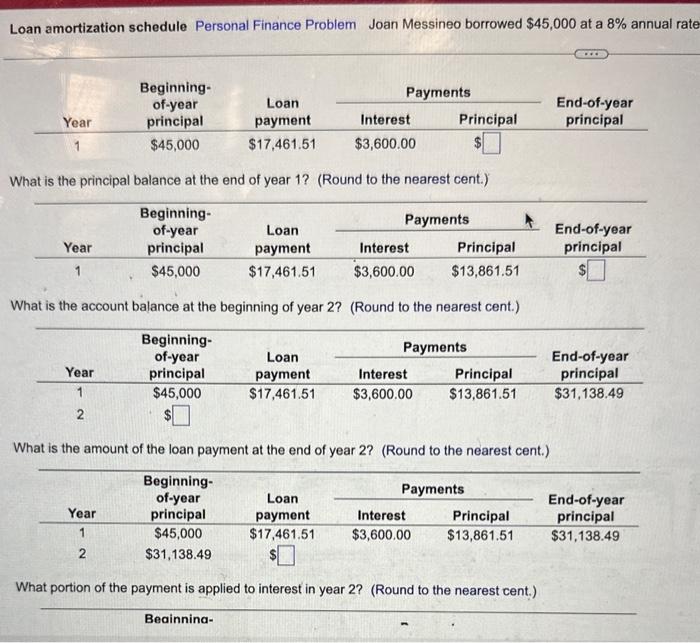

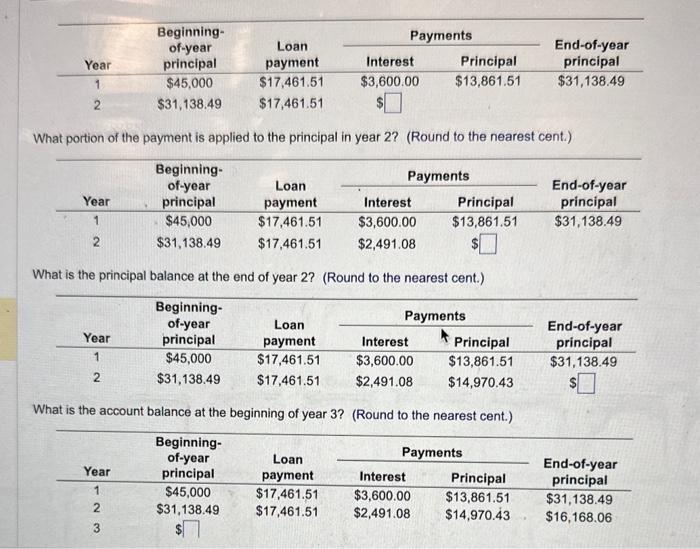

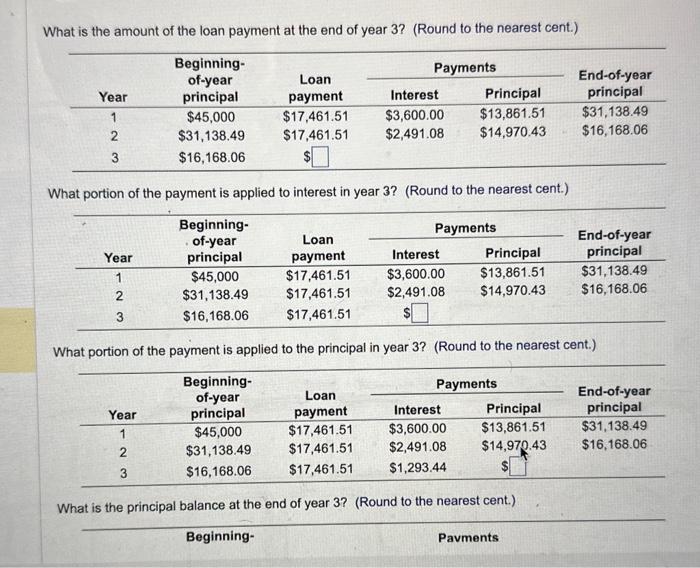

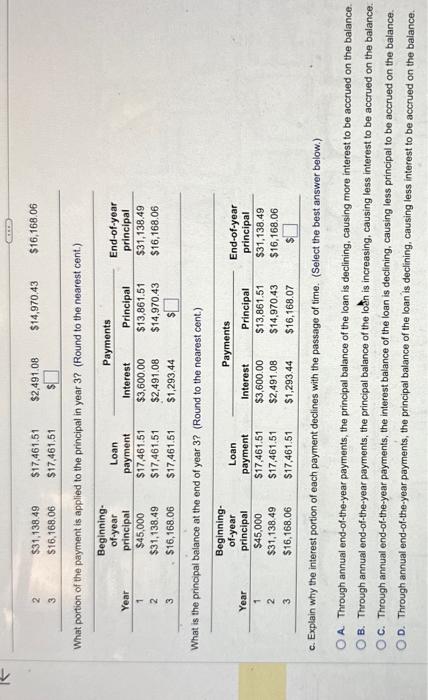

Loan amortization schedule Personal Finance Problem Joan Messineo bonowod $45,000 at a 8% annual ralo of intorest to be repaid over 3 years. The loan is anorized into three equat, annual, end-ofyear payments. a. Calculate the annual, end-ofyear loan payment b. Prepare a loan amorization schedule showing the interest and principal breakdown of each of the three loan payments. c. Explain why the interest portion of each payment decines with the passage of tme. a. The amount of the equal, annual, end-ofyear loan payenent is 5 (Round to the nearest cent) b. Prepare a loan amorization schedule showing the intocest and principal breakdown of each of the throe loan payments. Many francial calculatons have an amertiation function which maks this procoss easy. Once the payment is determined in step a above, you can use the AMORT function to calculate the interest paid, principal paid and anding loan balance for each payment peried You should consult your calculator instructions for specific details pertaining to your calculator. What is the account balance at the beginning of year 1 ? (Round to the nearest cent) What is the amount of the loan payment at the end of year 17 (Round to the nearest cent) What portion of the payment is appled to interest in year 1? (Round to the nearest cent) Loan amortization schedule Personal Finance Problem Joan Messineo borrowed $45,000 at a 8% annual rat What is the principal balance at the end of year 1 ? (Round to the nearest cent.) What is the account balance at the beginning of year 2? (Round to the nearest cent.) What is the amount of the loan payment at the end of year 2? (Round to the nearest cent.) What portion of the payment is applied to interest in year 2? (Round to the nearest cent.) What portion of the payment is applied to the principal in year 2? (Round to the nearest cent.) What is the principal balance at the end of year 2 ? (Round to the nearest cent.) What is the account balance at the beginning of year 3 ? (Round to the nearest cent.) What is the amount of the loan payment at the end of year 3 ? (Round to the nearest cent.) What portion of the payment is applied to interest in year 3 ? (Round to the nearest cent.) What portion of the payment is applied to the principal in year 3 ? (Round to the nearest cent.) What is the principal balance at the end of year 3 ? (Round to the nearest cent.) What portion of the payment is applied to the principal in year 3 ? (Round to the nearest cent.) What is the principal belance at the end of year 3 ? (Round to the nearest cent.) c. Explain why the interest portion of each payment declines with the passage of time. (Select the best answer below.) A. Through annual end-of-the-year payments, the principal balance of the loan is declining, causing more interest to be accrued on the balance. B. Through annual end-of-the-year payments, the principal balance of the loth is increasing, causing less interest to be accrued on the balance. C. Through annual end-of-the-year payments, the interest balance of the loan is declining, causing less principal to be accrued on the balance. D. Through annual end-of-the-year payments, the principal balance of the loan is declining, causing less interest to be accrued on the balance