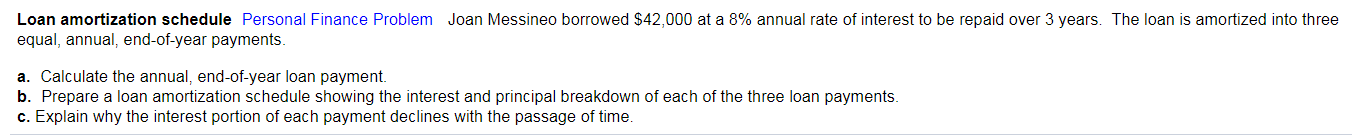

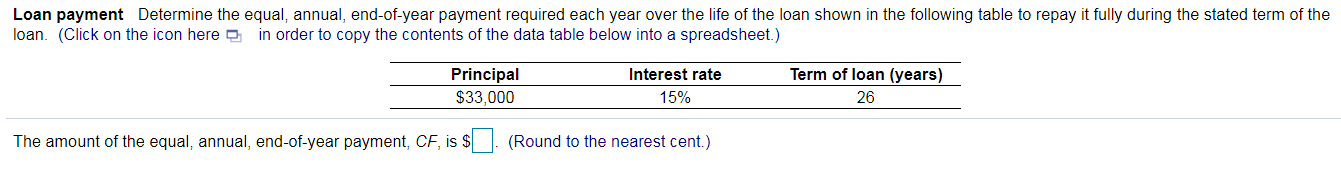

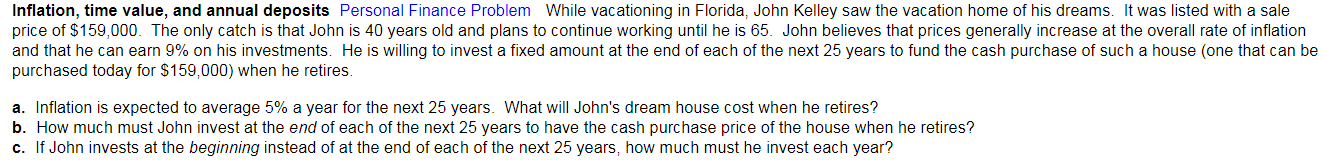

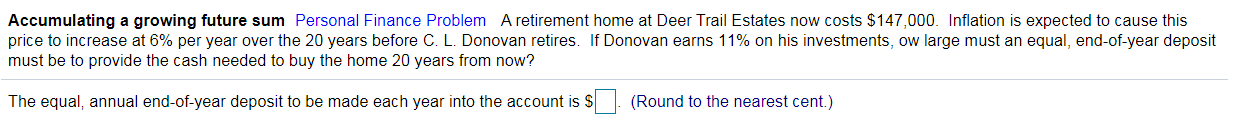

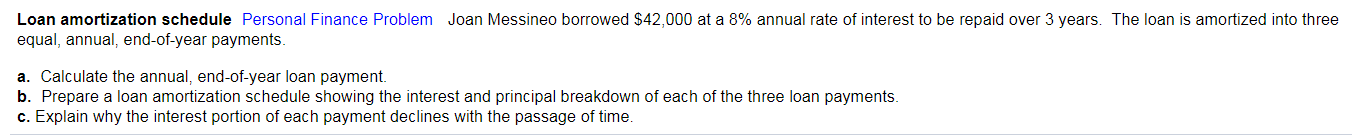

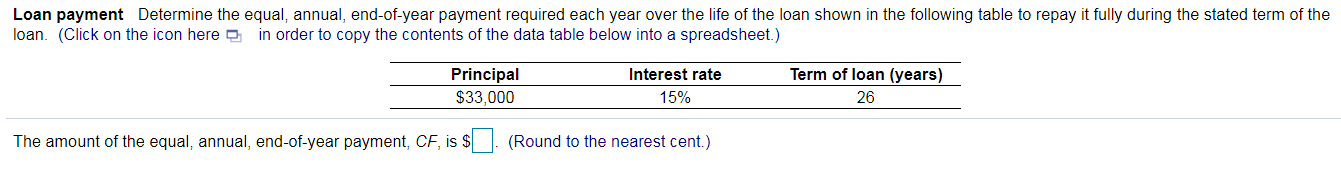

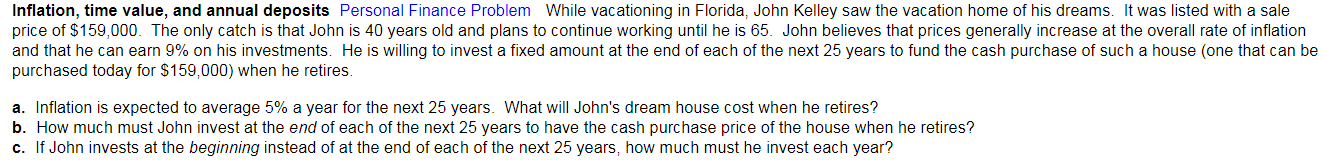

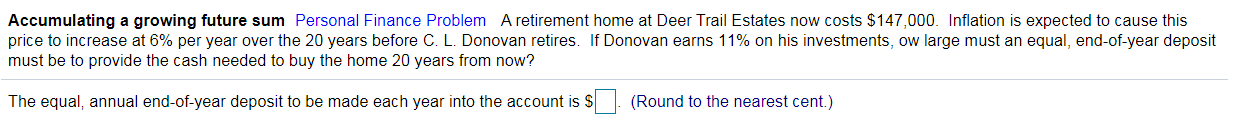

Loan amortization schedule Personal Finance Problem Joan Messineo borrowed $42,000 at a 8% annual rate of interest to be repaid over 3 years. The loan is amortized into three equal, annual, end-of-year payments. a. Calculate the annual, end-of-year loan payment. b. Prepare a loan amortization schedule showing the interest and principal breakdown of each of the three loan payments. c. Explain why the interest portion of each payment declines with the passage of time. Loan payment Determine the equal, annual, end-of-year payment required each year over the life of the loan shown in the following table to repay it fully during the stated term of the loan. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Principal $33,000 Interest rate 15% Term of loan (years) 26 The amount of the equal, annual, end-of-year payment, CF, is $ . (Round to the nearest cent.) Inflation, time value, and annual deposits Personal Finance Problem While vacationing in Florida, John Kelley saw the vacation home of his dreams. It was listed with a sale price of $159,000. The only catch is that John is 40 years old and plans to continue working until he is 65. John believes that prices generally increase at the overall rate of inflation and that he can earn 9% on his investments. He is willing to invest a fixed amount at the end of each of the next 25 years to fund the cash purchase of such a house (one that can be purchased today for $159,000) when he retires. a. Inflation is expected to average 5% a year for the next 25 years. What will John's dream house cost when he retires? b. How much must John invest at the end of each of the next 25 years to have the cash purchase price of the house when he retires? c. If John invests at the beginning instead of at the end of each of the next 25 years, how much must he invest each year? Accumulating a growing future sum Personal Finance Problem A retirement home at Deer Trail Estates now costs $147,000. Inflation is expected to cause this price to increase at 6% per year over the 20 years before C. L. Donovan retires. If Donovan earns 11% on his investments, ow large must an equal, end-of-year deposit must be to provide the cash needed to buy the home 20 years from now? The equal, annual end-of-year deposit to be made each year into the account is S (Round to the nearest cent.)