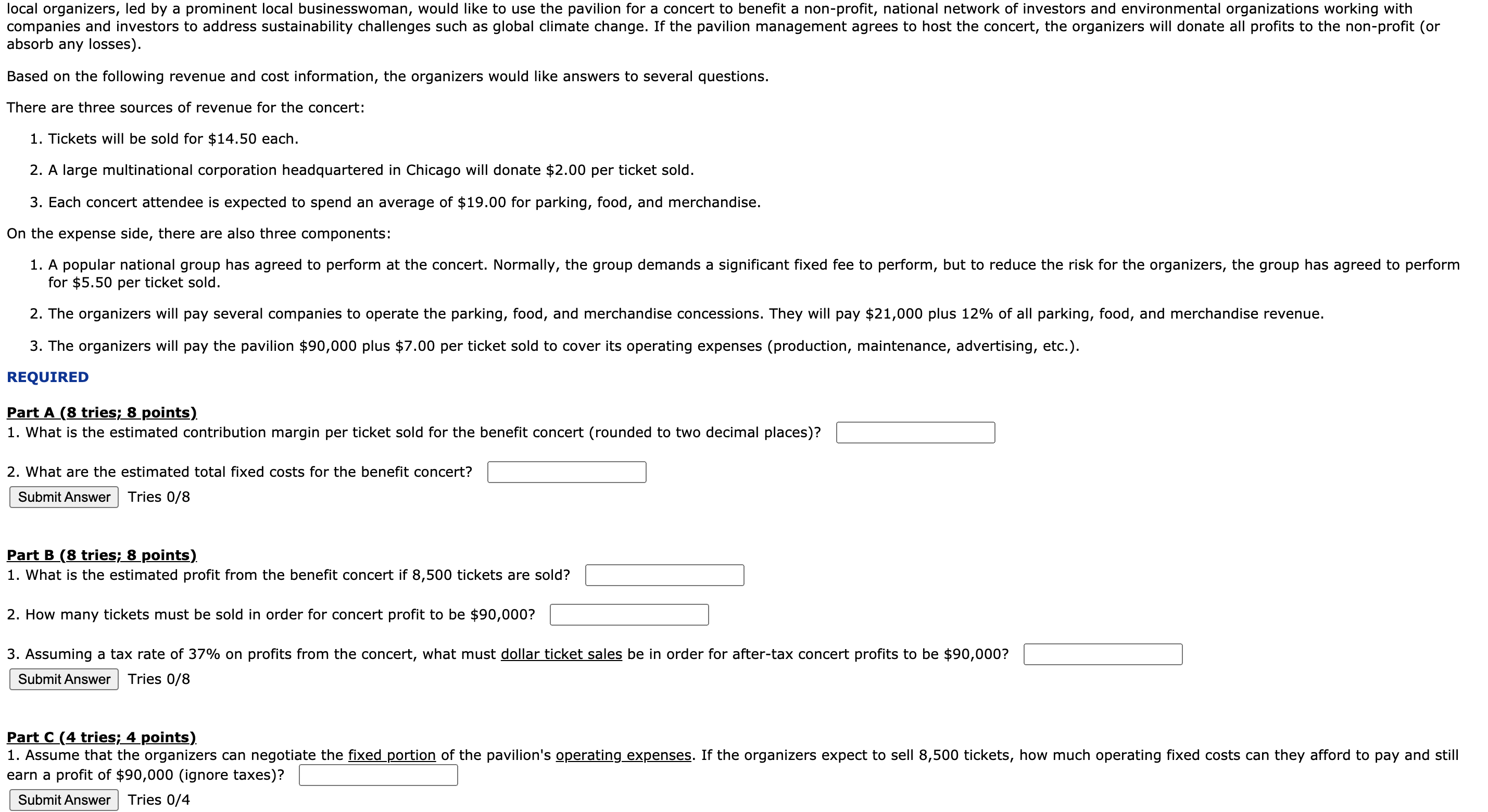

local organizers, led by a prominent local businesswoman, would like to use the pavilion for a concert to benet a non-prot, national network of investors and environmental organizations working with companies and investors to address sustainability challenges such as global climate change. If the pavilion management agrees to host the concert, the organizers will donate all prots to the non-prot (or absorb any losses). Based on the following revenue and cost information, the organizers would like answers to several questions. There are three sources of revenue for the concert: 1. Tickets will be sold for $14.50 each. 2. A large multinational corporation headquartered in Chicago will donate $2.00 per ticket sold. 3. Each concert attendee is expected to spend an average of $19.00 for parking, food, and merchandise. 0n the expense side, there are also three components: 1. A popular national group has agreed to perform at the concert. Normally, the group demands a signicant fixed fee to perform, but to reduce the risk for the organizers, the group has agreed to perform for $5.50 per ticket sold. 2. The organizers will pay several companies to operate the parking, food, and merchandise concessions. They will pay $21,000 plus 12% of all parking, food, and merchandise revenue. 3. The organizers will pay the pavilion $90,000 plus $7.00 per ticket sold to cover its operating expenses (production, maintenance, advertising, etc.). REQUIRED Part A (8 triespoints) 1. What is the estimated contribution margin per ticket sold for the benefit concert (rounded to two decimal places)? 2. What are the estimated total xed costs for the benet concert? Submit Answer Tries 0/8 Part B (8 tries; A points) 1. What is the estimated prot from the benet concert if 8,500 tickets are sold? 2. How many tickets must be sold in order for concert profit to be $90,000? :] 3. Assuming a tax rate of 37% on prots from the concert, what must dollar ticket sales be in order for alter-tax concert prots to be $90,000? Submit Answer Tries 0/8 Part C (4 tries;ipoints)_ 1. Assume that the organizers can negotiate the xed portion of the pavilion's gperatinggpenses. If the organizers expect to sell 8,500 tickets, how much operating xed costs can they afford to pay and still earn a prot of $90,000 (ignore taxes)? Submit Answer Tries 0/4